Preparing for Global Financial Market Uncertainty Next Year... Specialized Personnel Deployed in Digital Platform and AI Sectors

KB Appoints Lee Jae-geun as Head of Global Division, Lee Chang-kwon of KB Kookmin Card for Digital and IT

Hana Establishes 'Future Growth Division' Entrusted to Vice Chairman Lee Seung-yeol

Kookmin Bank and Hana Bank Focus on New Growth Engines and Digital Enhancement Following Holding Companies

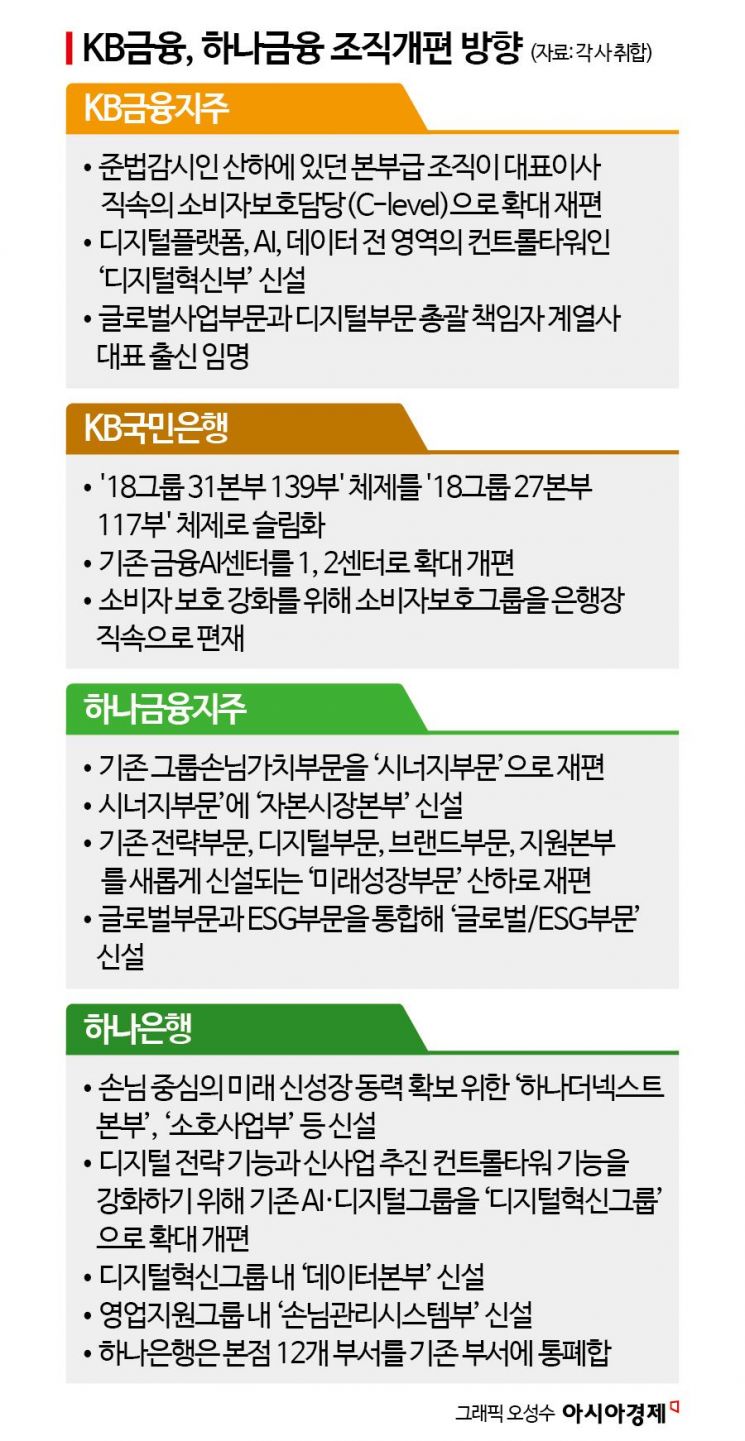

KB Financial Group and Hana Financial Group have consecutively streamlined their holding and banking organizations while reorganizing to expand and strengthen areas that will serve as new growth engines such as future growth, digital, and global businesses. They have also carried out key executive appointments. The plan is to overcome the increasing internal and external uncertainties and lay the foundation for sustainable growth and innovation. As part of responsible management, they also paid attention to strengthening internal controls.

