The financial authorities have decided to reduce the card fee for merchants with annual sales of 300 million KRW or less from the existing 0.5% to 0.4%. Considering the burden on card companies due to decreased sales and the deterioration of their profitability, the fee rate recalculation cycle will be extended from 3 years to 6 years.

According to the Financial Services Commission on the 17th, Chairman Kim Byung-hwan met with Jeong Wan-gyu, Chairman of the Credit Finance Association, and CEOs of eight specialized card companies at the Credit Finance Association in Jung-gu, Seoul, at 2 p.m. to discuss next year's card fee revision plan.

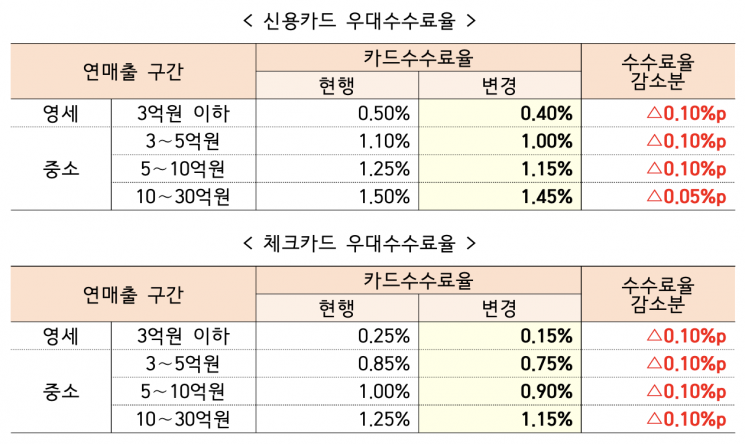

At the meeting, it was decided to lower the credit card fee for small and medium-sized merchants with annual sales of 300 million KRW or less by 0.1 percentage points from the existing 0.5% to 0.4%. For annual sales between 300 million and 500 million KRW, the card fee will be reduced from 1.1% to 1%, from 1.25% to 1.15% for 500 million to 1 billion KRW, and from 1.5% to 1.45% for 1 billion to 3 billion KRW.

The Financial Services Commission's analysis shows that this preferential fee rate reduction will reduce the card fee burden for small and medium-sized merchants by about 300 billion KRW annually. The card fees for approximately 3,046,000 small and medium-sized merchants will decrease by an average of 8.7%, and about 1,786,000 small electronic payment gateway (PG) operators will see their fee burden reduced by an average of 9.3%.

In the previous adjustment in 2021, the fee rate for small merchants with annual sales under 300 million KRW was lowered from 0.8% to 0.5%, and for medium-sized merchants with sales between 300 million and 3 billion KRW, it was reduced from 1.3-1.6% to 1.1-1.5%. The fee reduction effect was about 700 billion KRW annually. A Financial Services Commission official explained, "The scope for reduction has decreased compared to the past due to increases in procurement costs, risk management costs, and approval/settlement costs, excluding general administrative expenses among the components of eligible costs."

For general merchants with annual sales of 100 billion KRW or less, the card fee rate will remain unchanged. In previous card fee revisions, the fee rate for merchants with annual sales exceeding 3 billion KRW was increased by more than 30%. However, considering the difficult business environment for self-employed individuals due to recent domestic demand sluggishness, the financial authorities and the card industry have agreed not to raise the fee rate for three years.

Additionally, the recalculation cycle for eligible costs will be adjusted from 3 years to 6 years. Recalculation of eligible costs refers to the process of analyzing the cost of merchant fees, including card companies' funding costs, risk management costs, general administrative and marketing expenses, and then adjusting the card fee rate accordingly. Since card fees have been lowered every three years, making it difficult for the card industry to earn profits from their core credit sales business, the adjustment cycle has been extended to 6 years. However, if it is deemed necessary to recalculate eligible costs based on domestic and international economic conditions, the business environment of small business owners and self-employed individuals, and the operational and business conditions of card companies, eligible costs can be recalculated every three years.

The preferential fee rate adjustment according to the card fee revision plan is expected to be applied from February 14 next year, starting with the selection of small and medium-sized merchants in the first half of the year, following amendments to supervisory regulations.

The meeting also discussed risk factors and development directions for the card industry. The card industry stated that there are no disruptions to the current funding plans, but they are monitoring funding conditions in real time and preparing contingency plans in response to increased financial market volatility. They also said they will continue to actively promote the sale and disposal of non-performing loans (NPLs) to manage soundness indicators such as delinquency rates. The card industry also proposed improvements to related systems, including activating financial and non-financial combined services and expanding ancillary businesses to respond to new payment demands.

Chairman Kim said, "We will actively support the regulatory system centered on physical cards and face-to-face transactions to align with the digital and artificial intelligence (AI) era," adding, "We need to actively manage to prevent deterioration of the card industry's soundness due to increased card loan handling, while responding in a balanced manner so that funding for vulnerable borrowers is not restricted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.