Foreign Visitors Dry Up... Domestic Demand Also Weak Due to High Exchange Rates

Tourists Choose H&B Stores Over Duty-Free Shops

Martial Law Aftermath... Exchange Rates Soar and Countries Issue 'Travel Warnings'

The domestic duty-free industry has encountered a major obstacle. Amid several years of high exchange rates, the downturn in China's economy has led to a halt in visits from Chinese tourists, who are the 'big spenders' at duty-free shops, causing performance deterioration. On top of this, a state of emergency has erupted. After President Yoon Suk-yeol declared a state of emergency on the night of the 3rd, major countries such as the UK, the US, and Japan issued travel advisories for South Korea, raising concerns that the number of foreign tourists?who account for a large share of duty-free sales?may decline.

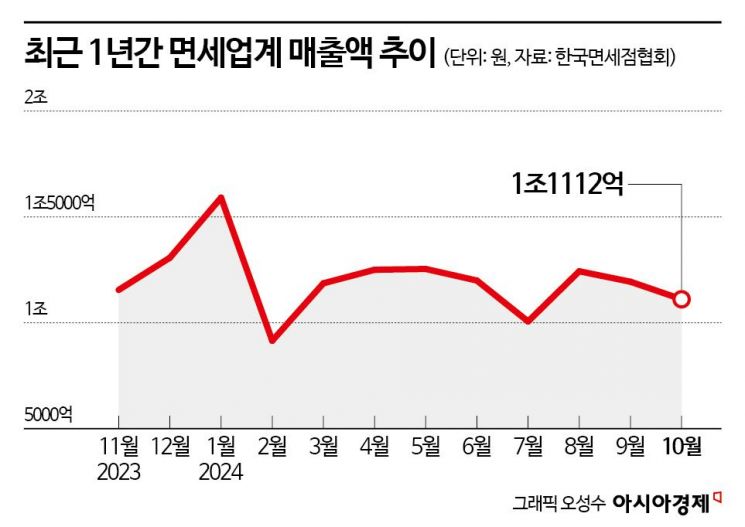

According to the Duty-Free Shop Association on the 6th, the combined sales of domestic duty-free shops for both domestic and foreign customers in October reached approximately 1.11 trillion KRW. This represents a decrease of about 16.4% compared to the combined sales of 1.33 trillion KRW in October of last year.

The prolonged slump in the domestic duty-free industry is also reflected in sales figures. Last year, the total sales of domestic duty-free shops amounted to approximately 13.76 trillion KRW, which is a 22.8% decrease from 2022’s 17.82 trillion KRW. Recovery remains slow even compared to the pre-COVID-19 period, which dealt a significant blow to the industry. Last year’s duty-free sales were only about half of the 24.86 trillion KRW recorded in 2019, before the pandemic. From January to October this year, total domestic duty-free sales reached approximately 11.95 trillion KRW, and if this trend continues, the industry is expected to post results slightly exceeding last year’s sales.

The prolonged downturn in the duty-free industry is largely due to the disappearance of the core customer base, the Chinese "bottari-sang" (daigou). Additionally, the shift in tourism trends among Chinese visitors?from group tours to smaller individual travel?has also impacted duty-free sales. Typically, shopping at duty-free shops is included in the travel itinerary of Chinese group tourists. According to the 'Analysis of Changes in Trends of Chinese Tourists Visiting Korea' published in December last year by the Ministry of Culture, Sports and Tourism and the Korea Culture and Tourism Institute, the average number of companions per Chinese tourist decreased from 5.1 in 2019 to 2.1 in 2023. The proportion of shopping activities among Chinese tourists also dropped from 95.1% in 2019 to 68.2% in 2023.

