Strengthening Credit Evaluation Standards for Landlords

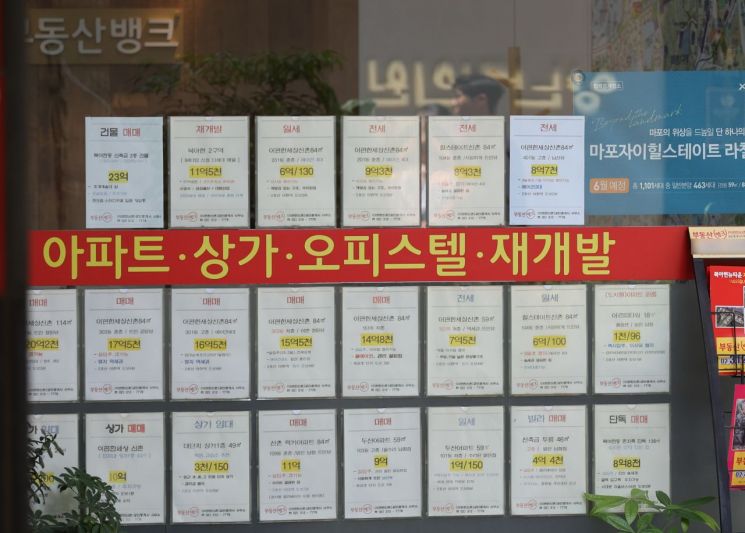

Public guarantees for jeonse loan funds provided by the Korea Housing & Urban Guarantee Corporation (HUG) and the Korea Housing Finance Corporation (HF) help alleviate housing costs for households living under jeonse contracts. However, an analysis revealed that these guarantees also lead to increased demand for jeonse, affecting price fluctuations not only in the jeonse market but also in the sales market.

The Korea Research Institute for Human Settlements stated in its report titled "The Impact of Jeonse Loan Guarantees on the Housing Market and Policy Directions," released on the 24th, that the guarantees by HUG and HF for jeonse loans increased from 66.5 trillion KRW in 2019 to 104.9 trillion KRW last year.

HUG and HF act as guarantors when tenants take out loans from banks for jeonse deposits. The report's analysis shows that these jeonse loan guarantees have the effect of reducing housing costs. Households living under monthly rent who switch to jeonse housing reduce their monthly housing costs by an average of 92,000 KRW. In provincial and metropolitan cities, the savings are 137,000 KRW and 207,000 KRW respectively. However, in the Seoul metropolitan area, where jeonse prices are relatively high, the reduction is only 11,000 KRW.

The problem arises when the increase in public guarantees leads to higher demand for jeonse loans, which in turn affects both the jeonse and sales markets. Ultimately, this diminishes the housing cost alleviation effect. This is because the increased supply of jeonse loan guarantees leads to increased demand for jeonse.

Specifically, a 1% increase in the supply of jeonse loan guarantees results in an annual 2.16% rise in jeonse prices. When jeonse prices rise by 2.16%, the housing cost alleviation effect decreases to an average of 84,000 KRW per month.

As jeonse prices rise, landlords find it easier to purchase homes through gap investment, which increases demand in the sales market and can lead to higher sales prices. The report pointed out the need to expand the public sector’s role to maintain the original purpose of public guarantees for jeonse loans, which is to alleviate housing costs.

The report particularly recommended prioritizing the application of jeonse loan guarantees to affordable jeonse housing and considering policies to gradually reduce interest rates and guarantee fees. This is because applying guarantees to relatively affordable jeonse housing has a greater effect on reducing housing costs.

Since jeonse loan guarantees also impact the sales market, the report emphasized the need to strengthen credit evaluation criteria for landlords. It stressed the importance of tightening standards for jeonse deposits and considering guarantee issuance based on repayment ability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.