Market Cap of Top 10 Groups Drops by 166 Trillion Won This Year

From 135.2 Trillion Won at Year-End to 118.6 Trillion Won Now

POSCO Group Market Cap Halved Due to Secondary Battery Slump

Samsung Group Market Cap Falls by 140 Trillion Won Because of Samjeon

HD Hyundai Surges 120% on Strength in Power and Shipbuilding Stocks

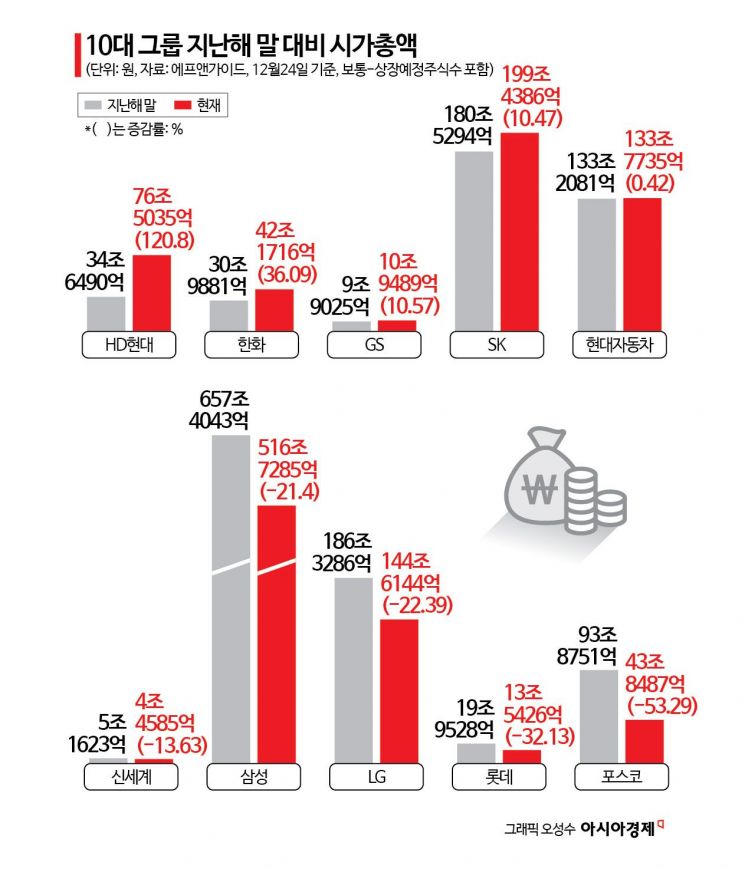

This year, the market capitalization of the top 10 conglomerates decreased due to the sluggish stock market. Samsung Group's market cap alone fell by 140 trillion won, causing the total market cap of the top 10 groups to shrink by 166 trillion won. POSCO's market cap, which more than doubled last year, was halved this year, returning most of the gains from the previous year. On the other hand, HD Hyundai Group, which showed notable strength in power stocks in the first half and shipbuilding stocks in the second half, saw its market cap increase by 120%.

According to financial information provider FnGuide on the 27th, as of the 24th of this month, the combined market capitalization of the top 10 groups was 1,186.0287 trillion won. This represents a decrease of about 166 trillion won from 1,352 trillion won in the same period last year. This amount exceeds the market cap of SK Hynix, the second largest in the domestic market.

POSCO showed the largest decline with a 53.29% decrease, followed by Lotte at 32.13%, LG at 22.39%, Samsung at 21.40%, and Shinsegae at 13.63%.

POSCO's market cap had surpassed 90 trillion won, more than doubling thanks to the strong performance of secondary batteries, but this year it dropped by more than 50% due to the sluggish secondary battery sector, returning to the 40 trillion won range. The market caps of all six listed affiliates also fell sharply. POSCO DX recorded the second largest decrease among the top 10 group's listed affiliates, with a 73.40% drop compared to the end of last year. POSCO Future M and POSCO M-Tech decreased by 58.86% and 58.2%, respectively, while POSCO Holdings fell by 48.95%, and POSCO Steelion and POSCO International declined by 47.53% and 34.86%, respectively.

Samsung experienced the largest absolute decrease, with its market cap dropping by 140 trillion won this year. Samsung accounted for 84% of the total 166 trillion won decrease in the top 10 groups' market cap. The poor performance of the flagship Samsung Electronics was a key factor in the decline of both Samsung Group and the overall top 10 groups' market cap. Samsung Electronics' market cap fell by about 144 trillion won, from 468.6279 trillion won at the end of last year to 324.7562 trillion won. Within Samsung Group, Samsung SDI (-45.97%), Hotel Shilla (-41.51%), Samsung Electro-Mechanics (-17.10%), and Samsung C&T (-13.01%) underperformed, but the finance and bio sectors performed well. Samsung Life Insurance's market cap increased by 48.48% this year, surpassing 20 trillion won, while Samsung Heavy Industries rose by 46.58%, Samsung Fire & Marine Insurance by 40.68%, Samsung Card by 26.43%, Samsung Securities by 25.71%, and Samsung Biologics by 23.42%.

Given the current situation, it is difficult to expect a recovery in Samsung Electronics' stock price in the near term, so further declines in market cap cannot be ruled out. Recently, securities firms have been revising down their earnings estimates for Samsung Electronics' fourth quarter. iM Securities lowered its operating profit forecast for Samsung Electronics in Q4 from 9.9 trillion won to 8.3 trillion won. Hanwha Investment & Securities also revised down its forecast from 10.6 trillion won to 8.4 trillion won and lowered next year's expected operating profit from 46 trillion won to 35.1 trillion won. Song Myung-seop, a researcher at iM Securities, said, "Samsung Electronics' stock price is unlikely to fall significantly going forward, but the semiconductor downturn cycle has just begun, and consensus earnings estimates for Samsung Electronics are likely to be revised downward, so it will take more time for a full-fledged stock price rally."

On the other hand, HD Hyundai, Hanwha, GS, SK, and Hyundai Motor saw their market caps increase this year. In particular, HD Hyundai's market cap surged by 120.8% compared to the end of last year, as the strong performance of power stocks in the first half was followed by shipbuilding stocks in the second half. HD Hyundai Electric recorded the largest increase among all listed affiliates of the top 10 groups, with its market cap rising by 373.84% this year. HD Hyundai Electric's market cap grew from 2.9631 trillion won at the end of last year to 14.0404 trillion won. Other major listed affiliates also saw significant increases: HD Hyundai Marine Engine (143.70%), HD Hyundai Heavy Industries (110.85%), HD Korea Shipbuilding & Offshore Engineering (86.93%), and HD Hyundai Mipo (57.60%). HD Hyundai Heavy Industries has recently recorded strong gains, repeatedly hitting new highs. Its market cap surpassed 26 trillion won, overtaking Shinhan Financial Group to rank 10th in market capitalization.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)