Government Expands Support Measures for Small Business Owners and Self-Employed

Financial 3-Set Target Expansion... 800 Billion Won Loan Supply

Additional Incentives for Faithful Repayers

Strengthened Relief for Four Major Livelihood Damages

The government will provide a total of 3.4 trillion won in new support by next year to alleviate the financial difficulties of small business owners suffering from sluggish domestic demand and excessive debt. It also plans to strengthen relief measures against no-shows (reservation defaults) and malicious review damages.

On the 5th, the government announced the "Strengthening Customized Support Measures for Small Business Owners and Self-Employed" at the Economic Ministers' Meeting chaired by Choi Sang-mok, Deputy Prime Minister and Minister of Economy and Finance. The meeting originally scheduled for the 4th was delayed due to the martial law situation. This measure includes additional support plans from the comprehensive measures for small business owners and the self-employed announced in the second half economic policy direction in July.

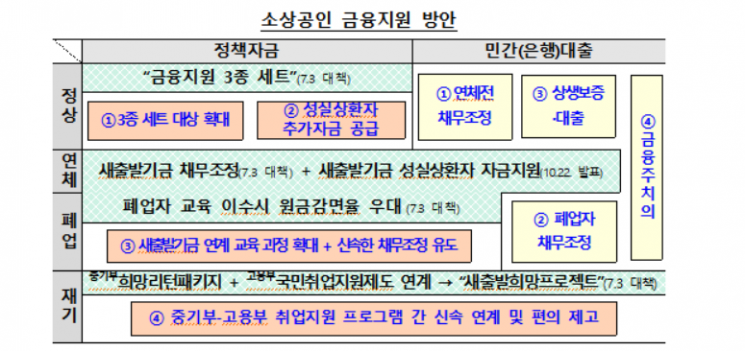

First, the government will further expand the three-pronged financial support set for small business owners facing prolonged high interest rates and domestic demand stagnation. Although the total support scale for the three sets?installment repayment, extension, and refinancing?was not specified, the plan is to provide 3.4 trillion won in new loans and guarantees by next year.

The low-interest loan amount will increase by 200 billion won within this year, supplying a total of 800 billion won, and the conversion guarantee scale will also be newly supported up to 3.2 trillion won starting next year. The regional credit guarantee insurance conversion guarantee will be expanded to 2.5 trillion won next year and 8 trillion won by 2027. The Korea Credit Guarantee Fund (KCGF)-type conversion guarantee will provide up to 700 billion won next year. The government expects about 80,000 beneficiaries through loan and guarantee support by next year.

To reduce the burden of loan repayment, the scope of beneficiaries for the repayment extension system will be expanded. Currently, only those with debts at three or more financial institutions or those whose sales have decreased by more than 10% compared to the previous period can benefit from the repayment extension system. Going forward, if it is confirmed that there is "multiple debt at two or more institutions and sales decrease compared to the previous period," they will be included in the repayment extension target. In addition, short-term delinquents within one month will also be included in the repayment extension target. To ease the initial principal repayment burden, a grace-type refinancing loan will be newly established, and the inclusion of policy-guaranteed loans such as Saessal-loan in the support target will be additionally reviewed.

Incentives will be strengthened for small business owners who faithfully repay the three-pronged support. For small business owners who have faithfully repaid for more than three months, a new "Small Business Owner Rechallenge Special Fund" worth 100 billion won will be linked and supported. For small business owners who have extended repayment and then faithfully repaid to recover their credit scores, the refinancing loan credit score standard (NCB 919 points) will not be applied.

The banking sector's customized support plan for small business owners was also announced. Support will be provided for long-term installment repayment conversion and maturity adjustment for normal borrowers, and a low-interest long-term installment repayment program will be introduced to allow gradual repayment of remaining loans after business closure. For small business owners with the will to restart and potential to enhance competitiveness, a "Small Business Owner Win-Win Guarantee Loan" will be prepared in consultation with guarantee institutions using regional credit guarantee funds. A Ministry of Economy and Finance official stated, "We will prepare and disclose detailed plans for sustainable small business owner support measures in the banking sector within this year."

The government also set a goal to complete 10 trillion won in debt restructuring next year through the New Start Fund, a debt restructuring program for small business owners. The linked education courses recognized as preferential conditions for principal reduction will be expanded, and faithful repayers of the New Start Fund will be included in the support requirements for policy-based low-income financial products.

Photo by Yonhap News

Photo by Yonhap News

The government plans to reduce delivery fees that burden small business owners and consider forming a permanent consultative body for delivery applications (apps) in the mobile gift certificate sector. It also announced plans to derive win-win measures within the year through a public-private consultative body for mobile gift certificates. Relief will be strengthened for four major damages related to small business owners' livelihoods: restrictions on disposable product use, illegal advertising agencies, excessive no-shows in the food service industry, and malicious reviews/comments. Businesses that have faithfully notified the ban on disposable products in-store will be exempt from fines even if customers change their minds and use disposable products inside the store and get caught. For malicious reviews/comments, a "Small Business Owner Livelihood Damage Response Team" will be formed jointly by ministries to respond.

Support to strengthen the sales base of small business owners will also be expanded. To revitalize local commercial districts, 5,000 creative small businesses that localize local content will be intensively nurtured by 2027. Additionally, local creative spaces will be expanded to 10 locations within three years, and a complex hub for work, residence, and leisure (Jikjurok) will be created in connection with local vitality towns.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.