Domestic Stock Returns Plunge, Worst Since 2022

Martial Law Direct Hit... Annual Profits of 100 Trillion Won Also Uncertain

"Aging Population → Long-Term Disadvantage for Domestic Investment" Analysis

The valuation of the National Pension Service's domestic stocks has approached its lowest level since the 2020s. As the domestic stock market continued to hit new lows throughout the year due to the 'martial law aftermath,' even the largest institutional investor took a direct hit. The annual domestic stock return is now very likely to end in the negative.

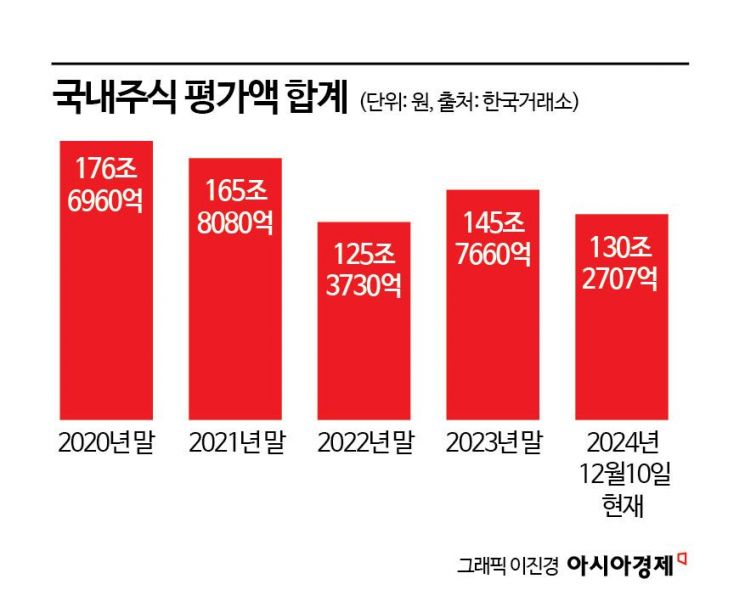

According to the Korea Exchange on the 11th, as of the previous day's closing price, the National Pension Service holds more than 5% stakes in 268 stocks, with a total valuation of 130.2707 trillion won. Compared to the 134.6603 trillion won on the 3rd, before the martial law incident, this represents a decrease of 4.3896 trillion won. In just one week, an amount close to a month's worth of pension insurance premiums (about 5 trillion won) has evaporated. The valuation is also on the verge of reaching the lowest level since the 2020s. The lowest valuation since 2020 was at the end of 2022, when the global downturn threatened the KOSPI 2000 level, with 125.373 trillion won.

100 Trillion Won Profit for 2 Consecutive Years? 'Red Light'

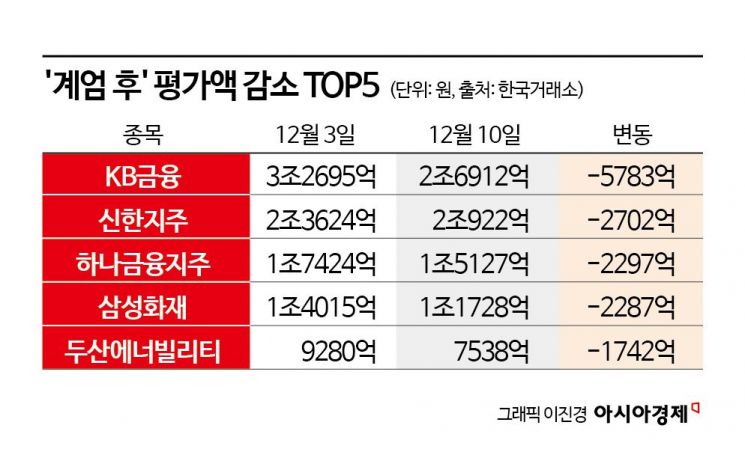

The stock with the largest valuation decrease after the martial law incident is KB Financial Group. Its valuation dropped from 3.2695 trillion won to 2.6912 trillion won, a decrease of 578.3 billion won. Compared to the closing price on the 3rd, KB Financial Group's decline rate as of the 10th is 18.77%. Following are Shinhan Financial Group (-270.2 billion won), Hana Financial Group (-229.7 billion won), Samsung Fire & Marine Insurance (-228.7 billion won), and Doosan Enerbility (-174.2 billion won). Except for Doosan Enerbility, all of the top five stocks by valuation decrease are in the financial sector. This sector benefited the most from the 'Corporate Value-Up Program' promoted by the Yoon Seok-yeol administration. Doosan Enerbility is considered one of the biggest victims of this incident, as its stock price plummeted and a merger was canceled.

The National Pension Service recorded its highest-ever return of 14.14% in 2023, earning 126 trillion won in profits. However, due to the poor performance of domestic stocks, which had been a 'cash cow' with a 22.12% return last year, it is difficult to guarantee 100 trillion won in profits and double-digit returns this year. According to the recent disclosure as of the end of September, the operating return rate is 9.18%, and the cumulative operating profit for the year is 97 trillion won. This is a 5 trillion won decrease from the profit of 102 trillion won as of the end of June. Profits were actually eroded during the third quarter. Domestic stock returns were only 0.46% through September, dragging down overall performance. Domestic stocks have fallen even further since September.

Domestic Stock Returns Turn Negative for the First Time in 2 Years

In the fourth quarter, the National Pension Service has tended to focus on buying domestic stocks while taking a breather on foreign stocks to meet target allocations. To do this, there were moves to sell large amounts of dollars in the foreign exchange market. This is part of 'asset rebalancing' (readjusting the proportion of assets under management) to maximize returns by purchasing relatively cheaper assets. However, domestic stocks have been even more dismal in the fourth quarter. Unless there is a significant turnaround for the rest of the year, the National Pension Service's domestic stock returns are very likely to end the year in the negative for the first time in two years since 2022 (-22.76%).

There are also analyses expressing concerns about the resilience of the domestic economy, including the stock market, and the fund's returns. On the 10th, Yoon Byung-wook, Deputy Research Fellow at the National Pension Research Institute, stated in the pension forum report titled 'Population Aging and Fund Investment Return Assumptions' that "As population aging progresses, economic growth potential and capital returns are declining," and "This is unfavorable for domestic fund investments, which is why the overseas investment proportion of the National Pension Service has increased." Although the National Pension Service has increased overseas investments and the proportion of risky assets to improve returns, the reason the long-term expected return was 4.5% in both the 4th actuarial valuation in 2018 and the 5th in 2023 is due to the decline in expected returns on domestic stocks and bonds caused by population aging.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.