KB Financial '2024 Korea Wealth Report'

Over 1 Billion KRW 'Ultra-High Net Worth Individuals' Number 10,000

Preferred Investments: Short-Term Stocks and Mid-to-Long-Term Residential Housing

An analysis revealed that the number of wealthy individuals holding financial assets worth over 1 billion KRW in South Korea exceeded 460,000 last year. They showed the greatest interest in stocks as short-term investments within one year, and residential housing as mid- to long-term investments over 3 to 5 years.

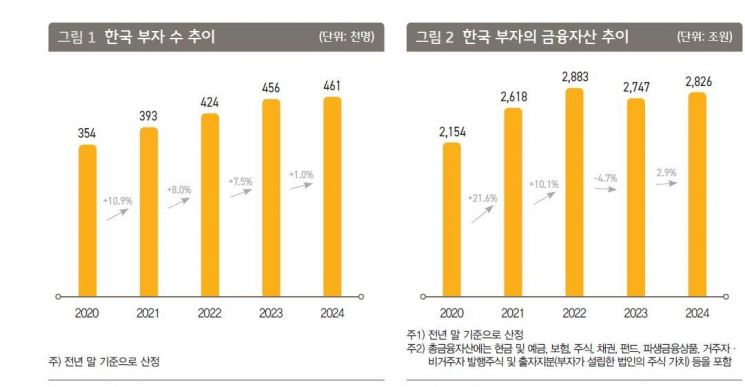

According to the '2024 Korea Wealth Report' published by KB Financial Group Management Research Institute on the 22nd, as of the end of last year, the number of 'wealthy individuals' with financial assets of 1 billion KRW or more was estimated at 461,000, accounting for 0.9% of the total population. The number of wealthy individuals increased by 1.0% compared to 2022, but this growth rate was the lowest since the counting of wealthy individuals began in 2011.

As of the end of last year, the total financial assets held by wealthy individuals in Korea amounted to 2,826 trillion KRW, marking a 2.9% increase. This was analyzed to be due to the KOSPI index rebounding by 18.7% last year.

When dividing wealthy individuals by asset size, 91.5% (422,000 people) were classified as 'asset holders' with financial assets between 1 billion KRW and less than 10 billion KRW. Those with financial assets between 10 billion KRW and less than 30 billion KRW, classified as 'high-net-worth individuals,' accounted for 6.3% (29,000 people), and 'ultra-high-net-worth individuals' with financial assets exceeding 30 billion KRW made up 2.2% (11,000 people).

Looking in detail at the asset composition of wealthy individuals in Korea, residential housing accounted for 32.0%, liquid financial assets such as cash 11.6%, non-residential housing 10.9%, buildings and commercial properties 10.3%, savings and deposits 8.7%, and stocks 7.4%. Compared to the same survey results published last year, the proportions of stocks and non-residential housing increased due to stock price rises and bottom-fishing in real estate.

The rate of experiencing returns by financial investment product was highest for stocks (32.5%), followed by funds (9.0%), maturity refund-type insurance (7.3%), and bonds (6.5%). Wealthy individuals investing in stocks held an average of 6.1 domestic stock items and 4.2 overseas stock items.

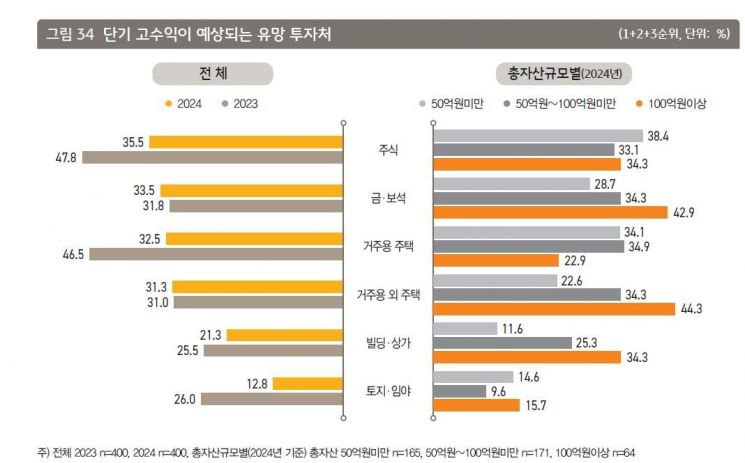

For short-term investments expected to yield high returns within the next year, wealthy individuals in Korea most frequently chose stocks (35.5%). This was followed by gold and jewelry (33.5%), residential housing (32.5%), non-residential housing (31.3%), and buildings and commercial properties (21.3%).

For promising mid- to long-term investments over 3 to 5 years with expected high returns, residential housing (35.8%), stocks (35.5%), non-residential housing (32.3%), and gold and jewelry (30.3%) were selected.

The main sources of wealth accumulation for wealthy individuals were business income (32.8%) and real estate investment (26.3%), and the average size of the 'seed money' for asset growth was confirmed to be 740 million KRW. They were found to have accumulated this seed money at an average age of 42.

Among wealthy individuals, 60.8% had received inheritances or gifts including cash and deposits (53.9% multiple responses), residential real estate (44.0%), and non-residential real estate (35.4%), and 24.5% had already gifted cash and deposits (54.6%), residential real estate (48.5%), and others to their spouses or children.

Among them, 75.5% have been investing in overseas assets for 'more than 3 years,' with preferred overseas investment products being overseas stocks (47.5%), foreign currency deposits, insurance, and funds (37.3%), and overseas bonds (12.3%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.