Sharp Decline for Two Consecutive Days After Martial Law

"Bottom Range Even Assuming Value-Up Policy Reduction"

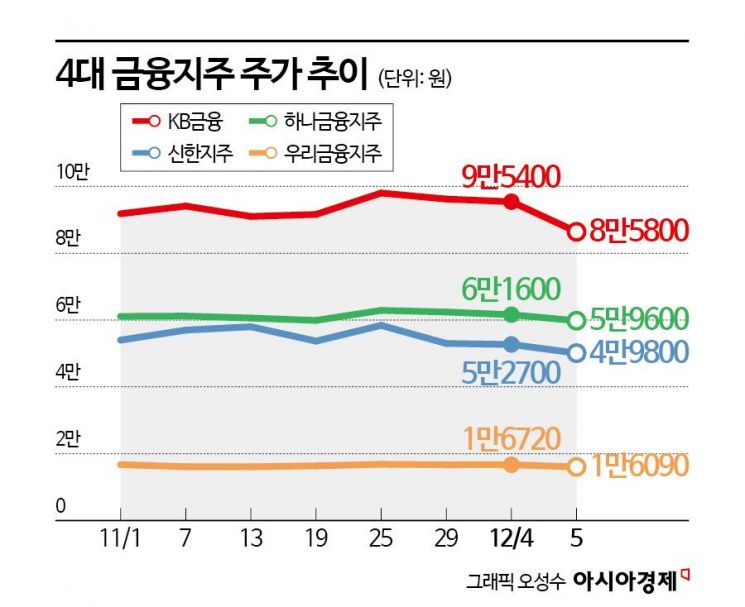

The stocks of the four major domestic banks have been on a continuous decline since the declaration of martial law. After rising in line with the government's value-up policy stance from the beginning of the year, the stock prices now appear to be shaken by political instability. The market views the current bank stock prices as excessively low, even when considering the worst-case scenario where the government fails to implement the value-up policy.

According to the Korea Exchange on the 6th, KB Financial fell 5.7% on the 4th. Shinhan Financial Group and Hana Financial Group also dropped by 6.6% and 6.7%, respectively, while Woori Financial Group closed the day down 2.7%. The previous day also saw declines with KB Financial down 10%, Shinhan Financial Group down 5.5%, Woori Financial Group down 3.7%, and Hana Financial Group down 3.2%.

The recent two-day decline in bank stocks is not primarily due to the Bank of Korea's interest rate cuts or the weakening of the Korean won. On the 3rd, the closing prices of major bank stocks, reflecting the interest rate cuts and exchange rate increases, were still 2-3% higher than on the 27th of last month, just before the rate cut.

The recent drop is analyzed to be due to the martial law. Around 10:30 PM on the 3rd, after President Yoon Seok-yeol declared martial law, domestic index futures plunged and the exchange rate soared. As a result, on the 4th, institutional and foreign investors flooded out of the domestic stock market. Among the four major bank stocks, institutions and foreigners showed strong net selling.

Kim Do-ha, a researcher at Hanwha Investment & Securities, explained, “The reason bank stocks fell for two consecutive days is that political uncertainty expanded after the declaration and lifting of martial law, increasing anxiety about the implementation of the value-up policy.” Despite expectations of a slowdown in operating income growth due to a decline in net interest margin (NIM), major bank stocks had shown an average rise of over 50% since the beginning of the year, outperforming the KOSPI index by more than 57%.

However, experts believe that this sharp decline has brought bank stocks to a bottom range. For example, assuming KB Financial’s stock price at 90,000 won and that shareholder return policies are implemented as previously expected, the total shareholder return (TSR) for 2025 is projected to be in the high 7% range.

If the scale of share buybacks and cancellations is maintained at this year’s level and only the total dividend amount increases moderately, the TSR is expected to be in the low 6% range. If all policies are completely scrapped and dividend payout ratios revert to past levels, the TSR would be expected in the mid-4% range.

Researcher Kim said, “Before the value-up policy emerged, the dividend yields of KB Financial and Shinhan Financial Group, which struggled to raise payout ratios, were in the 4-5% range, while Hana Financial Group and Woori Financial Group were more volatile but generally in the 6-8% range. Since there is now a possibility of falling short of previous value-up expectations, some price adjustment is reasonable, but considering expected returns, the current level of decline is excessive and is judged to be close to the bottom.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.