CEO Score, Survey of Top 500 Companies by Sales

Aggressive Kakao, SK, Naver Significantly Reduced

LS Electric Leads M&A with Total of 5 Deals

This year, mergers and acquisitions (M&A) activities among major domestic conglomerates have significantly contracted. The only large-scale deal exceeding 1 trillion KRW was Korean Air's acquisition of Asiana Airlines. Companies that had pursued aggressive M&A expansion strategies, such as Kakao, SK, and Naver, drastically reduced their M&A activities this year due to global economic instability and a sluggish domestic market.

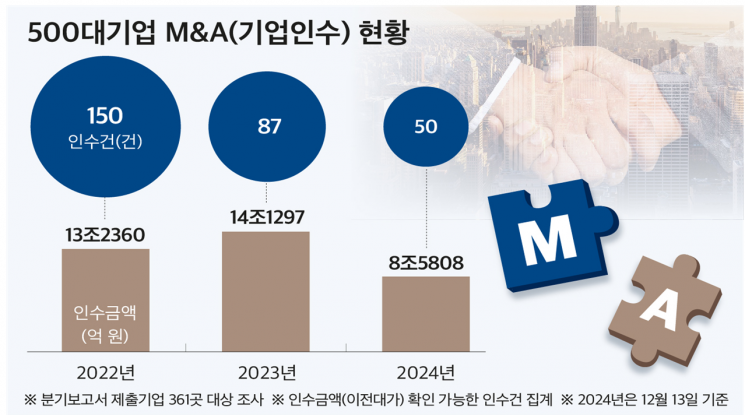

On the 18th, CEO Score, a corporate data research institute, surveyed 361 companies out of the top 500 domestic companies by revenue that submitted their third-quarter reports, investigating M&A status from 2022 until the 13th of this month. The total M&A investment scale this year was recorded at 8.5808 trillion KRW. This represents a 39.3% (5.5489 trillion KRW) decrease compared to last year's 14.1297 trillion KRW. During the same period, the number of M&A deals also dropped from 87 to 50, a 42.5% reduction. Compared to 2022 (150 deals), the figure has shrunk to one-third in two years.

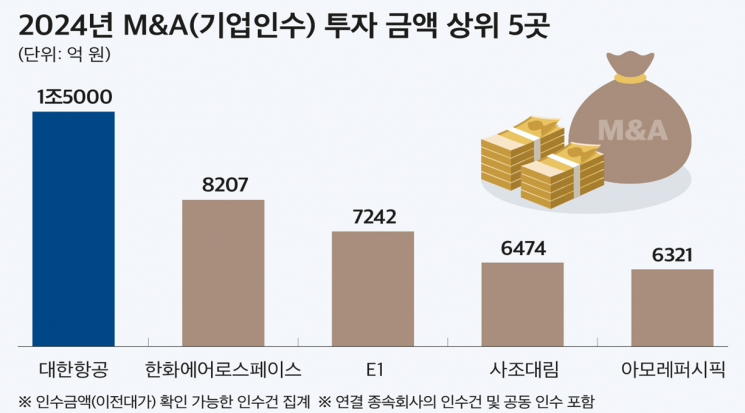

The only large-scale M&A exceeding 1 trillion KRW this year was Korean Air's acquisition of Asiana Airlines. Korean Air acquired a 63.88% stake in Asiana Airlines for 1.5 trillion KRW after four years since the related disclosure. The total acquisition amount reached 1.8 trillion KRW. Korean Air paid 800 billion KRW for new shares and received final merger approval.

The next largest M&A deal was Hanwha Aerospace's acquisition of Dynamac, a floating offshore facility specialist. Hanwha Aerospace acquired 95.15% of Dynamac's shares for 820.7 billion KRW through a Singapore special purpose company (SPC). Procedures for acquiring the remaining shares are underway.

Additionally, E1 acquired Pyeongtaek Energy Service for 594.3 billion KRW, and Sajo Daerim purchased 99.86% of Foodist shares for 252 billion KRW. Mirae Asset Securities acquired Indian securities firm Sharekhan for 586.7 billion KRW last month. Other companies conducting M&A include Orion (548.5 billion KRW), Shinsegae (470 billion KRW), SK Chemicals (356.3 billion KRW), and LIG Nex1 (332.9 billion KRW).

The company that conducted the most M&A deals among the surveyed firms was LS Electric. It acquired a total of five companies: KOC Electric (59.2 billion KRW), Tira Utech (38.5 billion KRW), Korea ENM (10.8 billion KRW), CX Solution (1.8 billion KRW), and LFMS (0.2 billion KRW). Following that, six companies including E1, Sajo Daerim, SK Chemicals, DB Insurance, LX International, and TKG Taekwang each conducted two M&A deals, while 33 companies including Hanwha Aerospace conducted one M&A deal each this year.

Kakao, which had expanded its territory through aggressive M&A (15 deals in 2022, 8 deals in 2023), only completed one acquisition of Tain's Valley. SK (7 deals in 2022, 6 deals in 2023) and Naver (6 deals in 2022, 3 deals in 2023) also did not engage in any notable M&A activities.

This survey excluded deals that have not been completed or whose acquisition dates are undecided. Hankook Tire & Technology's acquisition of Hanon Systems is pending scheduling after a capital increase within the year. Major deals such as Woori Financial Group's acquisition of Dongyang Life and ABL Life Insurance, and Hanwha Systems and Hanwha Ocean's acquisition of a U.S. shipyard in the Philippines are also awaiting completion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)