497 Companies with Interest Coverage Ratio Below 1 for 3 Consecutive Years

Accounting for About One-Fifth of All Listed Companies

Financial Authorities Also Share Concerns... Preparing Institutional Improvement Measures

Nearly 500 domestic listed companies are struggling to even cover their interest expenses with operating profits. To remove these struggling companies, which are dragging down healthy firms, from the stock market, financial authorities and the Korea Exchange plan to soon prepare institutional improvement measures.

According to financial information provider FnGuide on the 20th, the number of non-financial listed companies with an interest coverage ratio below 1 for three consecutive years reached 497 as of the third quarter this year. This accounts for about one-fifth of all listed companies (2,625). Among them, 101 are listed on the KOSPI and 396 on the KOSDAQ. The number of companies with a negative interest coverage ratio due to operating losses also reached 422.

The interest coverage ratio is calculated by dividing a company's operating profit earned in a year by the interest expenses due that year. A ratio below 1 means the company struggles to pay even the interest with its earnings. Being a struggling company for more than three years is practically a prelude to closure, commonly referred to in the market as a "zombie company." However, caution is needed with negative interest coverage ratios because if interest expenses are high, the result can be misleadingly low. When two companies have similar operating losses, the one with higher interest expenses will show a lower ratio. This is why investors need to consider actual interest expenses as well.

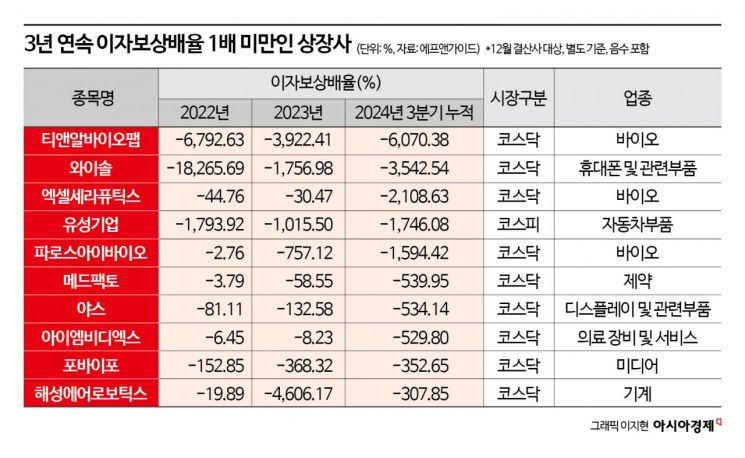

Among the 10 companies with the lowest interest coverage ratios this year (cumulative from Q1 to Q3), nine are KOSDAQ-listed companies except for Yuseong Corporation. These include T&R Biofab (-6070.38%), Ysol (-3542.54%), Excel Therapeutics (-2108.63%), Yuseong Corporation (-1746.08%), Pharos iBio (-1594.42%), MedPacto (-539.95%), YAS (-534.14%), IMBDX (-529.80%), Forbyfor (-352.65%), and Haesung Aerobotics (-307.85%). These companies are concentrated in the pharmaceutical and bio sectors, where operating losses are inevitable in the early years due to research and development (R&D) costs. Additionally, companies from various industries such as mobile phone parts, automotive parts, display parts, media, and machinery are included.

Struggling companies are suspected of being more likely to commit accounting fraud, such as inflating sales, to avoid delisting. The Financial Supervisory Service (FSS) announced last month that it has been steadily detecting struggling companies engaging in accounting fraud to avoid delisting and plans to proactively conduct accounting audits. For example, a KOSDAQ-listed company recently avoided being designated as a management item due to operating losses by supplying products once to a related party, falsely recording sales, and then recovering the proceeds through the CEO's nominee account. The FSS plans to comprehensively analyze signs of struggling companies by considering proximity to management item designation criteria, consecutive operating losses, interest coverage ratio below 1, rapid increase in fundraising, and going concern uncertainties.

Financial authorities share this concern and are preparing fundamental institutional reforms. The Korea Exchange commissioned the Korea Capital Market Institute in July to conduct a "Research Project to Strengthen Securities Market Competitiveness," and the authorities plan to finalize detailed measures based on the results. The market expects measures such as strengthening listing eligibility criteria, enhancing accounting transparency, and shortening delisting review periods to be considered. For example, the current maximum four-year improvement period granted to KOSPI-listed companies may be shortened to two years, and for KOSDAQ-listed companies, the number of review rounds upon delisting reasons arising may be reduced from three to two.

However, some in the market point out that due to the high volatility of the domestic industry, a cautious approach is necessary when judging struggling companies. Lee Sang-ho, a research fellow at the Capital Market Institute, said, "The shipbuilding industry had an interest coverage ratio below 1 for three consecutive years just a few years ago. If all those companies had been delisted then, the current glory of K-shipbuilding would not exist." He added, "In policy design, it is necessary to carefully consider various conditions, including companies with an interest coverage ratio below 1 that are more likely to commit fraud."

A financial investment industry official said, "In the past, when a company was decided to be delisted, many investors protested in front of the exchange or the FSS. Delisting many companies at once is a very burdensome task for the authorities, but the recent market atmosphere has become more favorable, so the authorities are likely to feel urgency not to miss the right timing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.