Rebellion and ABLY Achieve Unicorn Status

SV Investment and Shinhan Venture Investment, Both Investors in Two Companies, Expect Big Success

Increased Expectations for Future Returns... Multiples of 10x Also Possible

Artificial intelligence (AI) semiconductor startup Rebellion and commerce startup Abley have consecutively become unicorns(privately held companies valued at over 1 trillion KRW), bringing big smiles to the venture capitalists (VCs) who invested in these companies. These are newly emerged unicorns in Korea within about a year. If they go public through an initial public offering (IPO) in the future, early investors are expected to recover more than 10 times their principal investment.

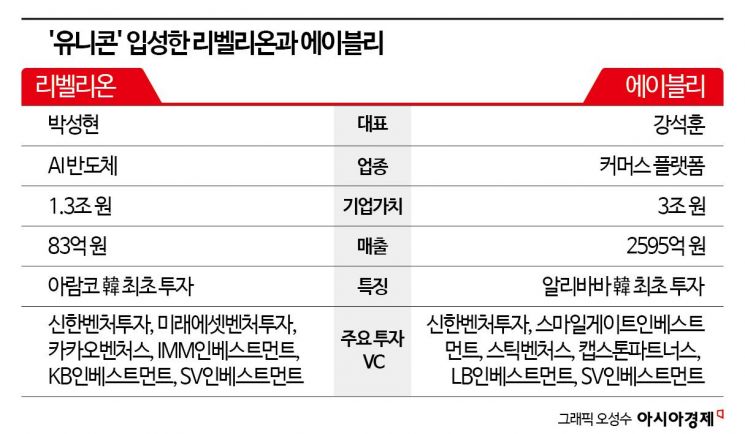

According to the VC industry on the 4th, SV Investment and Shinhan Venture Investment invested in both Rebellion and Abley. Although several VCs participated in the investments, only these two invested in both companies. Rebellion was recently valued at 1.3 trillion KRW through a merger with Sapion. Abley was recognized with a valuation of 3 trillion KRW following a 100 billion KRW investment from China's Alibaba Group. This was Alibaba's first investment in a Korean startup. Rebellion also became the first to attract investment from Saudi Arabia's state-owned company Aramco. They recognized and invested early in not just one but two promising startups that even overseas investors had their eyes on.

'Double Unicorn' Portfolio Companies... The Result of 'Principled Investment'

SV Investment invested 20 billion KRW each in Rebellion and Abley. SV Investment is a VC managing assets under management (AUM) in the trillion-KRW range. Even with such a large scale, it is uncommon for a single house to invest more than 10 billion KRW in a single startup. Jang Pil-sik, Head of Management at SV Investment, said, "I think this is the result of adhering to a top-down investment principle," adding, "In Abley's case, other investors hesitated due to financial difficulties, but we invested with confidence based on our past successful experience investing in HYBE."

Top-down investment is an approach that first considers macroeconomic factors and industry trends. It starts by selecting investment targets from the broadest areas and then narrows down gradually. SV Investment evaluated the semiconductor industry as promising and proceeded with investment in Rebellion, which operates in the AI semiconductor business. They also made large-scale investments in other semiconductor startups such as the semiconductor design platform company 'SemiFive' and Singapore's semiconductor chiplet packaging specialist 'Silicon Box.'

The background for SV Investment's investment in Abley was 'the younger generation' and 'digital transformation (DX).' Although the industries differ, the target (the 20s and 30s generation) and the aspiration (digital platform company) are the same, which is similar to the context of HYBE. SV Investment, known as an early investor in HYBE, invested about 4 billion KRW and recovered 108 billion KRW.

Shinhan Venture Investment, From Quantitative Growth to Qualitative Growth

Another VC that invested in both unicorns, Shinhan Venture Investment, has recently attracted attention in the industry. This is because it rapidly grew into a top 10 VC after a change in ownership. It entered the VC industry in 2000 under the name Neoplux and was acquired by Shinhan Financial Group in 2020. It ranked 6th in terms of investment amount in the first half of the year. Under the leadership of CEO Lee Dong-hyun, it established a Global Investment Division and a Synergy Investment Division, which did not exist during the Neoplux era, and nearly doubled its operational staff. The investments in the startups that recently became unicorns were made after the acquisition by Shinhan Financial Group. It invested early in Abley in 2020 and joined as an investor in Rebellion in December 2023, which was practically the 'last train' for investment. It has achieved not only quantitative growth but also qualitative growth.

Meanwhile, VCs that invested in either Rebellion or Abley are also optimistic about future returns. Investors in Rebellion include Mirae Asset Venture Investment, Kakao Ventures, IMM Investment, and KB Investment. Major VC investors in Abley include Smilegate Investment, Stick Ventures, Capstone Partners, and LB Investment. Many of these were selected as entrusted asset managers in major institutional investor (LP) fundraising projects this year. They are creating a virtuous cycle structure of fundraising based on performance → investing in the right places → recovering investment funds (exit).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.