Corporate Business Outlook, Worst Since COVID-19 Pandemic

Domestic companies' economic outlook has been negative for 2 years and 10 months in a row, setting a record for the longest continuous downturn in history. The decline in the forecast was also the largest since April 2020, when COVID-19 began in earnest. This is interpreted as a result of companies judging that a deterioration in profitability is inevitable as this year's average won-dollar exchange rate soared to levels comparable to the 1998 International Monetary Fund (IMF) foreign exchange crisis, and logistics costs also rose.

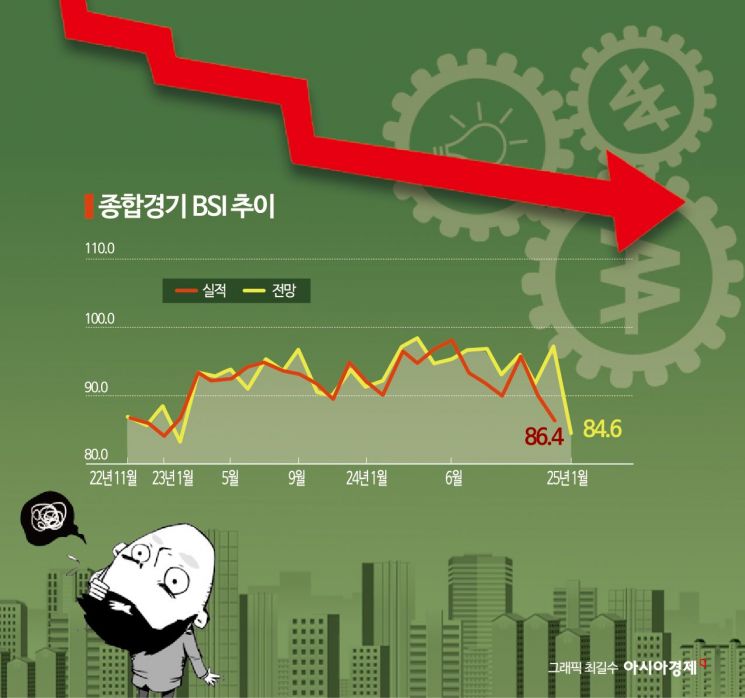

According to a survey conducted by the Korea Economic Association (HanKyungHyup) on the Business Survey Index (BSI) targeting the top 600 companies by sales on the 26th, the BSI forecast for January next year recorded 84.6. A BSI above 100 indicates a positive economic outlook compared to the previous month, while below 100 indicates a negative outlook. It has been below the baseline of 100 for 2 years and 10 months since April 2022 (99.1). This is the longest continuous downturn record since the survey began in January 1975.

The drop in the BSI forecast (84.6) was also notable. It fell by 12.7 points compared to December this year (97.3), marking the largest decline in 4 years and 9 months since April 2020 (25.1 points), when COVID-19 began in earnest.

The economic outlook by industry for January is unfavorable for both manufacturing (84.2) and non-manufacturing (84.9). The manufacturing BSI has remained below the baseline of 100 for 10 consecutive months since April (98.4), after exceeding 100 in March this year (100.5). The non-manufacturing BSI (84.9), which showed a positive outlook last month (105.1), plunged by 20.2 points compared to the previous month, falling far short of the baseline of 100 in just one month.

The outlook by sector is also negative. Domestic demand (88.6), exports (90.2), and investment (89.4) have all been sluggish for 7 consecutive months since July 2024. In particular, the domestic demand BSI (88.6) recorded its lowest level in 52 months since September 2020 (88.0), and the export BSI (90.2) recorded its lowest level in 51 months since October 2020 (90.2), showing record negative forecasts. The investment BSI (89.4) was the lowest in 21 months since April 2023 (88.6).

The negative economic outlook of companies is due not only to political risks but also to worsening corporate conditions such as exchange rates and logistics costs. The exchange rate, which was in the 1300 won range at the beginning of this year, began to rise again last month after Donald Trump's victory in the U.S. presidential election. Especially, with the unstable domestic political situation including the declaration of martial law and presidential impeachment, it rose to the 1450 won range and exceeded 1460 won on the morning of the 26th. The won-dollar exchange rate exceeding 1450 won is the first time since the global financial crisis (November 2008 to March 2009).

As the exchange rate surged, the burden on companies with high proportions of raw material and raw material imports such as petrochemicals, steel, and aviation also increased. According to the Korea Institute for Industrial Economics and Trade, if the exchange rate rises by 10%, the operating profit margin of large companies falls by 0.29%. The Small and Medium Business Venture Research Institute also stated that even a 1% increase in the exchange rate increases losses for small and medium-sized enterprises by 0.36% each.

Recent freight rate increases are also a burden for companies. The Shanghai Containerized Freight Index was 2390 as of the 20th, up 10% compared to a month ago. Compared to the same period last year, it is about twice as high. For export companies, this is a double whammy situation where exchange rate risks and freight burdens are increasing.

The recent prominent upward trend in sea freight rates is interpreted as an effect of increased short-term push exports due to unresolved global geopolitical risks such as the Red Sea incident and the announcement of high tariffs on Chinese raw materials in major regions such as the U.S. and Europe. The industry also sees that major shipping companies have adjusted ship supply. From the shipper's perspective, it is still difficult to find ships.

In particular, with President Trump, who announced tariff bombs, taking office next month, the move to advance exports is also stimulating sea freight rates. According to the Korea International Trade Association, exports to the U.S. from the beginning of this month to the 20th amounted to $8.012 billion, a 6% increase compared to the same period last year.

Lee Sang-ho, head of the Economic and Industrial Headquarters at HanKyungHyup, said, "In addition to changes in the external business environment such as the Trump administration, domestic political uncertainty is intensifying, raising concerns about increased exchange rate volatility and prolonged domestic demand sluggishness," and emphasized, "Efforts to stabilize the exchange rate and support to revitalize the industry must be thoroughly pursued to revive the economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)