Pension Supervision Office Moves to Financial Investment Sector

Discussing Pension System with Ministry of Employment and Labor

Ministry of Employment and Labor Avoids Principal Loss

Financial Supervisory Service Wants to Expand Risk Asset Investment

Clear Agreement Needed on Pension Management Direction

The Financial Supervisory Service (FSS) will actively encourage an expansion of the proportion of risky assets in retirement pension management starting next year. Despite the introduction of the default option system to increase retirement pension returns, 90% of subscribers still invest in principal-guaranteed products such as deposits. It is also interpreted as an effort to achieve value-up of the Korean stock market through the expansion of risky assets. However, active cooperation from the Ministry of Employment and Labor is necessary for this. The Ministry of Employment and Labor is the main authority overseeing the retirement pension system and prioritizes principal protection of pensions.

According to financial authorities and the Ministry of Employment and Labor on the 17th, the FSS’s Pension Supervision Office will conduct a business report on January 6 and hold a meeting related to the retirement pension system with the Ministry of Employment and Labor in Sejong City in mid-January.

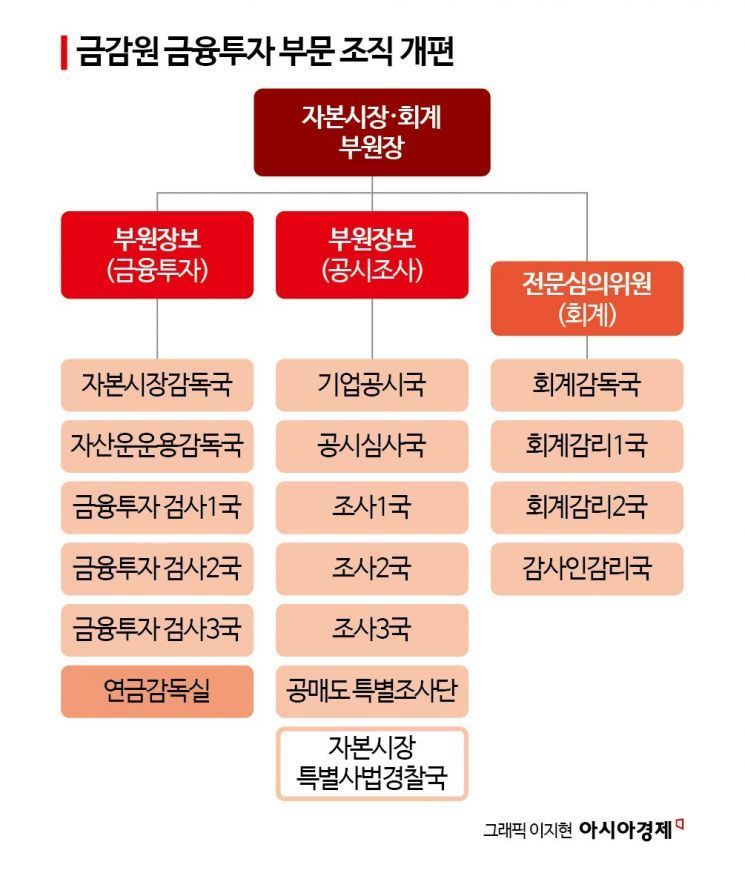

Earlier, the FSS reorganized its structure, moving the Pension Supervision Office, which was under the Consumer Finance Division, to the Financial Investment Division. The placement of the Pension Supervision Office under the Financial Investment Division is symbolic. It is interpreted as a sign that the direction of retirement pension management will be focused on risky assets such as stocks and exchange-traded funds (ETFs). In fact, the FSS explained the background of the reorganization by citing the growing importance and expansion of the retirement pension market, which necessitates stronger management and supervision of pension operators.

