China Approaches 80% Yield in DDR5 Domestic Market Sales

Memory Prices Plummet Sharply

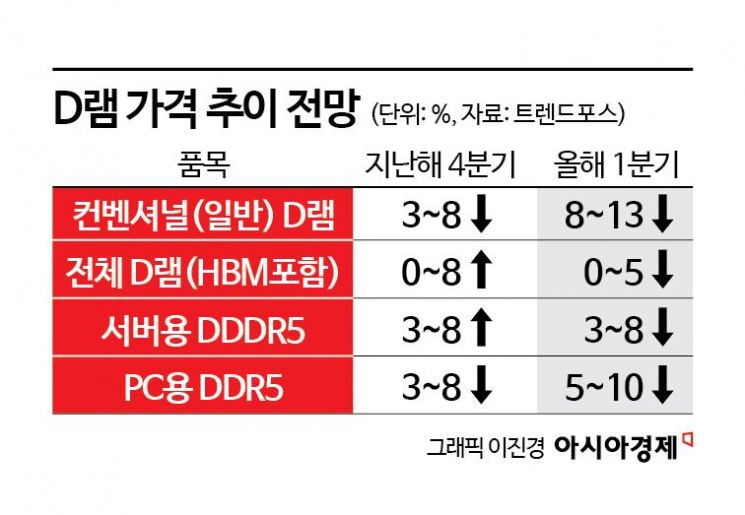

DRAM Down 8-13% in Q1 This Year

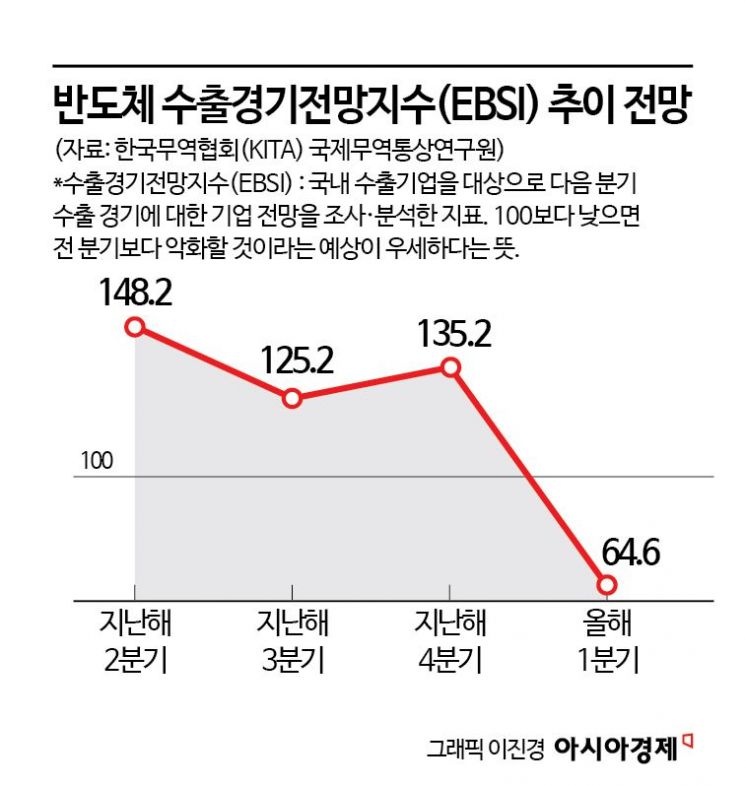

Q1 Semiconductor Export Business Outlook Index Halves Compared to Previous Quarter

As Chinese memory semiconductor companies are expected to flood the market with large volumes this year, early signs indicate a potential crisis for South Korea's semiconductor exports. Chinese IT companies are likely to reduce the volume imported from overseas by replacing high-performance memory with domestically produced products.

According to industry sources on the 3rd, China’s Changxin Memory Technologies (CXMT) launched Double Data Rate (DDR) 5 products last month, which are also used in data center servers, and has started selling them in the domestic market. According to the semiconductor industry, CXMT's DDR5 product yield (ratio of good products) is reported to reach 80%.

CXMT’s mass production of DDR5 is likely to accelerate the decline in DRAM prices. Chinese companies are already supplying older memory products like DDR4 at about half the market price.

Market research firm TrendForce has issued a warning about increasing inventory. TrendForce predicts that NAND flash prices will fall by 10-15% and general DRAM prices by 8-13% in the first quarter of this year, warning that "memory companies will face rising inventory levels and worsening order demand."

Despite the increase in supply, demand for memory semiconductors remains sluggish. The issue of excess inventory in smartphones and PCs has yet to be resolved.

The industry is concerned that market volatility will increase significantly if Chinese companies’ market share rises in earnest. Morgan Stanley forecasts that CXMT will surpass U.S. Micron to become the world’s third-largest DRAM shipper by 2026, supported by a strong domestic market and government backing. China’s semiconductor exports are already rising sharply. The General Administration of Customs of China announced that semiconductor exports from January to November last year increased by 20.3% year-on-year to 1.03 trillion yuan (approximately 203 trillion won).

Warning signs have been raised for South Korea’s semiconductor export outlook. According to the Korea International Trade Association (KITA) International Trade and Commerce Research Institute, the Semiconductor Export Business Survey Index (EBSI) for the first quarter of this year was 64.4. This is less than half compared to 148.2 in the second quarter of last year, 125.2 in the third quarter, and 135.2 in the fourth quarter. Additionally, a survey index (PSI) conducted by the Korea Institute for Industrial Economics & Trade among 133 experts in major domestic industries showed that the semiconductor industry’s PSI for January dropped 59 points from December’s 124 to 65.

An industry official said, "In the first half of this year, demand contraction for general-purpose semiconductors seems inevitable due to the volume from Chinese companies and tariff concerns following the inauguration of the second Trump administration. However, since demand for semiconductors in AI PCs and mobiles, new on-device AI products, and autonomous driving will not decrease, securing competitiveness in AI semiconductor products including High Bandwidth Memory (HBM) has become even more important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.