Micron Earnings Forecast Misses Expectations

Domestic Memory Industry Likely Impacted

Concerns Over 'HBM Oversupply' Becoming Reality

'Big 3' and Chinese Firms Join Market

Industry Worries Since Early This Year

Samsung Targets HBM4 Mass Production Next Year

Samsung Global Strategy Meeting

Vice Chairman Jeon Young-hyun Chairs Meeting

SK May Reconsider Strategy

Micron Technology, a key indicator of performance in the semiconductor industry, reported results for the first quarter of 2025 (September to November) that fell significantly short of market expectations. Despite strong sales of high-bandwidth memory (HBM), the disappointing results are expected to have a considerable impact on the domestic memory industry, including Samsung Electronics and SK Hynix. On the same day, Samsung Electronics' Device Solutions (DS) division, responsible for semiconductor business, began a global strategy meeting chaired by Vice Chairman and Division Head Jeon Young-hyun.

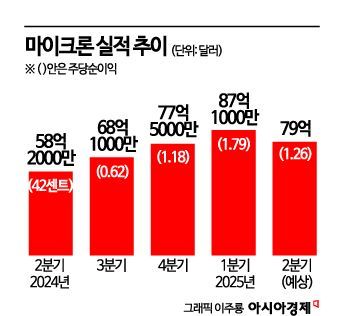

HBM Sales Doubled but Still Fell Short of Expectations

On the 18th (local time), Micron announced that its revenue for the first quarter of fiscal year 2025 was $8.71 billion (approximately 12.6251 trillion KRW), with earnings per share of $1.79. This significantly missed Wall Street’s forecast of $8.99 billion (approximately 13.031 trillion KRW) in revenue and $1.92 earnings per share. CEO Sanjay Mehrotra explained, "HBM sales doubled compared to the previous quarter, and data center sales exceeded 50% of total revenue for the first time," but these achievements did not translate into strong overall performance.

Industry analysts note that the fact that HBM, which Micron has been heavily focusing on, failed to significantly boost earnings is highly indicative. HBM is one of the ‘high value-added products’ that generate substantial profits when produced and sold. Micron recently had several positive developments related to HBM.

Micron designed the 5th generation HBM3E 8-stack specifically for Nvidia’s ‘Blackwell’ AI chip, a major player in the AI chip market, which was expected to increase supply compared to before. The HBM3E 12-stack also received favorable evaluations from customers. At the previous quarter’s earnings announcement, Micron pledged that all HBM3E 8-stack and 12-stack units, which began shipping in Q2 this year, were sold out through next year. They also unveiled plans to mass-produce the 6th generation HBM4 starting in 2026. These announcements had led Wall Street to anticipate an ‘earnings surprise’ from Micron this quarter.

Impact of Oversupply and DRAM Price Decline

This announcement can be interpreted as meaning that HBM did not have a significant impact on Micron’s overall performance. Negative factors such as HBM oversupply and sharp declines in memory prices, including DRAM, seem to have been highlighted instead.

Concerns about HBM oversupply have been ongoing in the industry since early this year. Analysts suggest that Micron’s recent earnings report may mark the realization of these concerns. With the competition among Samsung Electronics, SK Hynix, and Micron expected to intensify from next year over HBM4 and higher-stack HBM3E, the large supply of HBM entering the market is likely to drive prices down. The situation is further complicated by Chinese companies like Huawei independently developing high-performance HBM memory, which could exacerbate the oversupply problem.

The impact of the sharp decline in DRAM prices is also significant. The industry consensus is that DRAM profitability has greatly deteriorated due to aggressive low-price competition from Chinese companies. According to market research firm ‘DRAMeXchange,’ the average fixed transaction price for PC DRAM standard products (DDR4 8Gb 1Gx8) fell 35.7% in just four months, from $2.10 in July to $1.35 in November. This is the lowest level since September last year. Last month alone, prices plunged 20.59% compared to the previous month, marking the largest drop this year.

Strategic Revisions on HBM Focus Inevitable

This earnings report makes it inevitable that Samsung Electronics and SK Hynix, the world’s top two memory companies, will have to revise their business strategies. Samsung Electronics has pledged to regain memory leadership by mass-producing HBM4 starting late next year. SK Hynix officially announced the development of the world’s first HBM3E 16-stack at last month’s ‘SK Artificial Intelligence (AI) Summit.’ Both companies have recently shown their commitment to focusing on memory businesses, including HBM, through personnel and organizational changes, but reconsideration is now possible.

Besides HBM, trends in the NAND flash market are also noteworthy. Japanese semiconductor company Kioxia was listed on the Tokyo Stock Exchange on the 18th, signaling intensified competition in the NAND flash market. Kioxia is known as the ‘third player’ in the global NAND flash market. With its official debut in the stock market, it is likely to actively invest in facilities and technology development. Kioxia is expected to enhance financial stability through this listing and secure investment funds for production expansion.

Samsung Electronics and SK Hynix also face the burden of not yet securing U.S. government subsidies. If they fail to receive them before the new administration takes office next month, their situation could become difficult. Following Intel and Micron, on the 17th, Taiwanese silicon wafer manufacturer ‘GlobalWafers’ was finally approved to receive up to $406 million (approximately 583.422 billion KRW) in U.S. government subsidies. Samsung Electronics and SK Hynix are currently negotiating with preliminary agreements to receive $6.4 billion (approximately 9.2 trillion KRW) and $450 million (approximately 640 billion KRW) in subsidies, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.