This year, the total net assets of the Exchange-Traded Fund (ETF) market in South Korea surpassed 173 trillion won, ranking 11th in the global market. The total net fund inflow this year amounted to 41.8 trillion won, with funds concentrated in short-term interest rate ETFs and ETFs tracking major U.S. market indices. The top-performing ETFs in terms of returns were U.S. tech-related products and leveraged products tracking major U.S. market indices.

This year, the total net assets of South Korea's exchange-traded fund (ETF) market exceeded 173 trillion won, ranking 11th in the global market. Photo by Getty Images

This year, the total net assets of South Korea's exchange-traded fund (ETF) market exceeded 173 trillion won, ranking 11th in the global market. Photo by Getty Images

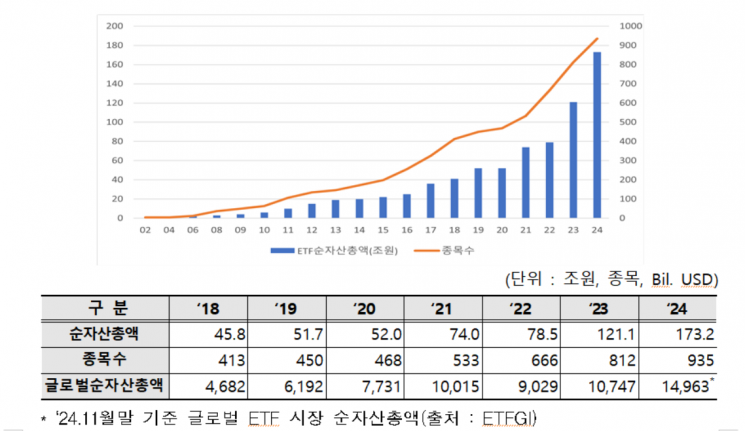

According to the Korea Exchange on the 30th, the total net assets of ETFs at the end of this year were recorded at 173 trillion won, a 43% increase compared to the end of last year. This ranked 11th globally in terms of total net assets and 5th in average daily trading volume.

This year, the increase in total net assets was particularly notable in overseas ETFs. Domestic ETFs grew by 14.2% year-on-year to 105.9 trillion won, while overseas ETFs surged by 137.1% to 67.2 trillion won.

In the ETF market this year, 174 new ETFs were listed, and 51 ETFs were delisted, bringing the total number of listed ETFs to 935. Among the newly listed ETFs, 126 were equity ETFs, with more than half?66 ETFs?being thematic ETFs such as artificial intelligence (AI) semiconductors. Dividend-type ETFs like covered calls accounted for 23 listings, and interest rate ETFs such as CD and KOFR had 6 new listings. This reflects growing interest in ETFs with stable cash flows. The number of delistings this year reached 51, the highest since the market's inception.

The net fund inflow from subscriptions and redemptions this year totaled 41.8 trillion won, concentrated in short-term interest rate ETFs and ETFs tracking major U.S. market indices. The top ETFs by fund inflow were △KODEX Money Market Active, △TIGER U.S. S&P 500, △KODEX CD Interest Rate Active (Synthetic), △KODEX U.S. S&P 500 TR, and △KODEX CD 1-Year Interest Rate Plus Active (Synthetic).

The average daily trading volume in the ETF market reached 3.5 trillion won, an 8.6% increase compared to the previous year. The average daily trading volume of ETFs accounted for 32.4% of the KOSPI market, similar to last year's 33.4%. By investor type, the proportion of individual investors' trades decreased to 32.9%, while institutional and foreign investors' shares increased.

The average return of the ETF market this year was 6.8%. There were 446 ETFs with positive returns and 314 with negative returns. The top-performing ETFs were leveraged products related to U.S. tech or major U.S. market indices. The highest annual return was achieved by ACE U.S. Big Tech TOP7 Plus Leverage (Synthetic), which rose by 201.6%.

The Korea Exchange explained that a key feature of this year's ETF market was the continued inflow of funds into overseas ETFs due to the bullish U.S. stock market, pushing the total net assets of ETFs beyond 170 trillion won. It also emphasized that the market's attractiveness and qualitative growth were enhanced through smooth supply of new products, including value-up ETFs and newly listed thematic ETFs. As the number of listed ETFs increased and market trends shifted, voluntary delistings by issuers also rose noticeably. The exchange added that notable changes included improved ETF product quality through asset management companies' rebranding, changes in underlying index calculation criteria, and ETF name changes.

Meanwhile, the total indicative value of the Exchange-Traded Note (ETN) market this year was 16.8 trillion won, a 21.7% increase compared to the end of last year. The total number of listed ETNs was 412, up by 37 during the same period. However, the average daily trading volume of ETNs was 120.9 billion won, a 23.9% decrease compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)