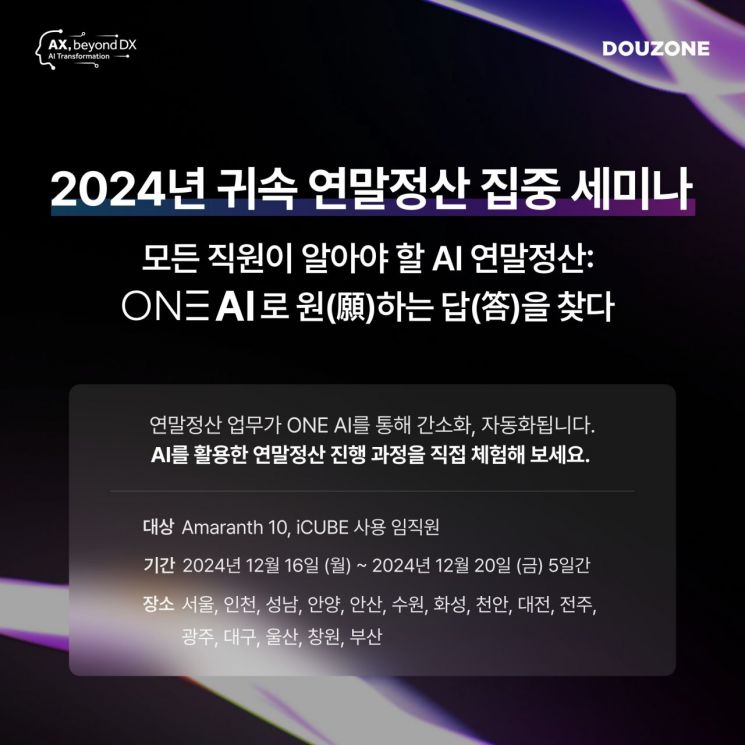

Duzon Bizon announced on the 10th that it will hold the ‘2024 Year-End Tax Settlement Intensive Seminar’ over five days starting from the 16th in 15 major regions nationwide.

Under the theme ‘AI Year-End Tax Settlement Everyone Should Know: Finding the Desired Answer with ONE AI,’ the seminar will reveal ways to maximize the efficiency, accuracy, and convenience of year-end tax settlement tasks.

The event will be held free of charge a total of 32 times across 15 regions nationwide, starting on the 16th in Suwon, Hwaseong, Daejeon, Changwon, and Busan; on the 17th in Seoul, Seongnam, Cheonan, Gwangju, and Busan; on the 18th in Incheon, Jeonju, and Daegu; on the 19th in Seoul, Anyang, and Ansan; and on the 20th in Seoul and Ulsan. Due to limited seating, registration is on a first-come, first-served basis. Early closure is possible due to high interest from participants. Detailed information and registration are available on the Duzon Bizon website.

This seminar, where participants can experience innovation in the year-end tax settlement process, will cover major revised tax laws including the 2024 Income Tax Act and Restriction of Special Taxation Act amendments. Through actual demonstrations using Amaranth 10 and iCUBE, the seminar will focus intensively on the entire execution process from preparation, progress, review, to final reporting of year-end tax settlement. New services such as functions to verify year-end tax settlement data, check estimated tax amounts, and automatic reporting via Hometax will also be introduced.

The seminar is designed to be useful for all employees, not only drastically reducing the workload of corporate practitioners and HR personnel preparing for the year-end tax settlement season but also significantly improving convenience for employees facing year-end tax settlement.

First, it provides tax-saving methods through pre-checks of year-end tax settlement and useful tips for work. Employees can automatically download the simplified National Tax Service data (PDF) for year-end tax settlement without accessing Hometax, simply through easy authentication. Integration with Duzon Bizon’s corporate document management system, One Chamber, also makes submitting additional supporting documents easier.

The workload of corporate HR personnel for year-end tax settlement is also greatly reduced. Through a comprehensive dashboard that allows a clear overview and control of the year-end tax settlement progress for all employees, the entire process from pre-preparation to completion can be shared, enabling smooth handling. The amounts entered and supporting documents submitted by employees are automatically and thoroughly reviewed and analyzed. The system is equipped with functions to automatically prepare year-end tax settlement summary reports as well as submit payment statements.

Methods to simplify the year-end tax settlement process and maximize efficiency using AI-based intelligent services and automation tools will also be introduced. Duzon Bizon’s ONE AI helps solve the complex and cumbersome year-end tax settlement in a one-stop manner. It supports all processes from preparation to responding to employee inquiries by HR personnel, reducing the existing year-end tax settlement process by half.

ONE AI supports all processes from selecting year-end tax settlement subjects, guidance, data input, review, to result notification. It simplifies the year-end tax settlement procedures and improves accuracy through data analysis and post-verification, AI chatbot, and automatic reflection of National Tax Service PDFs. Data verification, tax law consultation, and tax deduction opportunities through AI can also be reviewed at a glance.

A Duzon Bizon official said, “This seminar was prepared not only for practitioners in charge of year-end tax settlement tasks but also for all employees preparing for year-end tax settlement,” adding, “We hope many will take interest in this opportunity to check tax-saving methods through pre-checks and useful work tips, and to experience the innovation in year-end tax settlement tasks achieved with ONE AI.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.