Mass Rise from Early Year Amid Santa Rally Absence

Recovery to $97,000 Range After Dropping to $91,000

VanEck Mentions US Debt Offset Effect in Report

Contrary to the disappearance of last year's Santa rally, the cryptocurrency market, led by Bitcoin, is buzzing thanks to the 'Trump effect.' This is because Donald Trump, who is set to be inaugurated as the 47th President of the United States this month, is expected to implement pro-cryptocurrency policies. China's additional economic stimulus measures are also drawing attention.

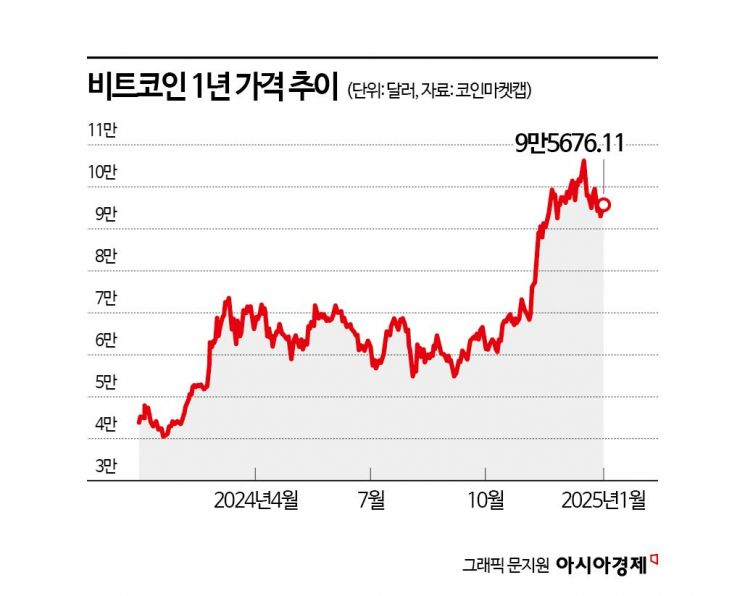

According to CoinMarketCap on the 3rd, Bitcoin, the leading cryptocurrency, recorded $96,830.16 at 7:46 a.m., up 2.19% from the previous day. During the session, it rose to a high of $97,739.82, continuing attempts to reclaim the $100,000 mark. Ethereum, an altcoin (cryptocurrency other than Bitcoin), showed gains in the 2% range. Other top altcoins such as Ripple rose about 3%, Solana about 6%, Dogecoin about 3%, Tron about 3%, and Avalanche about 4%, showing similar upward trends.

With the sustained upward trend from the beginning of the year, contrary to the disappearance of last year's Santa rally, cryptocurrency investors' expectations have grown. On December 31 last year, Bitcoin dropped to the $91,000 range, creating a tense moment. The Bitcoin price briefly retreated to $91,317.14.

The driving force behind the early-year rally is believed to be the 'Trump effect.' As Donald Trump’s inauguration as the 47th U.S. President approaches on January 20 (local time), expectations for pro-cryptocurrency policies have increased. Additionally, news that China is considering issuing special government bonds worth 3 trillion yuan has highlighted China's economic stimulus measures as policy momentum.

In the market, a supportive atmosphere has formed around Trump’s key Bitcoin-related policy of strategic Bitcoin reserves. Republican Senator Cynthia Lummis has introduced the 'BITCOIN ACT,' a bill proposing to hold Bitcoin as a strategic asset for the next 20 years. The BITCOIN ACT is an acronym derived from 'Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide.' The bill’s core provisions include ▲Strategic Bitcoin Reserve (SBR) legislation ▲a systematic Bitcoin purchase program ▲and comprehensive national custody policies.

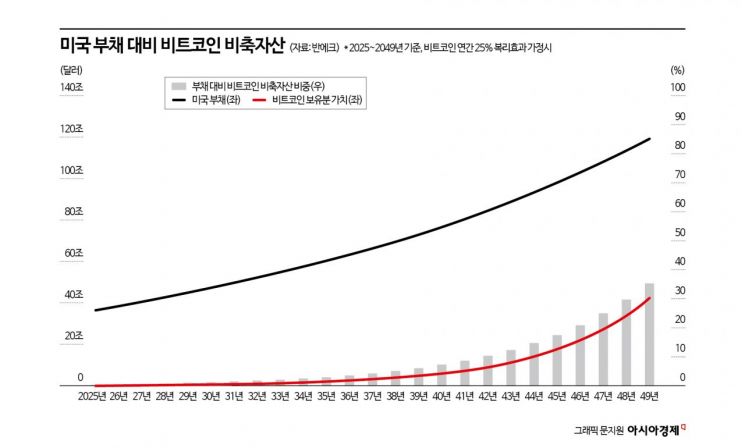

Matthew Sigel, Head of Digital Asset Research at VanEck, analyzed in a report last month that if the U.S. strategically reserves 1 million Bitcoins, it could reduce the national debt by 35% by 2049. VanEck assumed that the debt would grow from $37 trillion in 2025 at a 5% compound annual growth rate to reach that level in 2049, while Bitcoin would increase from $200,000 at a 25% compound annual growth rate, making one Bitcoin worth $42.3 million. This would have the effect of offsetting about $42 trillion in debt. However, this is based on the assumption that Bitcoin’s value will rise.

The research team at Xangle stated, "Expectations have grown as the possibility of the Trump administration designating Bitcoin as a strategic reserve asset has been raised," but also noted, "Unlike oil, which is reserved for energy security, Bitcoin’s strategic reserve purpose is heavily focused on financial aspects, so its validity needs to be reviewed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.