Despite the domestic REITs index declining amid a domestic economic downturn and political uncertainty, advice has emerged that it could be a safe investment destination in conjunction with expectations of interest rate cuts.

On the 11th, Ion Sang, a researcher at NH Investment & Securities, stated in a report, "The domestic REITs index rebounded in November as the rights offering was completed, but fell again due to political events," adding, "With expectations of interest rate cuts next year still valid, stocks with potential for dividend growth could be safe investment options."

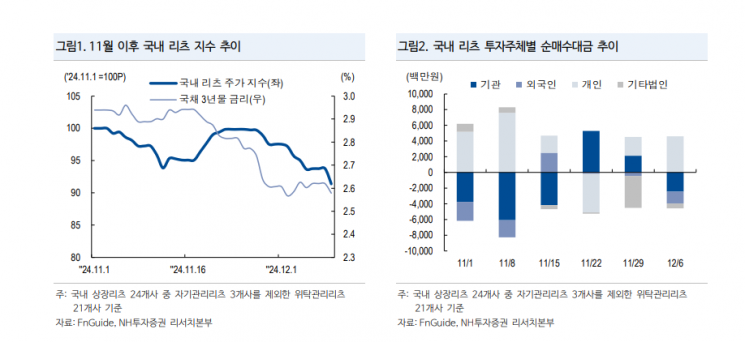

The domestic REITs index sought to rebound after the rights offering schedule was completed, but due to net selling by institutional and foreign investors amid increased domestic political uncertainty, it recorded a return of -8.6% from November 1 to December 10.

According to NH Investment & Securities, a total of eight REITs conducted rights offerings in the second half of this year, raising 927 billion KRW through these offerings. Researcher Ion Sang analyzed, "This amount accounts for 12% of the total market capitalization of domestic REITs as of the end of September, acting as a significant supply-demand burden factor," and added, "Although the rights offering schedule was completed in October and the decline mostly recovered in November, the index fell again by nearly 6% after December."

The main sellers in December were institutions and foreigners. Among the stocks whose institutional shareholding ratio significantly declined after December were Mirae Asset Maps REIT (-1.4%) and Hanwha REIT (-0.5%), with foreign shareholding ratios falling in 17 out of 21 entrusted management REIT stocks.

The researcher expected that dividend stock investment demand would be dispersed as stocks paying dividends for the December fiscal year-end are concentrated. He said, "The REITs stock price index is expected to struggle until the end of the year," but added, "However, due to political events, the role of the Bank of Korea has become more important than the government in economic stimulus, so expectations for a base interest rate cut remain valid."

Domestic REITs are products sensitive to interest rate changes due to their high leverage ratio, and the index is expected to rebound along with gradual interest rate cuts.

Researcher Ion Sang said, "Based on the current stock prices of covered companies, the expected dividend yields for 2025 are SK REITs 6.8%, ESR Kendall Square REITs 6.2%, Lotte REITs 8.1%, JR Global REITs 7.6%, and Shinhan Alpha REITs 5.7%. Compared to other companies undergoing value-up initiatives, the dividend yields alone are somewhat lacking in competitiveness, but attention should be paid to dividend growth potential achieved through refinancing to reduce financial costs and the incorporation of new assets," adding, "SK REITs and Lotte REITs are expected to reduce financial costs after refinancing next year, while ESR Kendall Square REITs and Shinhan Alpha REITs are expected to reflect the effects of new asset incorporation."

He continued, "Ultimately, since more than 90% of distributable profits must be paid as mandatory dividends, the predictability of dividends is higher compared to other sectors, which is also a strength. Given the ongoing domestic economic downturn and political uncertainty, it could be a safe investment destination."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)