Bank of Korea 'December Consumer Sentiment Survey Results'

Consumer Sentiment Drops 12.3P This Month... Largest Decline Since March 2020

Lowest Level in 2 Years 1 Month Since Legoland Incident

"Political Uncertainty Must Be Resolved for Consumer Sentiment Recovery"

Due to the emergency martial law situation, consumer sentiment this month deteriorated at the largest rate since the pandemic in March 2020. It is expected that consumer sentiment can recover only after political uncertainties are quickly resolved.

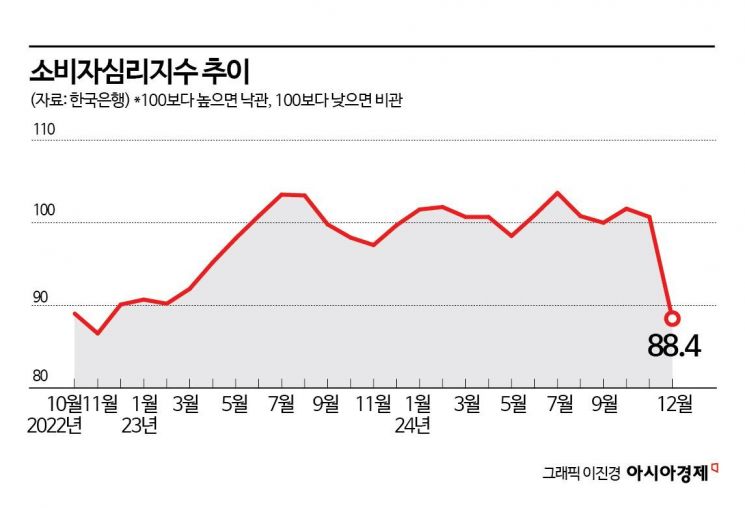

According to the 'December Consumer Sentiment Survey Results' released by the Bank of Korea on the 24th, the Consumer Confidence Index (CCSI) this month dropped sharply by 12.3 points from the previous month to 88.4. This is the largest decline since the pandemic in March 2020 (-18.3 points).

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Sentiment Index (CSI). A value above the long-term average of 100 indicates optimistic consumer sentiment, while a value below 100 indicates pessimism.

The December CCSI recorded its lowest level in 2 years and 1 month since November 2022 (86.6), when the Legoland incident occurred. The CCSI had consistently remained above 100, maintaining optimism from June (100.9), July (103.6), August (100.8), September (100.0), October (101.7), to November (100.7), but shifted to pessimism this month. This is due to the emergency martial law situation increasing political uncertainty, which contracted consumer sentiment and expanded volatility in the domestic financial market.

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea’s Economic Statistics Bureau, said, “Compared to the decline caused by external factors like the COVID-19 pandemic, the drop is not that large, but in terms of the magnitude of the fall, it has been significant recently,” adding, “Consumer sentiment can recover depending on how quickly political uncertainties are resolved and stability is restored.”

He further explained, “The decline was amplified by the overlapping political uncertainties caused by the emergency martial law situation, in addition to concerns over the slowdown in South Korea’s exports following the U.S. presidential election results in November.”

Economic Outlook Sentiment Severely Worsens... Current Economic Conditions CSI Drops at Largest Rate in 4 Years and 9 Months

In particular, sentiment regarding the economic outlook worsened significantly. The Current Economic Conditions CSI in December was 52, down 18 points from the previous month. This is the largest decline since March 2020 (-28 points). The Future Economic Outlook CSI was 56, down 18 points from the previous month, marking the largest drop since July 2022 (-19 points).

The Employment Opportunities Outlook CSI also fell by 14 points from the previous month to 65, the largest decline since July 2022 (-17 points).

On the 2nd, job seekers participating in the 'Korea Job Fair' held at aT Center in Seocho-gu, Seoul, are looking at the recruitment bulletin board. Photo by Jinhyung Kang aymsdream@

On the 2nd, job seekers participating in the 'Korea Job Fair' held at aT Center in Seocho-gu, Seoul, are looking at the recruitment bulletin board. Photo by Jinhyung Kang aymsdream@

The December Consumer Spending Outlook CSI was 102, down 7 points from the previous month. Consumer sentiment decreased for travel expenses (-8 points), dining out (-6 points), and durable goods (-3 points) due to contraction in consumer sentiment amid domestic political uncertainty.

The Housing Price Outlook CSI recorded 103, down 6 points from the previous month, reflecting the slowdown in apartment sale price increases and a decrease in apartment transactions in Seoul.

The expected inflation rate for the next year, which reflects consumer price inflation expectations over the coming year, rose by 0.1 percentage points from the previous month to 2.9%. Although the consumer price inflation rate remained in the 1% range, concerns over the sharp rise in exchange rates and public utility fee increases spread. The expected inflation rate three years ahead rose by 0.1 percentage points to 2.7%, while the five-year expected inflation rate remained unchanged at 2.6%.

This survey was conducted from the 10th to the 17th of this month, targeting 2,500 households in urban areas nationwide (2,271 households responded).

However, this survey did not reflect sentiment after the second impeachment vote held on the 14th. Team leader Hwang explained, “Although the survey period was from the 10th to the 17th, over 90% of responses were received by the 13th,” adding, “Sentiment after the approval was not significantly reflected.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)