"Koreans Have the Most Liquidity in the World"

"Korean investors are among the people with the largest market entry and exit liquidity in the world."

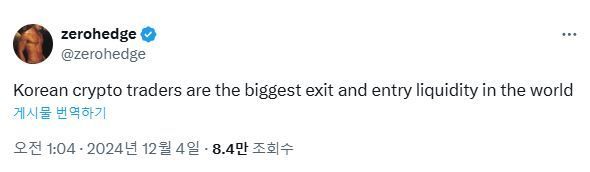

This was a statement left in the early hours of the 4th by 'Zero Hedge,' a popular financial influencer who wields as much influence on American social networking services (SNS) like X (formerly Twitter) as Wall Street analysts. On that day, after President Yoon Suk-yeol declared martial law, cryptocurrency prices such as Bitcoin temporarily plunged, and there is an interpretation that 'Korean ants' were behind this movement.

In fact, after President Yoon's declaration of martial law the previous day, the virtual asset market showed signs of temporary 'turbulence.' Bitcoin once fell about 30%, dropping to the 80 million KRW range for the first time in a month and a half. Major domestic virtual asset exchange applications (apps) such as Upbit and Bithumb experienced connection errors due to a sudden surge in users.

However, the confusion was quickly resolved. The price of one Bitcoin dropped to the 88 million KRW range around 10:57 PM on the 3rd but recovered to the 100 million KRW range within three minutes, then rose to the 120 million KRW range around 11:40 PM. As of 9:30 AM on the 4th, it was trading in the 130 million KRW range, restoring previous levels.

In other words, the domestic investor sentiment, which briefly contracted after the martial law declaration, was significant enough to ripple through the entire virtual asset market, indicating that Korean investors were 'big players' in cryptocurrency. Indeed, following Zero Hedge's remarks, many American investors expressed surprise, saying things like "Koreans were the drivers of the cryptocurrency market (today)" and "They went from panic selling to panic buying in an instant."

This is not the first time Korean ants have become the 'drivers' of cryptocurrency prices. The trading volume of 'Ripple,' one of the cryptocurrencies, is said to have been driven purely by Korean investors. The cryptocurrency specialized media 'CoinDesk' noted on the 2nd that Ripple's market capitalization rose to third place worldwide among cryptocurrencies, highlighting that "especially the trading volume increased the most on Korean exchanges."

Cryptocurrency has been a hot topic not only among investors but also in the political arena. Earlier, the Democratic Party of Korea announced on the 1st that it would agree to amend the Income Tax Act to postpone taxation on virtual asset income for two years. Originally, taxation on virtual asset income was scheduled to be implemented on January 1 of next year, but it faced strong opposition from domestic investors.

In particular, it is known that voters in their 20s and 30s react sensitively to cryptocurrency policies. When the Ministry of Economy and Finance announced a tax law amendment plan including cryptocurrency taxation in 2021, there was strong opposition from the younger generation. At that time, a petition titled "Urge the Financial Services Commission Chairman to resign voluntarily" was posted on the Blue House's public petition board, receiving over 200,000 agreements.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.