Upper resistance supported amid authorities' caution over direct intervention

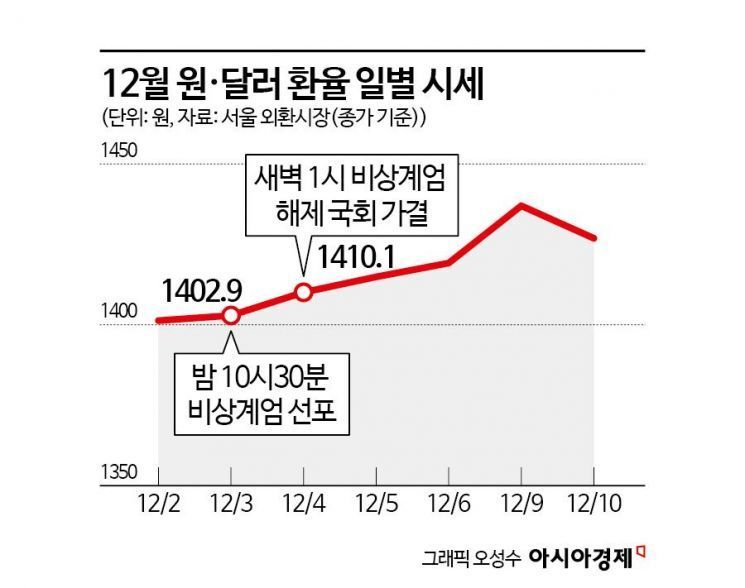

Woori Bank on the 11th forecasted that the won-dollar exchange rate would reverse the previous day's decline due to a global dollar rebound and a contraction in risk appetite.

Min Kyung-won, a researcher at Woori Bank, stated, "The won-dollar exchange rate will continue limited additional attempts to rise around the mid-to-late 1430 won range after a gap-up start."

Since the state of emergency, the won has become insensitive to traditional exchange rate decline factors such as the yuan's strength and particularly sensitive to strong dollar factors. Researcher Min analyzed, "With the U.S. stock market, led by Nvidia, showing two consecutive days of weakness this week, the domestic stock market, which rebounded yesterday, is likely to decline again. Therefore, there is a high possibility that long plays will resume, especially offshore, using the strong dollar and stock market decline as factors, and in terms of supply and demand, importers' payments will follow up with chase buying, driving increased upward pressure on the exchange rate."

However, the upper limit is expected to be supported due to authorities' caution on actual intervention and exporters' concerns about selling at peak prices.

Researcher Min explained, "The authorities are expressing a strong commitment to stabilization daily to minimize the transfer of political instability to the financial market. As the level of caution regarding actual intervention rises around the 1430 won range, it can suppress overheating of long sentiment, and exporters' deferred negotiation with sufficient ammunition can act as a factor limiting the extent of the exchange rate increase."

Researcher Min added, "Today, after a gap-up start, attention will be paid to foreign capital trends in the stock market, and limited additional attempts to rise around the mid-to-late 1430 won range are expected to continue, centered on offshore long plays and onshore real demand buying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)