Subsidiary Coca-Cola Launches Ulleungdo Drinking Water for the First Time

Ulleung-gun Joint Venture 'Ullim Water' Targets Premium Market

Focus on Smooth Landing Amid Intensifying Market Competition

LG Household & Health Care has played the Ulleungdo card in the increasingly fierce domestic bottled water market. With the title of Ulleungdo's first bottled water and the unique distinction of being the only natural spring water in Korea, the company is determined to create a disruption in the market landscape.

LG Household & Health Care's drinking water 'Vio Hwio Ulrim Water'. Provided by LG Household & Health Care

LG Household & Health Care's drinking water 'Vio Hwio Ulrim Water'. Provided by LG Household & Health Care

Ulleungdo's First Bottled Water 'Ullim Water'

According to the distribution industry on the 12th, LG Household & Health Care recently launched the bottled water brand 'Vio Hwio Ullim Water' (hereafter Ullim Water). Ullim Water is produced by 'Ulleung Saemmul,' a joint venture established by LG Household & Health Care and Ulleung County in Gyeongbuk Province, while distribution and sales are handled by Coca-Cola Beverage, a subsidiary of LG Household & Health Care.

Ullim Water is a product introduced by LG Household & Health Care, which considers bottled water a key category within its beverage portfolio, targeting the premium market. LG Household & Health Care, which owns bottled water brands such as 'Gangwon Pyeongchang Water,' 'Hwio Pure,' and 'Hwio Diamond,' has been steadily seeking opportunities to expand and diversify its portfolio. In 2013, Ulleung County invited partners to develop water sources and lead the project, and after a public offering, LG Household & Health Care was selected as the business operator.

Subsequently, in January 2019, LG Household & Health Care invested 50 billion KRW to establish Ulleung Saemmul, a public-private joint venture with Ulleung County, acquiring an 87.03% stake and officially entering the water intake business in Ulleung County. The project to develop natural spring water from Yongcheon (natural spring water) in Nari, Buk-myeon, Ulleung County, faced a temporary crisis due to allegations of violating the Water Supply Act, but the Board of Audit and Inspection concluded in 2022 that the Yongcheon water project was feasible, allowing production preparations to continue.

Ullim Water plans to emphasize its differentiation as the first bottled water produced in Ulleungdo and the only natural spring water in Korea. While most bottled waters sold in the market are groundwater extracted from rock layers (bedrock water), Ullim Water is natural spring water that flows through cracks in rocks or strata. It is made from surface-exposed natural spring water that has been naturally purified for 31 years in the primeval forest of Seonginbong, Ulleungdo, designated as Natural Monument No. 189, and is characterized by containing various minerals such as sodium, potassium, and calcium.

Domestic Bottled Water Market Continues Growth... Can It Land Smoothly Amid Intensifying Competition?

