Stock Prices Surge Immediately After 12·3 Emergency Martial Law Incident

Institutions Accumulate Stocks During Surge and Suffer Valuation Losses

Foreigners Net Sell 40 Billion Won Over Five Days Starting from the 4th

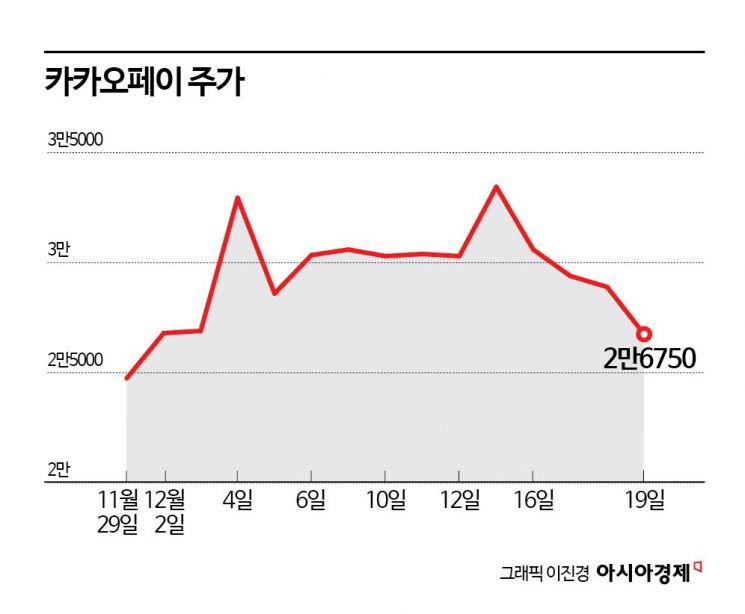

The stock price of Kakao Pay, which surged sharply immediately after the 12·3 emergency martial law incident, has returned to its original level. The mood reversed following the passage of the impeachment motion against President Yoon Suk-yeol. As investors perceived the issue as having dissipated and began to realize profits, the stock price declined. This has drawn attention as the fortunes of investors diverged.

According to the financial investment industry on the 20th, Kakao Pay's stock price fell 7.44% the previous day, closing at 26,750 won. Kakao Pay's stock price soared from 26,900 won on the 3rd to 34,400 won on the 16th. After reaching a short-term peak on the 16th, profit-taking sell orders poured in, causing the stock price to drop more than 20% in just four days.

Kakao Pay attracted investors' attention on the 4th when its stock price surged more than 20% in a single day. Given the strong checks on the Kakao Group under the Yoon Suk-yeol administration, there was vague optimism that the company would benefit from a regime change, which drove the stock price up.

From the 4th to the 13th, institutional investors accumulated a net purchase of 1.27 million shares of Kakao Pay. The average purchase price per share was 30,667 won, and based on the previous day's closing price, the evaluation loss rate was 12.8%. From the 16th, institutions showed a selling bias for four consecutive days, disposing of about 450,000 shares during that period. The average selling price was 29,106 won, approximately 1,561 won lower than the average purchase price of previously acquired shares. A simple calculation shows an average loss rate of 5.1%.

Institutions that reduced their Kakao Pay holdings after the passage of the impeachment motion were able to minimize losses. On the other hand, investors still holding shares are experiencing increasing losses.

A financial investment industry official explained, "Expectations for Kakao Pay's performance improvement had been reflected even before the 12·3 emergency martial law incident," adding, "After the martial law incident, Kakao Pay surged sharply, and it seems institutions hurried to accumulate shares."

While institutions were driving up Kakao Pay's stock price, foreign investors reduced their holdings. From the 4th to the 10th, they sold stocks worth 40 billion won. The average selling price was 30,524 won. The foreign ownership ratio decreased from 37.8% to 36.8%.

More than two weeks have passed since the martial law incident, and it can be seen that foreign investors responded better than domestic institutions. However, the Yeouido securities market expects a stock price rebound driven by Kakao Pay's core business growth. Im Hee-yeon, a researcher at Shinhan Investment Corp., said, "We expect steady profit growth in core businesses such as payment and financial services," adding, "On a separate basis, sales and operating profit are estimated to increase by 8.9% and 36.6%, respectively, compared to the previous year."

As affiliates such as Kakao Pay Securities and Kakao Pay Insurance grow, expectations for a turnaround to profitability on a consolidated basis are also increasing. Kakao Pay recorded an operating loss of 24.5 billion won cumulatively through the third quarter of this year. Starting next year, it is expected to turn profitable, which should increase corporate value. Kim Dong-woo, a researcher at Kyobo Securities, said, "Stable profit bases from payment and loan services are being supplemented by high growth in insurance sales and a reduction in operating losses in the securities business," forecasting, "Continuous improvement in the profit and loss structure is possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.