Half of SMEs Unprepared for Currency Risk

Operating Profit Could Drop Up to 25%

Exchange Loss of 0.36% When KRW-USD Rate Rises 1%

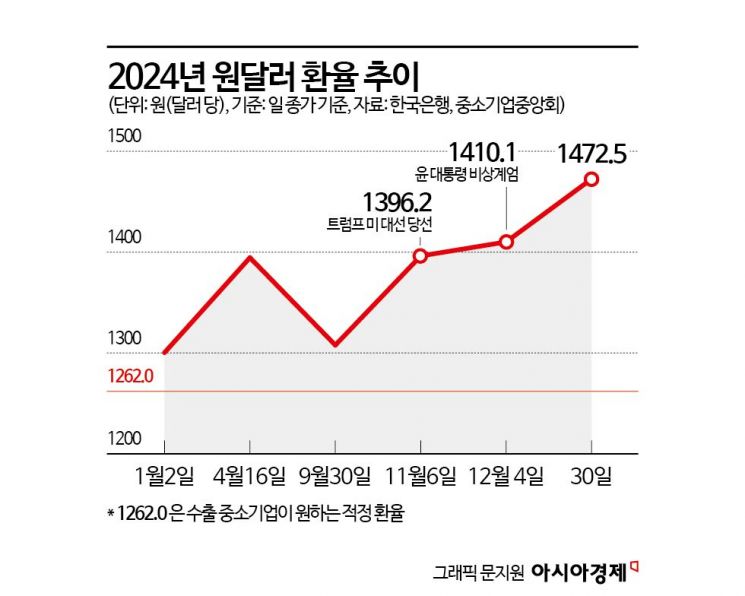

The high exchange rate, considered the biggest economic risk this year, is expected to hit small and medium-sized enterprises (SMEs) first. Unlike large corporations, SMEs have relatively limited capabilities in exchange rate forecasting and response. Some even worry that the won-dollar exchange rate of 1500 may become the 'new normal.' Emergency signals have been triggered for the SME sector, which has not adequately prepared.

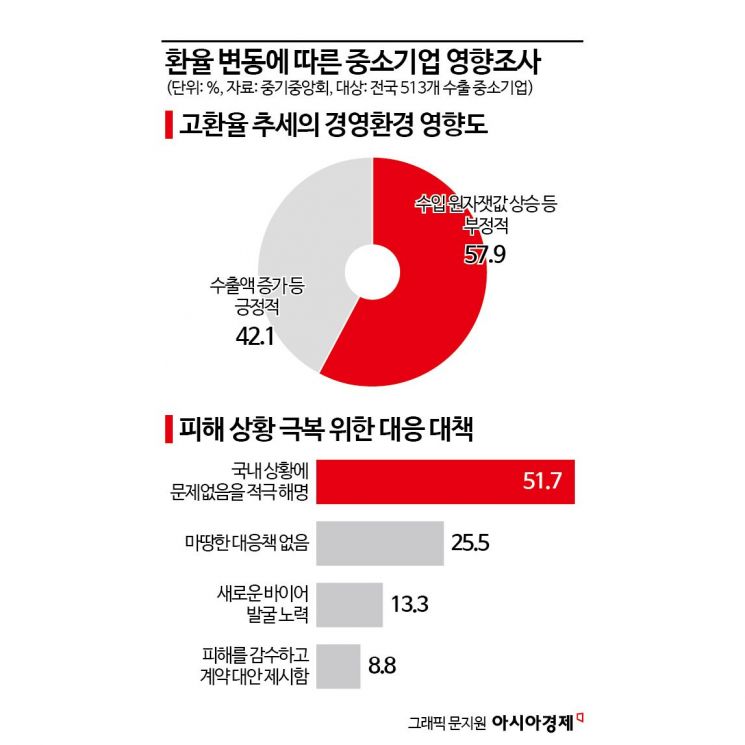

According to the Korea Federation of SMEs on the 2nd, a recent survey on the impact of the high exchange rate trend on the business environment of SMEs showed that 57.9% responded that it was 'negative, such as rising import raw material costs.' The urgent survey was conducted on 513 export SMEs, and this negative response was higher than the 42.1% who expected export amounts to increase due to exchange gains from the sharp rise in the won-dollar exchange rate.

Raw Material Costs Up by 10%

This is because companies that had set their business plans based on an exchange rate in the 1300 won range until early this year now have to pay at least 10% more for raw materials due to the sharp rise in the exchange rate. A manufacturer in Cheonan producing bolts and nuts lamented, "The rise in exchange rates has increased the cost of raw materials imported from Japan, leading to deteriorating profitability."

SMEs that import raw materials, process them, and then supply to domestic large corporations or sell in the domestic market have been directly hit. A manufacturer in Chilgok, Gyeongbuk, said, "As the exchange rate rises, the counterparties are delaying contracts on ongoing projects." A manufacturer of inspection and measurement equipment in Gyeonggi Province also said, "We had received the invoice and were about to make payment, but the sudden surge in the exchange rate within a day caused losses."

In the Korea Federation of SMEs survey, 3 out of 10 SMEs reported damage to sales due to the recent situation, and among them, 22% said the problems were caused by the high exchange rate. Choo Moon-gap, head of the Economic Policy Division at the Federation, said, "SMEs are facing difficulties due to the decline in national credibility and image and the repercussions of the sharp rise in exchange rates," adding, "Above all, exchange rate stability is crucial."

Concerns Over Up to 25% Decrease in Operating Profit

Experts say that operating profits of SMEs could decrease by up to 25% due to the high exchange rate. According to the 'SME Exchange Rate Risk Analysis Study' published by the Small and Medium Business Research Institute in September last year, considering that the operating profit margin of domestic manufacturing SMEs is about 4-5%, the proportion of exchange rate risk (foreign exchange gains and losses) in operating profits of manufacturing SMEs reached up to 25%. Also, it was found that a 1% increase in the won-dollar exchange rate results in about a 0.36% increase in foreign exchange losses. Since the exchange rate jumped 14% over the past year, a simple calculation shows losses increased by more than 5%.

In particular, many SMEs cannot afford to hedge against exchange rate risks, which could worsen the damage. A survey conducted by the Korea Federation of SMEs on 304 SMEs showed that nearly half, 49.3%, do not manage exchange rate risks at all. The biggest reason was a lack of personnel. The problem is that if the upward trend of the won-dollar exchange rate continues, it could lead to long-term weakening of competitiveness beyond immediate losses. A sharp rise in exchange rates causing problems in raw material supply can lead to delivery delays, cost reductions to compensate for losses, and reduced investments.

In this situation, experts advise that SMEs survive by formulating response strategies centered on exports. Song Young-chul, a research fellow at the Small and Medium Business Research Institute, said, "We must defend import costs as much as possible while expanding or enlarging export markets to offset rising costs. Domestic companies should also take this opportunity to explore export markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.