Conclusion on the 13th Regarding Rehabilitation Procedures and Liquidation

Two Parties Submitted Letters of Intent

Low Possibility of Acquisition and Business Resumption

The fate of TMON and WEMAKEPRICE (Timep), which triggered a large-scale unsettled payment crisis, is just a week away from being decided. Timep plans to resume operations to increase the value of its assets and find a new owner. However, difficulties are expected in every step, starting with the normalization of operations. Han Young Accounting Corporation, the investigation committee for Timep, is scheduled to submit a report to the court on the 13th containing the results of the investigation on whether to maintain the rehabilitation process or liquidate the company. If a new owner is not found by the 13th, liquidation is highly likely. In the event of liquidation, the current damage amount of about 1.5 trillion won to Timep is practically irrecoverable.

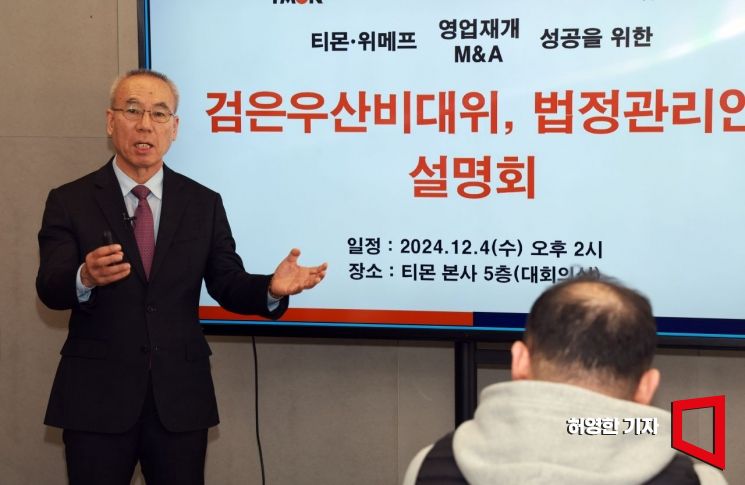

The Black Umbrella Emergency Committee for the successful M&A of Timon and Wemakeprice (Timaf) business resumption held a briefing session with the court-appointed administrator on the 4th at Timon's headquarters meeting room in Gangnam-gu, Seoul, attended by victims, related parties, and reporters. Jo In-cheol, the court-appointed administrator and Timaf's Chief Operating Officer, is explaining the progress. Photo by Heo Young-han

The Black Umbrella Emergency Committee for the successful M&A of Timon and Wemakeprice (Timaf) business resumption held a briefing session with the court-appointed administrator on the 4th at Timon's headquarters meeting room in Gangnam-gu, Seoul, attended by victims, related parties, and reporters. Jo In-cheol, the court-appointed administrator and Timaf's Chief Operating Officer, is explaining the progress. Photo by Heo Young-han

According to the industry on the 6th, the card Timep has played to prevent corporate liquidation is normalization. Currently, about 200 employees are working to resume operations. The plan is to recreate cash flow, increase corporate value, and find a buyer as quickly as possible.

On the 4th, Jo In-cheol, the court-appointed manager overseeing Timep’s operations, held a briefing at TMON headquarters and said, "Resuming operations is essential until a new buyer appears," and also estimated that the company could turn a profit six months after restarting operations. He explained, "Two parties have already submitted letters of intent (LOI)," and "Mergers and acquisitions (M&A) are the only solution to resolve the sellers' damages."

However, the industry consensus is that it will not be easy to proceed with M&A. First, difficulties are expected even in normalizing operations. Having lost trust, credit card companies and PG companies (payment gateway providers) are reluctant to participate. It is also questionable whether sellers will rejoin the platform. Sellers who attended the briefing stated that they would participate in sales only if former executives do not get involved in management.

However, some sellers are negative about rejoining Timep. Seller A said, "I think operations need to resume to receive unsettled payments, but there is no guarantee that the same problem won’t happen again," adding, "I also doubt whether there will be customers to buy our products."

Even if operations normalize, there is analysis that Timep will find it difficult to regain competitiveness in the fiercely competitive e-commerce market as before. Timep’s past core competitiveness was aggressive discount promotions. Some products were marketed at a loss. Through this, the company grew in size and survived by rolling over unsettled payments. However, due to excessive marketing, it became impossible to roll over payments at one place, and eventually, affiliated companies collapsed like dominoes.

At the briefing, Timep proposed measures such as charging free or minimal commission fees for advertising to expand business scale and shortening the settlement period to a maximum of 10 days. Aggressive marketing is necessary for Timep to regain competitiveness, but it is difficult in the current situation without immediate cash flow. Also, if operating profit margins are lowered by offering free advertising, there is a risk of further insolvency.

An industry insider said, "The overall e-commerce market is struggling, so it will not be easy to readily acquire Timep," adding, "Even if operations resume, aggressive marketing is necessary to survive, but to build trust, Timep’s financial stability must be secured, which puts it in a situation where it cannot do either."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)