The retirement pension management direction envisioned by the Pension Supervision Office is modeled after the U.S. retirement pension system '401K.' In 401K, employees contribute a fixed amount monthly, and companies match the contributions, with about 71% of the investment portfolio allocated to stocks. In contrast, most Korean retirement pensions invest in safe assets such as deposits and bonds. As the aging society deepens, the government introduced the default option system in July last year to boost pension returns.

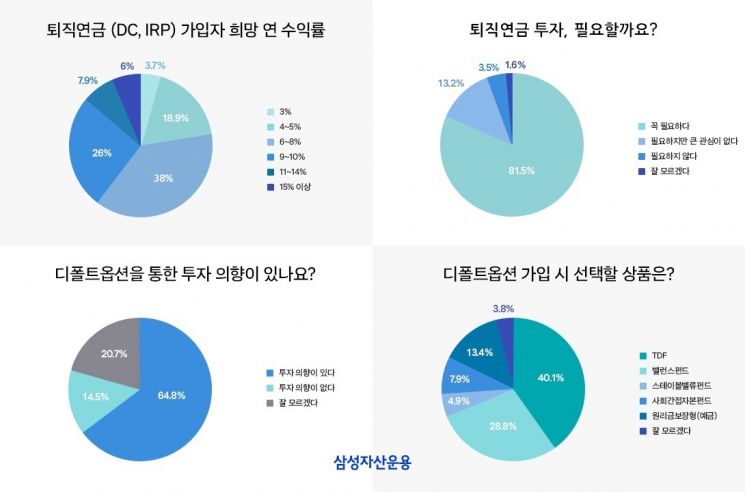

The default option is a system where, if defined contribution (DC) or individual retirement pension (IRP) subscribers do not provide investment instructions, the accumulated funds are automatically managed according to a pre-determined method. Default option products are divided into four categories based on expected returns and investment risk: ultra-low risk, low risk, medium risk, and high risk.

According to FSS data, as of the first half of this year, the accumulated amount in default option products was 32.9095 trillion won, an increase of 162.19% (20.3575 trillion won) from the end of last year (12.552 trillion won).

Among the accumulated funds at the end of last year (12.552 trillion won), ultra-low risk products accounted for 89% (11.2879 trillion won). Although the default option accumulated funds more than doubled in the first half of this year, 89% (29.3478 trillion won) still invested in ultra-low risk products such as deposits and bonds. High-risk products accounted for only 1.47% (483.4 billion won) as of the first half of this year. This is why there are criticisms that the purpose of introducing the default option is not being realized at all. The one-year average return of retirement pension products as of the first half of this year shows that ultra-low risk products yielded only 3.47%, which is lower than last year’s consumer price inflation rate of 3.62%. In contrast, high-risk products recorded 16.55%, medium risk 12.16%, and low risk 7.51%.

The FSS plans to reorganize the default option system and manage and supervise to increase the stock proportion. To this end, Lee Dong-gyu, head of the Capital Market Supervision Bureau’s General Team, was assigned to the Pension Supervision Office. Since joining, Lee has been exclusively in charge of capital markets and accounting. He is evaluated by executives as having strong execution power, a high understanding of capital market systems overall, and charisma. He was appointed to induce a change in the management policy of retirement pension operators.

However, there is a prevailing view that organizational restructuring and talent appointment at the FSS alone have limitations. This is because the retirement pension system falls under the jurisdiction of the Ministry of Employment and Labor. The perspectives of the Ministry of Employment and Labor and the FSS on the retirement pension system are completely different. The Ministry of Employment and Labor prioritizes retirement pension policies in the order of ① phased mandatory implementation ② encouraging pension receipt (strengthening incentives for annuitization) ③ improving returns. In particular, considering long-term fiscal stability is a major task.

A financial investment industry official said, "The Ministry of Employment and Labor focuses on protecting the principal in retirement pension management, while the FSS aims to increase returns by expanding the proportion of risky assets such as stocks and ultimately targeting stock market value, so they have opposing positions. To increase returns, consensus from the Ministry of Employment and Labor is absolutely necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.