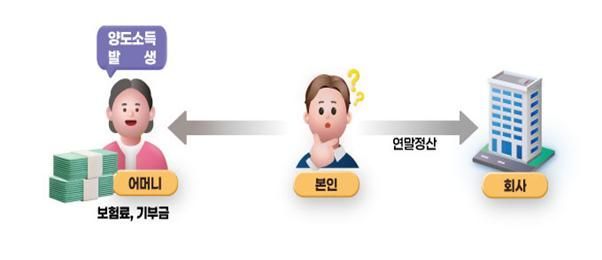

Worker A did not know that his mother transferred a commercial property last June and that her income exceeded 1 million won, and he claimed a personal deduction for his mother as a dependent as usual. At this time, he also received deductions for the insurance premiums paid for his mother and the amount his mother donated, but he was later notified of an excessive deduction during the year-end tax settlement.

On the 5th, the National Tax Service (NTS) introduced frequent mistakes and intentional improper deductions for reference in year-end tax settlements. An NTS official explained, "The NTS operates the year-end tax settlement system so that 20 million workers, who are the main players in economic activities, can report their taxes more easily and conveniently," adding, "The current system has somewhat insufficient functions to verify whether income and tax deduction requirements are met, so if the provided data is submitted without thorough review, excessive deductions due to mistakes often occur."

Typical cases include claiming deductions without knowing that the dependent’s income exceeds the standard, or mistakenly claiming deductions by loading previously reported dependent data into the system even though the dependent has passed away and is no longer eligible.

There were also cases where people were caught intentionally claiming deductions falsely to reduce their tax burden. According to the NTS, worker B, who works at a large corporation, colluded with the head of a religious organization he was acquainted with to pay commissions and falsely issued donation receipts without actual donations along with hundreds of company colleagues, improperly receiving donation tax credit benefits during the year-end tax settlement until being caught by the NTS.

An NTS official said, "If you make mistakes in the year-end tax settlement, taxpayers will not only face inconvenience in correcting their reports but also suffer disadvantages such as penalties of up to 40% if they report improperly," and added, "The NTS will strive to improve the system by providing as much assistance as possible for year-end tax settlement reporting and payment to make the process easier and more comfortable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.