Possibility of Procedural Delays Even if Impeachment Passes

Macroeconomic Conditions More Negative Than Previous Two Impeachments

Additional Uncertainty from Foreigners' Perspective

Amid growing concerns that the political turmoil triggered by President Yoon Suk-yeol's 'martial law' declaration could prolong, Shin Young Securities has raised its 2025 upper limit forecast for the KRW-USD exchange rate to 1,465 won. The securities industry pointed out that short-term volatility in the KRW-USD exchange rate is expected to increase, emphasizing the importance of defending the exchange rate within the 1,440?1,450 won range.

On the 10th, Jo Yong-gu, a researcher at Shin Young Securities, stated, "As the situation progressed from martial law to a presidential impeachment crisis, the Korean won has been exposed to bearish factors," adding, "We have revised the upper limit forecast for next year upward by 40 won to 1,465 won and have also raised the quarterly forecasts by 30 won each."

The reason for the upward revision in the exchange rate forecast is due to concerns that domestic political instability may persist for an extended period. In the short term, the passage of the impeachment bill remains uncertain due to opposition from the ruling party, and even if the bill passes, delays in the process are likely because of a shortage of Constitutional Court justices.

Researcher Jo explained, "Compared to the two previous presidential impeachment cases (2004 and 2016), the domestic and international macroeconomic conditions are more negative, and the financial markets appear relatively unstable," adding, "From the perspective of foreign investors, the addition of uncertainties that were not previously considered is causing a stronger reaction than the impact on the real economy."

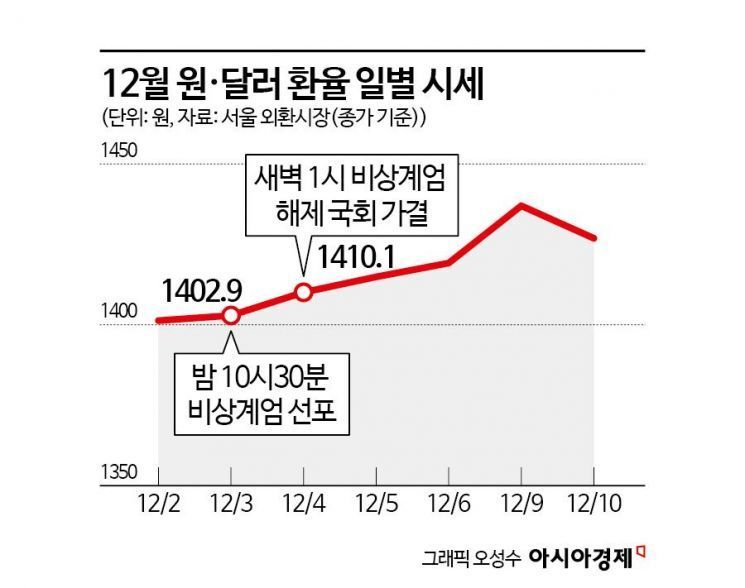

In fact, just before the martial law declaration (on the 3rd), the dollar index fell slightly from 106.5 to around 106.2 (on the 10th). In contrast, the KRW-USD exchange rate surged nearly 34 won from 1,402.9 won (on the 3rd) to 1,437.0 won on the 9th. This is interpreted as a strong reflection of bearish pressure on the Korean won driven entirely by domestic factors.

The securities industry assesses that while the KRW-USD exchange rate is unlikely to rise to the 1,500 won level, it could see further increases within the 1,400 won range. Domestic political risks are said to induce foreign capital outflows, which could impact the KRW-USD exchange rate.

Byun Jun-ho, a researcher at IBK Investment & Securities, analyzed, "Considering an economic growth rate in the 1% range, attempts to rise to the resistance level of around 1,440 won from two years ago may continue," adding, "Due to increased exchange rate volatility and upward pressure, the trend of foreign investors selling more than buying in the second half is unlikely to shift to buying."

Researcher Byun pointed out, "Especially with the election of Donald Trump as U.S. president, investment sentiment toward Korea has weakened, leading to continued foreign capital outflows and a situation where the exchange rate remains stuck in the 1,400 won range, further highlighting these political risks."

Oh Jae-young, a researcher at KB Securities, said, "While the outlook that the strong dollar will gradually ease within the first half of 2025 due to global liquidity expansion and that the KRW-USD exchange rate will decline remains intact, short-term volatility in the exchange rate is expected to increase," diagnosing, "Whether the KRW-USD exchange rate can be defended within the 1,440?1,450 won range will be a key point."

Meanwhile, on the 9th in the Seoul foreign exchange market, the KRW-USD exchange rate surpassed 1,430 won, expanding its gains to close at 1,437.0 won. However, on the 10th, it fell by 10.1 won to close at 1,426.9 won amid concerns over intervention by foreign exchange authorities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.