Personal 'Palja'... Domestic Stock Market Sell-off

Concerns Over KOSPI Fair PBR Downgrade

"If Foreign Markets Fall, Gukjang Will Shake Again"

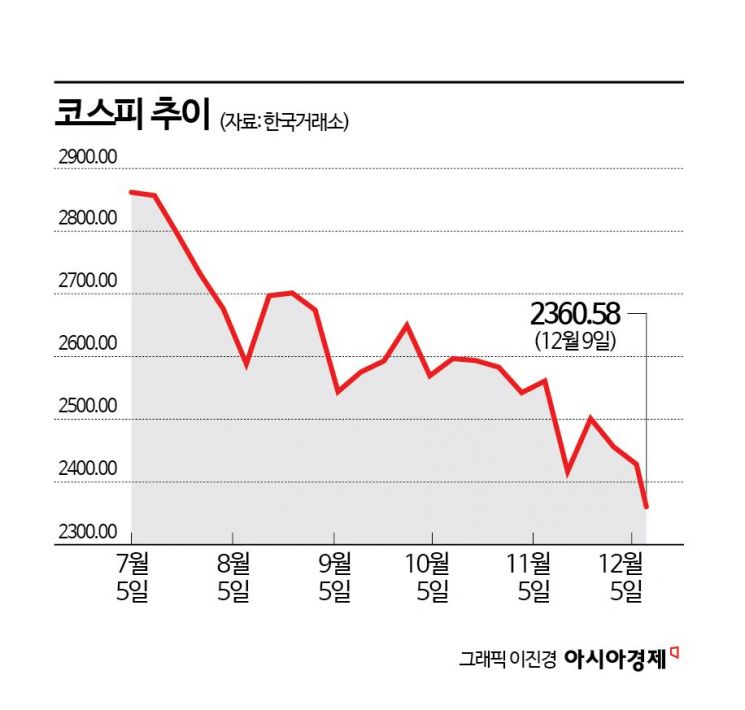

The KOSPI is plunging, hitting new annual lows. In the securities industry, there are concerns that the valuation benchmarks, which have been key support levels in analyzing the domestic stock market, may be lowered, and that the KOSPI could also be shaken if the global stock market undergoes a correction in the future.

According to the Korea Exchange on the 10th, the KOSPI closed at 2,360.58, down 67.58 points (2.78%) from the previous trading day, marking a new annual low. Notably, individual investors' sell-offs stood out. On that day, foreigners were net buyers of 101 billion KRW, institutions net bought 691.8 billion KRW, but individuals were net sellers of 889.6 billion KRW. Following the rejection of the impeachment motion against President Yoon Seok-yeol on the 7th, which signaled a prolonged impeachment political situation, even individual investors turned their backs, greatly increasing volatility.

As the Korean stock market has shown particularly poor performance compared to the global stock market since the second half of this year, the securities industry has cited valuation appeal as a basis for buying domestic stocks. However, warnings have emerged that the price-to-book ratio (PBR) may show a downward trend. Da-woon Jung, a researcher at LS Securities, said, "In the short term, we expect downside support around the 2,300-point level, but the worst-case scenario is a downward adjustment of the KOSPI’s appropriate PBR level," adding, "From 2012 to 2015, when the KOSPI was in the so-called 'Boxpi' range, net assets increased while the PBR declined." He further explained, "That period can be interpreted as the market reflecting Korea’s declining growth rate, and the reason the nightmare of that time resurfaces now is due to the absence of Samsung Electronics and concerns about a prolonged growth rate below 2%."

Advice has been given to prepare for further declines along with corrections in the U.S. and other global markets for the time being. Hyun-ki Kang, head of equity strategy at DB Financial Investment, said, "The momentum of the global business cycle appears to have entered a downward trend since mid-year, and the domestic market, which has many cyclical sectors, reacted most sensitively," adding, "In the future, with some time lag, markets in various countries may move similarly to Korea now. When their declines occur, the final tremors will reappear in Korea."

Kang said that after the additional downward trend and once the market enters a period of adjustment, it will be necessary to apply new strategies. He stated, "The extent of further declines in the domestic market is likely to be smaller compared to other markets. If the Korean market shows sideways movement in the first half of next year, large-cap stocks may stagnate while small- and mid-cap stocks could move individually, presenting an opportunity to enhance returns through small- and mid-caps." He added, "As we move into the second half of next year, when interest rates bottom out and lending begins to increase, the economy is expected to rebound and the market to rise in earnest," forecasting, "At that time, we will be able to identify new leading stocks that will emerge."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)