As stock-linked securities (ELS) based on the Hong Kong H-Index are expected to incur losses amounting to trillions of won in the first half of this year alone, financial authorities have begun on-site inspections targeting major distributors. The photo shows KB Kookmin Bank in Yeouido, Seoul, on the 8th. Photo by Jinhyung Kang aymsdream@

As stock-linked securities (ELS) based on the Hong Kong H-Index are expected to incur losses amounting to trillions of won in the first half of this year alone, financial authorities have begun on-site inspections targeting major distributors. The photo shows KB Kookmin Bank in Yeouido, Seoul, on the 8th. Photo by Jinhyung Kang aymsdream@

According to the financial sector on the 27th, KB Financial Group will reorganize its structure from '3 divisions, 7 departments, 6 headquarters, 30 teams' to '3 divisions, 8 departments, 4 headquarters, 31 teams' next year, appointing Lee Jae-geun, President of KB Kookmin Bank, as head of the Global Business Division, and Lee Chang-kwon, CEO of KB Kookmin Card, as Chief Digital Officer (CDO) and Chief Information Technology Officer (CITO).

In particular, to find new revenue sources in digital finance, the digital and artificial intelligence (AI) organizations were strengthened. A new 'Digital Innovation Department,' which serves as the control tower for the entire digital platform, AI, and data domains, was established. The Digital Innovation Department supports the comprehensive strategy formulation for the group's digital initiatives and facilitates organic collaboration among affiliates.

To secure differentiated AI capabilities and actively integrate generative AI into business, the bank's financial AI center will be expanded to two centers. The two expanded financial AI centers appointed Lee Kyung-jong, born in 1980 and a former senior researcher at LG AI, and Lee Kyung-jong, born in 1978 and formerly with NCSoft, as managing directors.

Hana Financial Group also reorganized its existing Strategy Division, Digital Division, Brand Division, and Support Headquarters under the newly established 'Future Growth Division,' assigning it to Vice Chairman Lee Seung-yeol, who stepped down as Hana Bank President. Additionally, the existing Global Division and ESG (Environment, Social, Governance) Division were merged into a new 'Global/ESG Division,' led by Vice Chairman Lee Eun-hyung.

To enhance expertise in retail, wealth management (WM), corporate investment banking (CIB), and capital markets, the existing Group Customer Value Division was reorganized into the 'Synergy Division,' aiming to strengthen competitiveness through internal reinforcement and expanded collaboration across divisions. The Synergy Division established a new 'Capital Markets Headquarters' with the goal of transforming the existing 'debt-centered' financial structure into a 'capital-centered' financial structure.

KB Financial Group, which suffered significant losses this year due to the Hong Kong H-Index equity-linked securities (ELS) incident, decided to strengthen its consumer protection organization to safeguard customers and enhance customer value amid increasing financial uncertainties. The department-level organization under the compliance officer was expanded and reorganized into a consumer protection division directly under the CEO (C-level). The names of internal control organizations in both the holding company and affiliates were unified as the 'Compliance Promotion Department.'

KB Kookmin Bank and Hana Bank also streamlined their organizations while emphasizing new growth engines and digital enhancement

This organizational restructuring direction of the holding companies was directly reflected in their subsidiary banks. Hana Bank slimmed down its head office organization by consolidating 12 departments into existing ones, while reorganizing the Asset Management Group to focus on the group's senior specialized service, ‘HANA THE NEXT,’ to secure future growth engines. Additionally, to strengthen expertise by concentrating financial product planning, development, and management functions, the existing Trust Business Headquarters and Investment Product Headquarters were merged into the ‘Trust & Investment Product Headquarters.’

To strengthen digital strategy functions and the control tower function for new business promotion, the existing AI & Digital Group was expanded and reorganized into the ‘Digital Innovation Group.’ To prepare for the rapidly changing financial environment, a new ‘Data Headquarters’ was established within the Digital Innovation Group, aiming to secure synergy between data and digital based on financial big data.

KB Kookmin Bank boldly streamlined its existing structure from 31 headquarters and 139 teams to 27 headquarters and 117 teams, improving efficiency in management and support organizations within the headquarters and strengthening organizational health. This resulted in a reduction of 4 headquarters and 22 teams.

To comply with the financial authorities’ strong demands for consumer protection, a dedicated permanent monitoring and accountability management organization was separately established under the compliance officer to prevent financial accidents and tighten internal control management systems. At the same time, the expanded Financial AI Centers 1 and 2 will be utilized to focus on practical application in customer asset management and corporate financial services. Furthermore, to strengthen consumer protection, which is increasingly important in the digital era, the Consumer Protection Group was placed directly under the bank president, and organizational restructuring was also carried out to improve the global management system.

A KB Kookmin Bank official explained, "To prepare for an uncertain management environment, we appointed outstanding talents who have consistently demonstrated performance and capabilities as executives based on meritocratic personnel principles," adding, "To realize a sales and customer-centric philosophy, we prioritized talents with field sales experience, appointing 20 out of 21 new executives born in the 1970s."

A Hana Financial Group official also stated, "We renewed the organization through executive appointments centered on ▲field ▲performance ▲expertise, prioritizing customers," and added, "Through organizational restructuring and executive appointments, we plan to further solidify a management system focused on field, performance, and expertise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.