[KR Solar Power Gets a Break] China’s Oversupply and Low-Price Offensive Slow Down

China Declares Production Cuts Citing Sustainability

China's solar power strategy, which had been shaking the global market due to oversupply and low-price competition, is passing a turning point. While selling a solar panel factory in the United States that was completed just a week ago, key related material companies have declared production cuts under the banner of 'sustainability.'

According to the solar industry and local Chinese media on the 9th, Trina Solar (Tianhe Guangneng), the world's third-largest solar panel manufacturer, recently sold its solar panel factory located in Texas, USA. The factory, purchased by the Norwegian company FREYR for $340 million, has a power generation capacity of 5 gigawatts (GW) and covers an area of 1.35 million square feet (approximately 125,419 square meters).

The sale contract was made just one week after the factory was completed and on November 6 last year, the day the US presidential election results were finalized. FREYR officially announced the acquisition completion at the end of last month. The factory is scheduled to start full-scale production this year, and a contract has already been confirmed to sell about 30% of the estimated production volume to the United States.

Trina Solar had actively sought to secure a production base in the US after the announcement of the Inflation Reduction Act (IRA) in August 2022 to avoid trade barriers. However, as Democratic senators in the US proposed bills banning Chinese companies from receiving tax credit benefits, increasing pressure, the company quickly withdrew.

Chinese companies are also accelerating their relocation to third-party regions to avoid US tariff attacks. According to major foreign media, Chinese companies are carrying out at least four solar panel and battery factory projects in Indonesia and Laos. Two of these alone have a combined capacity of 22.9 GW. This is a response to the US significantly strengthening tariffs on four Southeast Asian countries: Vietnam, Thailand, Malaysia, and Cambodia.

Indonesia and Laos have recently attracted attention as 'tariff circumvention' routes by increasing solar panel exports to the US. According to US federal data, solar panel imports from Indonesia reached $246 million from January to August last year, nearly doubling compared to the previous year. Laos, which had almost no exports to the US in 2023, recorded $48 million in exports during the same period (January to August 2024).

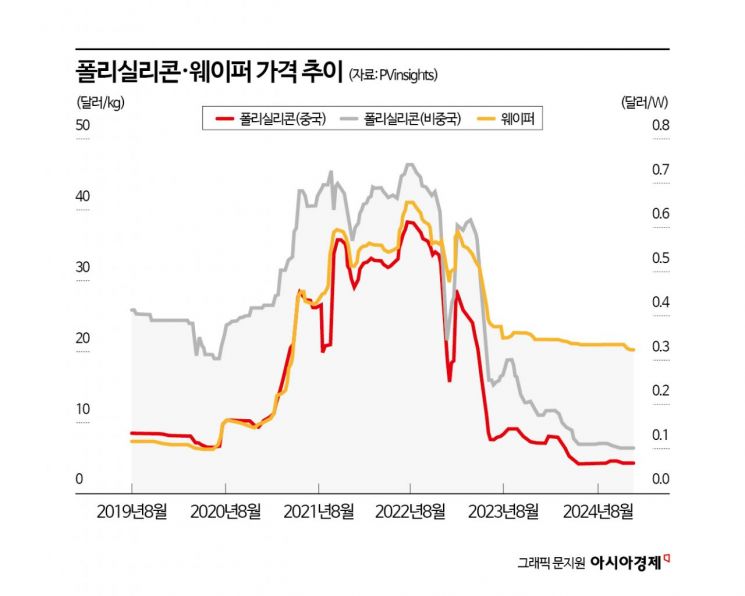

Earlier, Chinese solar companies announced 'orderly production cuts' under the banner of 'sustainable development.' According to local media, Tongwei, China's largest solar polysilicon producer, and Daqo New Energy, the third-largest, recently agreed to reduce polysilicon production. Their combined annual production (1.2 million tons) accounts for nearly 41.4% of China's total production (about 2.9 million tons).

Four polysilicon producers affiliated with Tongwei's subsidiary, Yongxiang, announced last month that they agreed to production cuts, explaining that "this will help reduce operating losses under the current market environment." Tongwei owns polysilicon production bases with an annual capacity of over 900,000 tons in Sichuan, Yunnan, and Inner Mongolia. Daqo New Energy plans to conduct phased maintenance at its polysilicon factories in Xinjiang and Inner Mongolia while also reducing production. Another polysilicon producer, GCL Technology, had previously disclosed its production cut policy. Local Chinese media evaluated that "these companies' production cuts will play a positive role in stabilizing and recovering silicon material prices."

Kang Dong-jin, an analyst at Hyundai Motor Securities, said, "The position of Chinese companies seems likely to shrink further after the Trump administration took office," adding, "A gradual rise in module prices is expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)