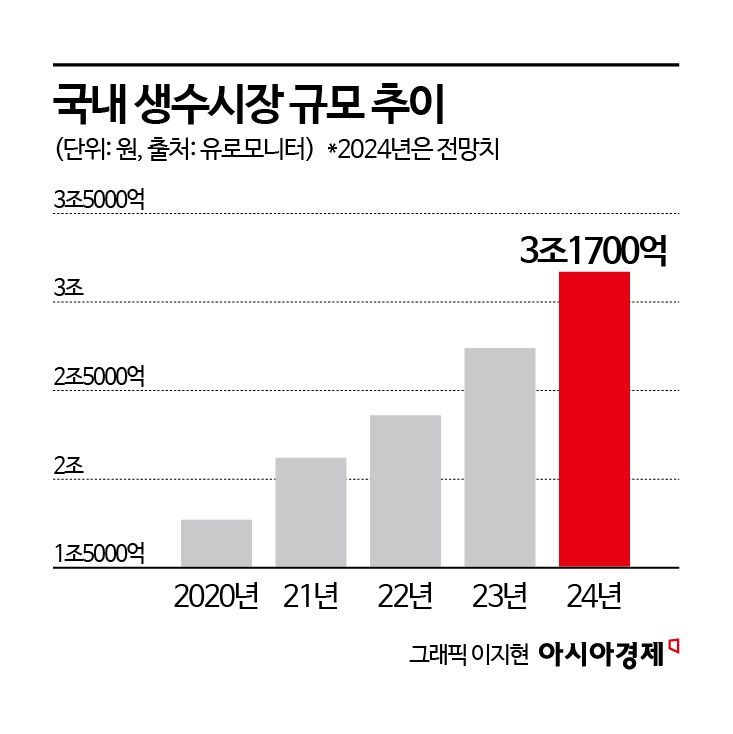

The domestic bottled water market has been growing every year. According to market research firm Euromonitor, the domestic bottled water market, which was around 1.77 trillion KRW in 2020, grew to 2.12 trillion KRW the following year, surpassing the 2 trillion KRW mark. It continued to grow to 2.12 trillion KRW in 2021, 2.74 trillion KRW in 2023, and is expected to reach 3.17 trillion KRW this year. With a high market growth rate of 54.8% over the past three years, the number of bottled water brands distributed in the market has expanded to over 400. Online sales surged after COVID-19, and with the increase in single-person households, demand is expected to continue growing for the time being.

However, despite market expansion, it is not easy for new brands to land smoothly. Currently, the domestic bottled water market is dominated by the top three brands?Jeju Samdasoo by Jeju Development Corporation, Icis by Lotte Chilsung Beverage, and Baeksansu by Nongshim?which together account for more than 60% of the total market. These brands have established stable market shares based on high consumer recognition and loyalty, making it difficult for latecomers to secure meaningful market shares. Additionally, the increase in private brand (PB) products, which are planned and manufactured directly by large retailers and convenience stores to significantly reduce distribution margins, adds to the challenge.

Orion, which launched 'Dr. You Jeju Lava Water' in 2019, is a representative example. Orion challenged the market by emphasizing the high mineral content of hard water in a market centered on soft water, but its market share remains around 1%. Other companies such as Pulmuone Saemmul and Dongwon Saemmul have recently expanded their factories and businesses but have yet to meet expectations.

LG Household & Health Care's drinking water 'Vio Hwio Ulrim Water'. Provided by LG Household & Health Care

LG Household & Health Care's drinking water 'Vio Hwio Ulrim Water'. Provided by LG Household & Health Care

In this market environment, LG Household & Health Care plans to pursue a premium strategy reflecting Ullim Water's unique feature of being natural spring water from Ulleungdo. Before its launch, since September, it has conducted tasting events targeting consumers visiting five-star hotels and VIP lounges in department stores, and its first sales outlets were set at Lotte Department Store and Galleria Department Store. The price is relatively high at around 2,000 KRW per 450ml bottle.

An LG Household & Health Care official said, "We will focus on nurturing Ullim Water, which has a special water source in Ulleungdo, as a premium bottled water brand to provide differentiated value to customers. We will first expand mainly through sales channels that can convey the uniqueness of the premium water brand." He added, "Next year, we plan to expand Ullim Water's sales channels online as well. Existing brands Gangwon Pyeongchang Water and Hwio will continue to strengthen sales mainly through online channels."

There are no major issues expected with future production volume expansion. Currently, the Yongcheon natural spring water in Buk-myeon, Ulleung County, produces 15,000 to 35,000 tons of raw water per day, and among the surplus water remaining after use as tap water, 1,000 tons per day will be used for bottled water production. According to the Ministry of Environment, as of the end of June this year, there are 60 bottled water manufacturers in Korea, with the largest single water intake source being the Jeju Samdasoo intake in Jocheon-eup, Jeju City, with a daily intake of 4,600 tons.

The fact that Coca-Cola Beverage is responsible for distribution and sales is also a positive factor. The bottled water business is classified as a business with low manufacturing costs such as raw materials and labor costs in factory operations, except for initial facility investment and logistics costs. Therefore, if a high-quality water source with abundant intake volume is secured, there is a higher possibility of a smooth market landing through stable supply using existing logistics and distribution networks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)