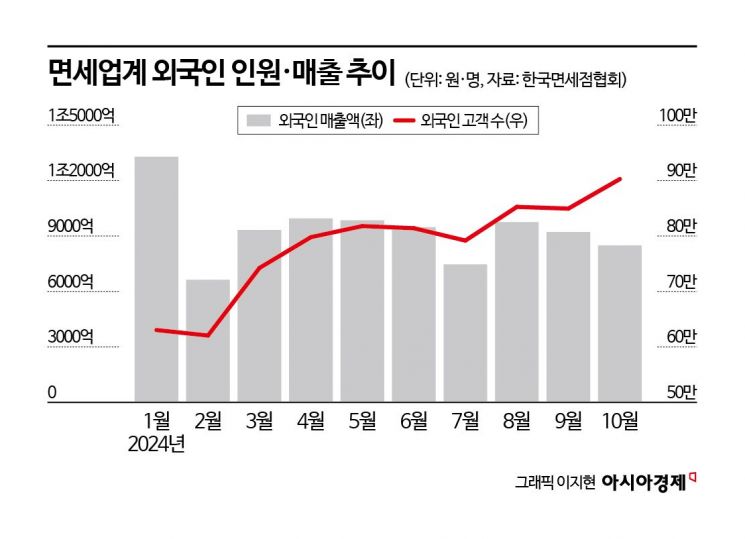

The sales share of foreigners, including Chinese tourists, at domestic duty-free shops is overwhelming. As of October this year, the number of foreign customers at duty-free shops reached 900,000, with sales amounting to 849.2 billion KRW, accounting for 76% of total sales (1.1 trillion KRW).

However, these foreign tourists have recently been shifting from duty-free shops to downtown health & beauty (H&B) stores. With the global popularity of 'K-Beauty,' they prefer cost-effective Korean cosmetics over expensive global luxury brands. The high exchange rate has also reduced the price competitiveness of duty-free products, leading to decreased demand. In fact, Yu Jeong-hyun, a research fellow at Daishin Securities, stated at the '2025 Retail Industry Outlook Seminar' hosted by the Korea Chamber of Commerce and Industry on the 2nd, "The shopping venues for foreigners are shifting from downtown duty-free shops to H&B specialty stores, such as Olive Young," and predicted, "While the duty-free industry is experiencing poor performance, Olive Young’s sales growth rate this year is expected to reach about 30% compared to last year."

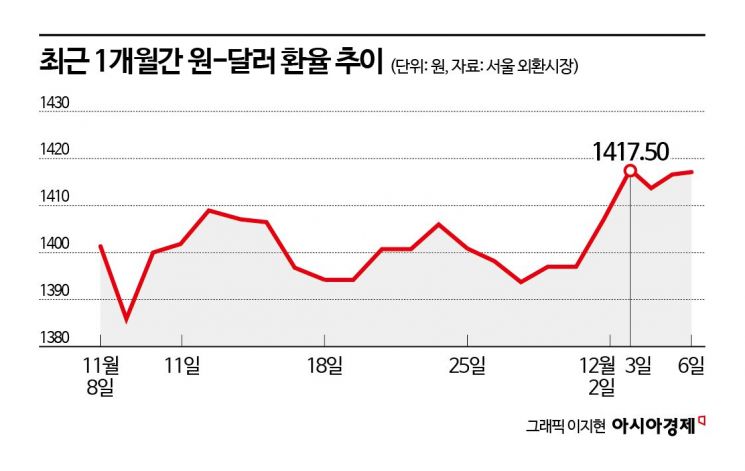

Furthermore, the recent state of emergency is expected to act as a major negative factor for the duty-free industry. Due to the weak won caused by the high exchange rate, even domestic demand for duty-free products has declined, and the exchange rate surged immediately after the state of emergency was declared. On the 4th, right after President Yoon Suk-yeol declared the state of emergency, the weekly closing exchange rate (at 3:30 PM) of the Korean won against the US dollar in the Seoul foreign exchange market closed at 1,410.1 won, up 7.2 won from the previous day. This is the highest level in 2 years and 1 month. During the day, the won-dollar exchange rate briefly surpassed the 1,440 won level.

The state of emergency is also expected to impact the demand for visits by foreign tourists. The US Department of State, upon the declaration of the state of emergency, posted a red alert banner on its English website on the morning of the 4th (local time), urging, "Even after the lifting of President Yoon Suk-yeol’s martial law, the situation remains fluid. Avoid protest sites and exercise caution near large crowds, gatherings, and demonstrations." The UK Foreign Office also posted a warning on the South Korea page of its country-specific travel advice on the 3rd (local time), stating, "We are aware of the situation unfolding after the declaration of martial law in South Korea. Avoid political protests." Even Israel, which is currently at war, issued a travel warning for South Korea, advising its citizens to "consider the necessity of visiting this country."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.