Export Industry Business Outlook Survey... Below Baseline for 4 Consecutive Quarters

Semiconductor Q4 135.2 → Q1 Next Year 64.4 'Halved'

Due to expanded import regulations and sluggish economic recovery, it is forecasted that the export performance of domestic companies in the first quarter of next year will deteriorate. This is the first time in four quarters that companies have projected a decline in export performance compared to the previous quarter. In particular, the outlook for the semiconductor and home appliance sectors has halved compared to the fourth quarter figures. Semiconductors are expected to face export declines due to increased exports of general-purpose DRAM semiconductors from China, while home appliances are likely to see reduced exports due to weakened demand from major customers in North America and the European Union (EU).

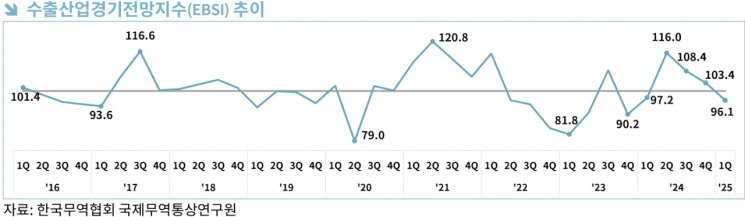

The Korea International Trade Association (KITA) announced on the 22nd that the International Trade and Commerce Research Institute recently published the '2025 Q1 Export Industry Business Survey Index (EBSI) Report' containing these findings.

According to the report, the EBSI index for the first quarter was 96.1, falling below the baseline of 100 for the first time in four quarters. An EBSI above 100 indicates a prevailing optimistic outlook for export growth in the next quarter, while below 100 indicates the opposite. The survey was conducted among 2,000 companies with export performance exceeding $500,000 (approximately 720 million KRW) in the previous year. A total of 1,010 companies participated in this survey.

By product category, 10 out of 15 items recorded values below 100. Home appliances showed the highest possibility of export contraction with an index of 52.7, due to reduced demand from major export destinations such as North America and the EU. The home appliance outlook dropped from 100.8 in the third quarter to 97.5 in the fourth quarter, falling below 100, and the forecast for the first quarter of next year was halved.

Semiconductors also fell significantly below the baseline at 64.4. Export conditions are expected to worsen due to intensified competition from increased exports of general-purpose DRAM from China and rising inventories in upstream industries. The semiconductor index had recorded values between 120 and 140 in the second quarter (148.2), third quarter (125.2), and again in the third quarter (135.2), before halving.

Shipbuilding (146.4) is expected to see improved export conditions due to expanded exports centered on container ships and liquefied natural gas (LNG) carriers, as well as rising ship prices. Automobiles and auto parts (130.7) are also expected to maintain strong export growth due to increased demand for hybrid electric vehicles (HEV) and continued export strength mainly to North America.

Among the categories, 9 out of 10 were forecasted negatively. The indices for 'Import Regulations and Trade Frictions (74.5)' and 'Manufacturing Costs of Export Products (82.7)' were low. KITA stated, "Concerns about a significant expansion of import regulations due to intensified protectionism in major countries were the most prominent."

However, conditions for 'Export Unit Prices (106.2)', mainly for petroleum products and automobiles/auto parts, were evaluated to be similar to or slightly improved from the previous quarter.

The main export challenges for the first quarter of next year were identified as 'Rising Raw Material Prices (17.4%)' and 'Economic Slump in Export Destinations (15.2%)'. Notably, concerns about expanded import regulations rose to 8.1%, more than double the 3.6% recorded in the fourth quarter.

Researcher Heo Seul-bi from KITA said, "There are concerns that the trade environment may worsen following the inauguration of the second Trump administration," adding, "As global uncertainties increase, our export companies must closely monitor trade policies of various countries and thoroughly prepare for raw material supply management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)