Foreign Ownership Changes in Individual Stocks Are Small

New Money Withdraws After Martial Law Shock... Returns to Previous Levels

Short Selling Ban Leaves No Hedge Options

Foreign investors sold off more than 1 trillion won worth of financial stocks in just one month of December amid the impeachment crisis triggered by President Yoon Suk-yeol. Only long-term investors who witnessed the historic fluctuations of the Korean stock market remained, while the new money (new funds) that had flowed in since the beginning of the year on expectations of value-up policies quickly exited the Korean stock market.

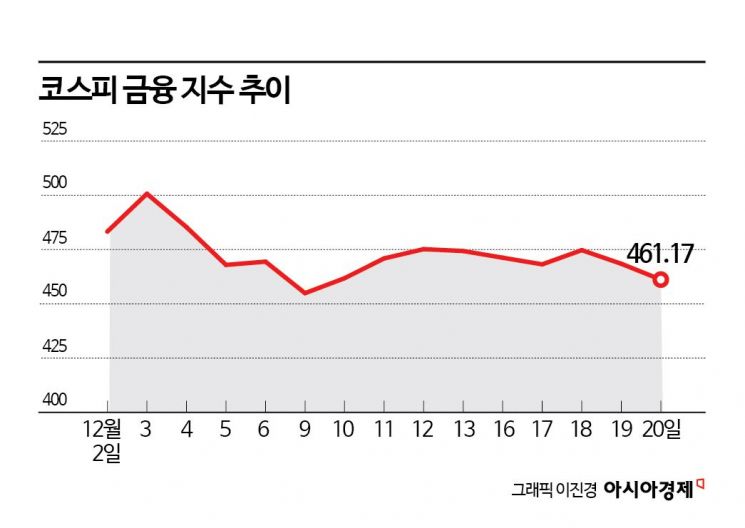

According to the financial investment industry on the 23rd, foreign investors net sold 1.0037 trillion won worth of KOSPI financial sector stocks from December 2 to 20. This accounted for 34.5% of the total KOSPI net sales amount (2.9083 trillion won) during the same period. Except for two days out of 15 trading days, selling pressure was maintained throughout. By KOSPI sector, the scale of net sales was the third largest following manufacturing and electrical & electronics.

Since the declaration of emergency martial law on December 3, financial stocks including the four major financial holding companies (KB Financial, Shinhan Financial Group, Hana Financial Group, and Woori Financial Group) have widened their losses amid concerns over the loss of value-up momentum. The foreign ownership ratio of KB Financial, a top market cap stock, fell by 1.2 percentage points from 78.0% on the 2nd to 76.8% on the 19th of this month. Shinhan Financial Group dropped from 61.0% to 60.2%, Hana Financial Group from 68.17% to 67.89%, and Industrial Bank of Korea from 14.88% to 14.50%. However, Woori Financial Group rose from 45.74% to 45.89%.

Interpretations within the financial investment industry regarding the recent sluggishness of bank stocks are divided. A representative from a commercial bank said, "The fact that foreigners are leaving even the stable financial sector that pays high dividends means that confidence in the Korean stock market itself has been shaken," adding, "It will not be easy to turn foreign investors' sentiment before meaningful signs of economic rebound centered on semiconductor sectors like Samsung Electronics emerge."

There is also a counterargument that significance should be placed on the fact that the foreign ownership ratio of individual stocks has not significantly decreased. Kim Jae-woo, senior research fellow of the Financial Consumer Goods Team at Samsung Securities, said, "Bank stocks showed a high rate of price increase from the beginning of the year but experienced a sharp correction in December," while emphasizing, "However, the limited change in foreign ownership ratio suggests that the perspective on banking, centered on long-term investors, has not been significantly damaged."

Lee Nam-woo, chairman of the Korea Corporate Governance Forum, diagnosed, "A kind of new money such as hedge funds and foreign asset management companies invested in large financial stocks that are good at value-up policies this year, fueled by expectations of value-up policies, but recently, as uncertainty has increased, there has been a strong tendency to realize profits and leave," adding, "Traditional foreign investors are holding on with the expectation that the Korean stock market will recover, but funds without hedging means in Korea, where short selling is banned, seem to be seeking alternatives outside Korea."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)