Obligation to Submit Account Information by Corporation and Independent Trading Unit

Linked to Registration Number Issuance System - NSDS

Preparation for Short Selling Computerization by March

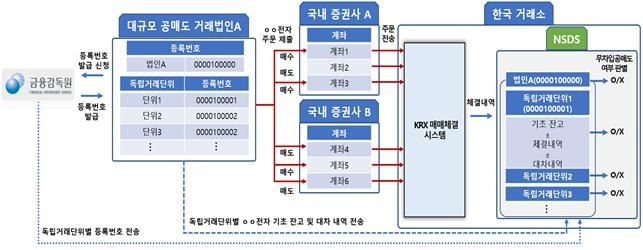

Short selling registration number-based short selling central inspection system (NSDS) detection process. Data provided by the Financial Supervisory Service

Short selling registration number-based short selling central inspection system (NSDS) detection process. Data provided by the Financial Supervisory Service

Going forward, except for some exceptional cases, corporations wishing to engage in short selling transactions must obtain a short selling registration number.

On the 6th, the Financial Supervisory Service (FSS) announced that starting from the 7th, it will issue registration numbers to corporations with large-scale short selling transactions to implement the computerized short selling system aimed at preventing naked short selling.

The target transactions are those where naked short selling is likely to occur, while transactions with a low likelihood of naked short selling, such as pre-deposit trading, are exempt. Target corporations are those with a short selling balance of 0.01% or more, or 1 billion KRW or more.

When applying for a short selling registration number, short selling corporations must submit not only corporate information but also account information for each independent trading unit to the FSS.

The FSS will review the investor's identity and whether the independent trading unit requirements are met, then issue registration numbers for each investor and independent trading unit. Registration numbers will be issued in order of investors who have completed the establishment of balance management systems within their institutions. Among domestic and foreign corporations, the process will proceed in the order of domestic securities firms and asset management companies, followed by foreign investment banks (IBs).

The short selling registration number issuance system is directly connected to the Korea Exchange's short selling central monitoring system (NSDS). The NSDS, currently being established by the Exchange, aggregates all orders from investors who have obtained short selling registration numbers by registration number. It also collects transaction information even when multiple securities firms and accounts are used, continuously detecting instances of naked short selling.

The financial supervisory authorities plan to complete preparations for computerized short selling, including system linkage mock tests, by March, starting with the short selling registration number issuance service. The computerized short selling task force (TF) will support investors in creating the prerequisites for resuming short selling through inspections of custodian securities firms.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.