Korean Stocks Undervalued but High Uncertainty

US Stocks Face Exchange Rate Pressure Near 1,500 Won

Hope for 6:4 Portfolio... Preference for US Treasury Bonds

Among Samsung Securities' high-net-worth clients holding financial assets exceeding 3 billion KRW, 55% of the top 10 responded that they have no plans to increase their equity assets this year. Despite the undervaluation appeal of Korean stocks, overall uncertainty remains high, and investing in U.S. stocks is challenging due to the dollar-won exchange rate approaching 1,500 KRW.

On the 2nd, Samsung Securities conducted a '2025 Market Outlook' survey targeting 341 SNI clients, revealing that 55.1% of respondents have no plans to expand their equity assets this year. This is 7.4 percentage points lower than last year's 62.5% who planned to increase their holdings. SNI is an exclusive service for high-net-worth individuals with entrusted assets exceeding 3 billion KRW.

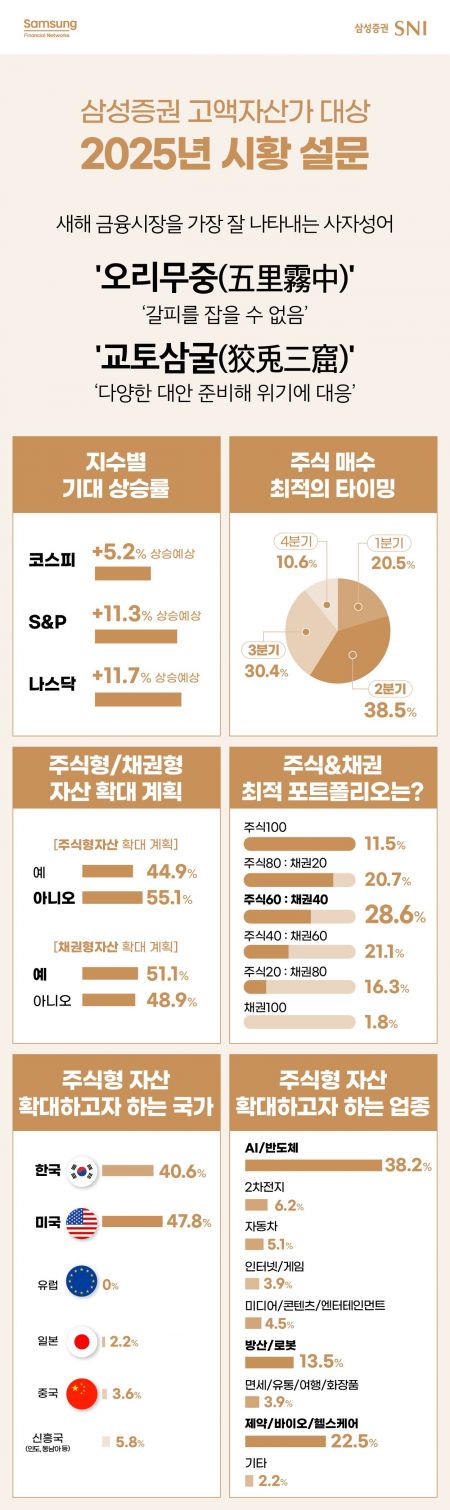

In fact, the expectations of high-net-worth investors for this year's stock market, viewed through four-character idioms, have declined compared to last year. Last year, 77% of respondents chose optimistic idioms such as 'Geoan Sa-wi' (resting peacefully at home), 'Dada Ikseon' (the more, the better), and 'Sangjeon Byeokhae' (a complete transformation), but this year, the proportion dropped to around 50%. The optimal timing for stock purchases was identified as Q2 (38.5%), followed by Q3 (30.4%), Q1 (20.5%), and Q4 (10.6%).

Following last year, the U.S. is expected to lead the stock market direction this year as well. When asked about the key themes for the 2025 financial market, more than half of respondents (55.9%) cited 'Policies of Trump's second term.' Other factors included 'Domestic political situation' (17.2%), 'Resolution of U.S.-China trade disputes' (8.4%), and 'Interest rate cuts by major countries' (7.0%). Donald Trump, the 47th President of the United States, was also selected as the most influential figure on the stock market in Samsung Securities' 2024 survey last year.

High-net-worth investors identified Korea and the U.S. as the most promising stock investment destinations. The U.S. ranked highest at 47.8%, followed by Korea at 40.6%. Emerging markets, Japan, China, and Europe accounted for only 2-5%. The expected annual index growth rates also favored the U.S., with the Standard & Poor's (S&P) at 11.3% and Nasdaq at 11.7%, significantly surpassing the KOSPI's 5.2% year-end expected growth. Notably, the proportion of respondents expecting the KOSPI to rise more than 10% by year-end dropped from nearly 80% last year to about 51% this year.

The dilemma for high-net-worth investors is that investing in both Korea and the U.S. is not easy under current conditions. Shin Seung-jin, head of the Investment Information Team at Samsung Securities, diagnosed, "There is consensus on the relative valuation attractiveness of the Korean market, but persistent domestic and international uncertainties prevent investor sentiment from easily recovering." The U.S. faces the exchange rate as the biggest obstacle. In fact, 41.0% of respondents said that the difficulty in forecasting the exchange rate makes investing in U.S. stocks challenging.

The most preferred sectors within equity assets were artificial intelligence (AI) and semiconductors (38.2%), followed by pharmaceuticals, bio, and healthcare (22.5%), defense and robotics (13.5%), secondary batteries (6.2%), automobiles (5.1%), media, content, and entertainment (4.5%), and internet and gaming (3.9%). The least favored sectors were domestic demand-sensitive stocks such as duty-free, distribution, travel, and cosmetics.

Conversely, the preference for bond-type assets among high-net-worth investors is expected to strengthen. The proportion of respondents planning to expand bond-type assets was 51.1%. Among the bonds they intend to increase, U.S. government bonds were the highest at 33.7%, followed by Korean government bonds (22.3%) and domestic corporate bonds (13.7%). With market interest rates declining, investors are expected to show strong demand for stable assets such as U.S. and Korean government bonds, as well as relatively high-yield, high-quality corporate bonds. Samsung Securities explained, "With Trump's U.S. election victory and the hawkish Federal Open Market Committee (FOMC) leading to higher interest rates, carry returns have reached an attractive level. If concerns about fiscal deficits expand due to proposed income and corporate tax cuts, U.S. Treasury yields are expected to rise further. This could also temporarily increase domestic long-term bond yields, enhancing the attractiveness of bond investments."

Consequently, more investors are considering the portfolio balance between equity and bond products. Regarding the portfolio ratio of stocks and bonds (interest rate-type products) in 2025, 86.7% of respondents said they plan to allocate investments across both asset classes. The most common allocation was a 60:40 split between stocks and bonds at 28.6%, slightly down from 31.5% last year.

Based on this survey, Samsung Securities proposed three major investment alternatives for 2025: U.S. Treasury investments, U.S. equity wrap accounts, and domestic long-short fund investments. U.S. Treasuries are analyzed to have entered an attractive carry return level due to the higher interest rates following Donald Trump's election and the hawkish FOMC. For U.S. equity wrap accounts, it emphasized the need to invest in the U.S., the best alternative within the global stock market, by leveraging the indirect investment capabilities of verified managers. Lastly, for domestic long-short funds, given the recent sluggish Korean stock market due to weak domestic demand and peaking exports, which have led to excessive declines, it is expected to be effective to use long-short funds to generate alpha returns amid increased volatility and sector differentiation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.