2023 Broadcasting Industry Survey Results Announced

Significant Decline in Terrestrial and PP Revenues... Advertising Also Weak

Paid Broadcasting Subscriptions Low, Only IPTV Shows Growth

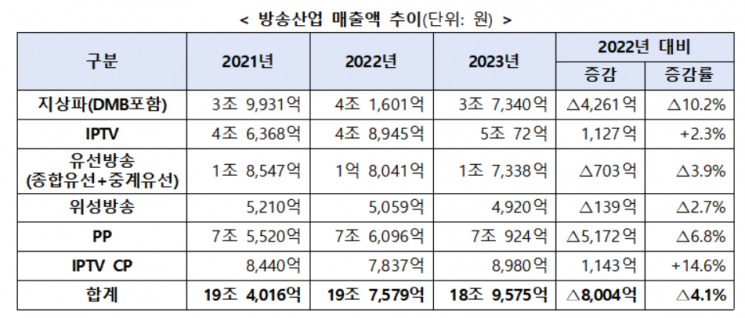

Last year, broadcasting business revenue recorded 18.9 trillion KRW, a 4.1% decrease compared to the previous year, signaling a red light across the broadcasting industry. While the growth rate of paid broadcasting subscribers converged to the 0% range, only Internet Protocol Television (IPTV) providers continue to show growth.

On the 25th, the Ministry of Science and ICT and the Korea Communications Commission released the results of the "Broadcasting Industry Survey" reflecting the status of the domestic broadcasting industry in 2023. The survey has been conducted since 2000 targeting broadcasting operators with sales exceeding 100 million KRW, investigating and announcing data on sales, program production and purchase costs, exports and imports, and workforce. This time, the survey included IPTV Content Providers (hereinafter IPTV CP) regarding their production, distribution, and workforce status.

Last year, the size of the domestic broadcasting market was 18.9575 trillion KRW in sales, a decrease of 800.4 billion KRW (4.1%) compared to the previous year. By operator, terrestrial broadcasters (hereinafter Terrestrial) saw sales drop by 426.1 billion KRW (10.2%) to 3.734 trillion KRW, and Pay TV channel operators (PP) recorded a decrease of 517.2 billion KRW (6.8%) to 7.0924 trillion KRW, showing a significant decline.

Broadcast advertising revenue decreased by 592.6 billion KRW (19.2%) year-on-year to 2.4905 trillion KRW, with all operators except Comprehensive Cable TV Operators (SO) experiencing declines.

For Terrestrial broadcasters, advertising revenue, which had a large share of sales, fell by 282.5 billion KRW (23.3%) to 927.9 billion KRW, causing program sales revenue to surpass advertising revenue.

Total sales of paid broadcasting operators including IPTV, satellite broadcasting, SO, and Relay Cable TV Operators (RO) amounted to 7.23 trillion KRW, showing a slight increase compared to the previous year. However, the growth rate was only 0.4%.

By paid broadcasting medium, IPTV sales increased by 2.3% to 5.0072 trillion KRW due to increased subscriber fees and home shopping transmission fees, whereas SO, RO, and satellite broadcasting saw declines in subscriber fees and home shopping transmission fees, recording 1.7338 trillion KRW and 492 billion KRW respectively, down from the previous year.

IPTV CP operators’ sales rose 14.6% year-on-year to 898 billion KRW.

Total sales of PPs, including comprehensive programming PPs, news-specialized PPs, and general PPs, decreased by 6.8% (517.2 billion KRW) to 7.0924 trillion KRW compared to the previous year. Home shopping PPs, including data home shopping, recorded total sales of 3.4908 trillion KRW, down 5.9% (219 billion KRW) year-on-year.

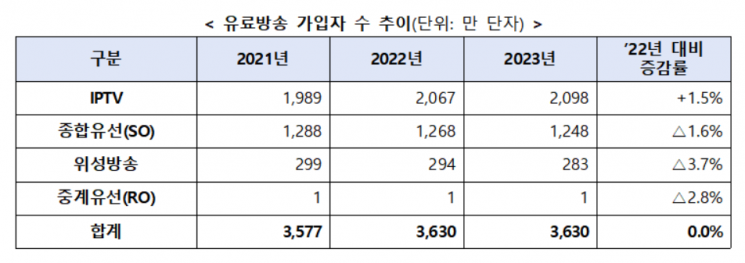

The number of paid broadcasting subscribers stood at 36.3 million as of December last year, increasing by only about 30,000 subscribers compared to the previous year, resulting in a growth rate in the 0% range. The subscriber growth rate has been continuously declining since 2018 when it was 3.5%.

By medium, IPTV subscribers increased by 1.5% to 20.98 million, while SO (12.48 million), satellite broadcasting (2.83 million), and RO (10,000) subscribers decreased.

Broadcast program production and purchase costs totaled 3.8682 trillion KRW with the addition of IPTV CP statistics. Of this, production costs accounted for 73% (2.8247 trillion KRW) and purchase costs 27% (1.0435 trillion KRW).

Exports, including IPTV CP, amounted to 667.31 million USD. Among these, Terrestrial broadcasters accounted for 95.21 million USD (14.3%), PPs 286.02 million USD (42.9%), and IPTV CP 286.08 million USD (42.9%).

The major export countries were led by the United States with 28.6%, followed by Japan (20.5%), Singapore (3.3%), and Taiwan (2.1%).

The number of workers in the broadcasting industry was 38,299, reflecting the IPTV CP pilot survey results from the previous year, showing a decrease of 424 compared to the previous year.

By operator, the number of Terrestrial broadcaster employees was 13,192, down 2.2% year-on-year; paid broadcasting had 6,003 employees, up 0.6%. PPs had 17,212 employees, down 2%, while IPTV CP had 1,892 employees, up 11.4%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.