KCGI Asset Management Survey on 'Retirement Preparation' for Clients

Preference for Pension Savings Funds over Pension Savings Insurance

US-Centered Overseas Stock Funds, Domestic Stock Funds, TDF in Order

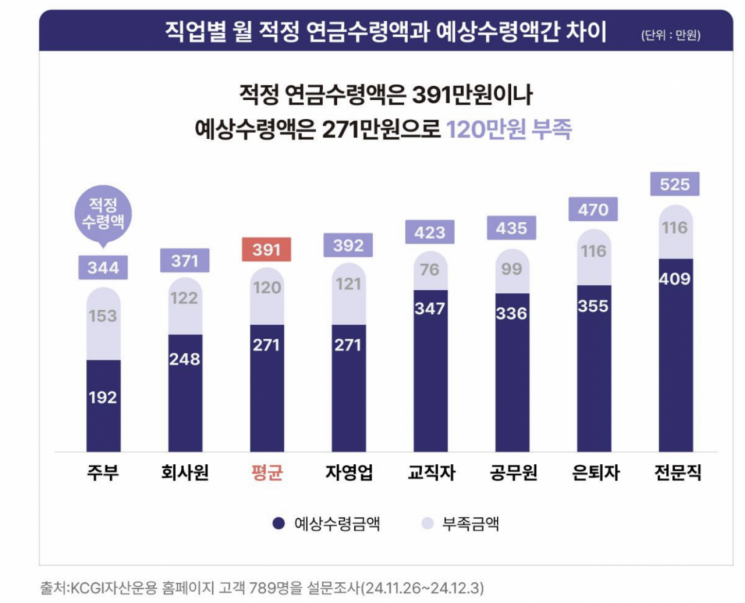

Due to rising prices and an improved standard of living, the gap between the appropriate pension amount and the actual amount received is widening. It was found that couples consider a monthly pension amount of 3.91 million KRW to be appropriate for retirement. However, the average expected amount to be received was only 2.71 million KRW.

According to a survey conducted by KCGI Asset Management from the 26th of last month to the 3rd of this month among 789 of its customers, 7 out of 10 respondents answered that their retirement preparation was insufficient. The most common reason given for inadequate retirement preparation was "not knowing how to prepare for retirement well," with 29% of respondents selecting this. This was followed by "low income" (27%) and "burden of children's education expenses" (22%).

The average appropriate pension amount reported by respondents was 3.91 million KRW (combined public and private pensions for couples). The appropriate and expected amounts were calculated by weighted averaging the amounts and number of responses. The appropriate pension amount surveyed this year increased by 17% compared to 3.34 million KRW during the same period last year. A KCGI Asset Management official stated, "The inflation rates announced by Statistics Korea for 2022 and 2023 were 6.0% and 3.9%, respectively," adding, "Prices have risen by more than 10% in two years, and the perceived inflation is even higher, which explains the increase in the appropriate pension amount."

By occupation, professionals reported the highest appropriate pension amount at 5.25 million KRW. Public officials and educators considered appropriate pension amounts to be relatively high at 4.35 million KRW and 4.23 million KRW per month, respectively. Housewives (3.44 million KRW), company employees (3.71 million KRW), and self-employed individuals (3.92 million KRW) estimated relatively lower appropriate amounts. Respondents who were already retired answered that the appropriate pension amount was 4.7 million KRW, clearly showing that the actual funds needed after retirement are higher than expected before retirement.

The average expected pension amount among respondents was 2.71 million KRW per month, which is 1.2 million KRW less than the appropriate amount. Expected amounts were highest among professionals at 4.09 million KRW per month, followed by educators (3.47 million KRW), public officials (3.36 million KRW), self-employed (2.71 million KRW), and company employees (2.48 million KRW).

Estimating the shortfall by comparing the appropriate pension amount and the actual expected amount, professionals were short by about 1.16 million KRW, with an expected amount of 4.09 million KRW compared to the appropriate amount. Public officials and educators had expected amounts 990,000 KRW and 760,000 KRW less than the appropriate amounts, respectively.

The proportion of respondents who answered that their retirement preparation was insufficient was 68%, down 4 percentage points (P) from 72% last year. By age group, younger respondents were more likely to say their preparation was insufficient. By occupation, housewives, company employees, and self-employed individuals were more likely to feel unprepared for retirement.

Analyzing the expected retirement age by occupation and age group using weighted averages of response rates, the average retirement age was found to be approximately 60.9 years, similar to 60.8 years last year.

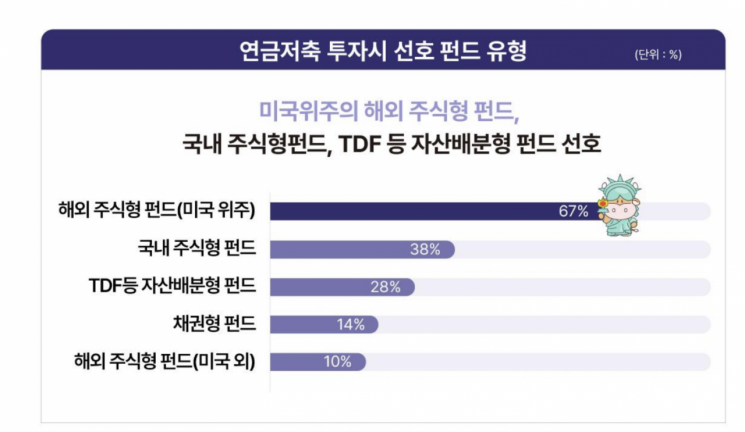

Respondents judged that pension savings funds are better than pension savings insurance for retirement preparation. They preferred pension savings funds because they expect higher long-term returns and tax benefits such as tax deductions. 92% of respondents said they preferred pension savings funds. The preferred product types were U.S.-focused overseas equity funds, domestic equity funds, and target-date funds (TDF) in that order. U.S.-focused overseas equity funds accounted for 67%, domestic equity funds 38%, asset allocation funds such as TDF 28%, and bond funds 14%. Preference for overseas funds excluding the U.S. was low at 10%.

A KCGI Asset Management official explained, "The U.S. stock market, led by big tech companies, has increased its global market dominance and delivered the best performance among global markets," adding, "This explains why it is the most preferred by investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.