Continued Correction Phase After Surpassing $100,000

Long-term Policy Benefit Expectations Remain

"Potential Increase of Over $250,000 Per Unit"

On the 9th (local time), a large Christmas tree installed in downtown San Salvador, the capital of El Salvador. The Bitcoin logo is engraved on it. Photo by Reuters and Yonhap News.

On the 9th (local time), a large Christmas tree installed in downtown San Salvador, the capital of El Salvador. The Bitcoin logo is engraved on it. Photo by Reuters and Yonhap News.

The price of Bitcoin, which surpassed $100,000 (approximately 145 million KRW) per coin for the first time this month, has fallen back to the $90,000 range and is undergoing a correction, but expectations for a mid- to long-term upward trend still remain. Experts in the cryptocurrency industry predict that if the U.S. government, under the administration of Donald Trump early next year, designates Bitcoin as a strategic reserve asset and begins purchasing it, the price could exceed $250,000 (approximately 360 million KRW) within the year. There is also an appeal of scarcity as the remaining unmined Bitcoin supply is limited.

Bitcoin Continues to Decline... "Possible Adjustment in the Coming Weeks"

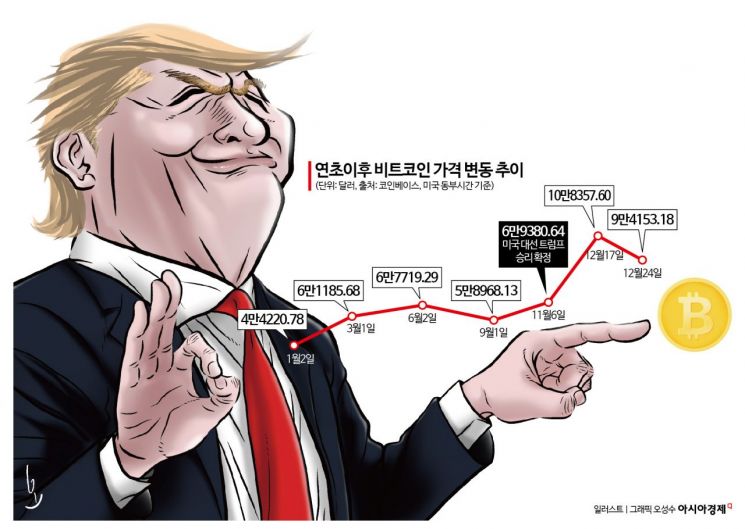

At the beginning of the year, Bitcoin started at $44,220.78 per coin and surpassed the $60,000 mark in March. It fluctuated between $50,000 and $60,000 before showing a steady upward trend from the confirmation of Trump's election victory on November 6 until mid-month. On the 17th of this month (local time), Bitcoin traded at $108,357.60 per coin, breaking the $100,000 barrier for the first time.

The upward momentum of Bitcoin stalled from mid-month. On the 18th, during the Federal Open Market Committee (FOMC) meeting of the U.S. Federal Reserve (Fed), Fed Chair Jerome Powell made 'hawkish' remarks, including the possibility of delayed interest rate cuts next year, causing Bitcoin's price to drop to the $90,000 range, and it has not shown significant rebound since.

It is expected that Bitcoin's price correction will continue for the time being. Andre Dragos, Head of European Research at Bitwise, a cryptocurrency asset management firm, explained, "Considering that indicators such as consumer price inflation have not changed significantly despite the Fed's interest rate cuts, Bitcoin may experience further losses over the next few weeks. If the pace of rate cuts slows more than initially expected, investments in safe assets may increase, while risk assets like cryptocurrencies could see some contraction."

Mid- to Long-Term Optimism Remains... "Possibility of Surpassing $250,000 per Coin Next Year"

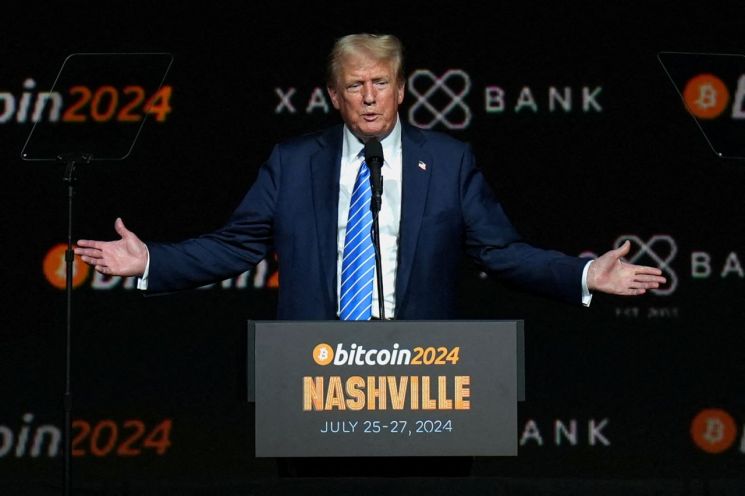

On July 27th (local time), Donald Trump, the President-elect of the United States, attended the 'Bitcoin 2024 Forum' held in Nashville, Tennessee. At the forum, President-elect Trump declared that after taking office, he would designate Bitcoin as a strategic reserve asset of the United States and make large-scale purchases. Photo by Reuters and Yonhap News.

On July 27th (local time), Donald Trump, the President-elect of the United States, attended the 'Bitcoin 2024 Forum' held in Nashville, Tennessee. At the forum, President-elect Trump declared that after taking office, he would designate Bitcoin as a strategic reserve asset of the United States and make large-scale purchases. Photo by Reuters and Yonhap News.

However, despite these correction movements, the prevailing view is optimistic about Bitcoin's mid- to long-term outlook. Since Trump, who campaigned on cryptocurrency-friendly policies, was elected, there is a strong possibility that Bitcoin will be designated as a U.S. strategic reserve asset, ensuring future demand.

Expectations that Bitcoin will benefit from the Trump administration starting in January have been ongoing since July. On July 27, Trump attended the 'Bitcoin 2024 Forum' held in Nashville, Tennessee, where he pledged to purchase Bitcoin as a strategic reserve asset.

Following Trump's pledge, U.S. Senator Cynthia Lummis introduced the 'BITCOIN Act of 2024,' further raising expectations. The main point of the bill is that the U.S. Treasury Department would purchase and hold one million Bitcoins over the next five years, alongside existing strategic reserve assets like gold. After Pennsylvania last month, bills to purchase Bitcoin as a strategic reserve asset have been introduced in about ten U.S. states, including Texas this month.

There is also growing anticipation that Bitcoin's price will rise due to scarcity, as the remaining mineable supply is limited. According to CoinDesk, the maximum possible issuance of Bitcoin is 21 million coins, with approximately 19.79 million currently circulating in the market as of the 1st of this month. The unmined Bitcoin is about 1.31 million coins, which is only 6.24% of the total maximum issuance. The expected completion of mining is projected for 2032.

Tom Lee, Head of Research at Fundstrat, a U.S. market research firm, told CNBC, "There is a very high possibility that Bitcoin's price will reach $250,000 by 2025. This is because the cycle of price increases due to reduced Bitcoin supply will return from the end of this year through next year." He added, "If the Trump administration adopts Bitcoin as a strategic reserve asset and secures over one million Bitcoins, Bitcoin's status as a global financial asset will also rise," expressing optimism.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.