Strong Rebound Compared to KOSPI

Power Infrastructure Cycle Still in Early Stage

"Will Overcome Undervaluation Compared to Global Markets"

Power equipment-related stocks, which led the stock market in the first half of this year but have recently stalled, are drawing attention as to whether they can return as leading stocks. Securities firms expect that the U.S. power infrastructure replacement cycle will continue at least until 2030, and that the profitability expansion of power equipment companies will continue into next year.

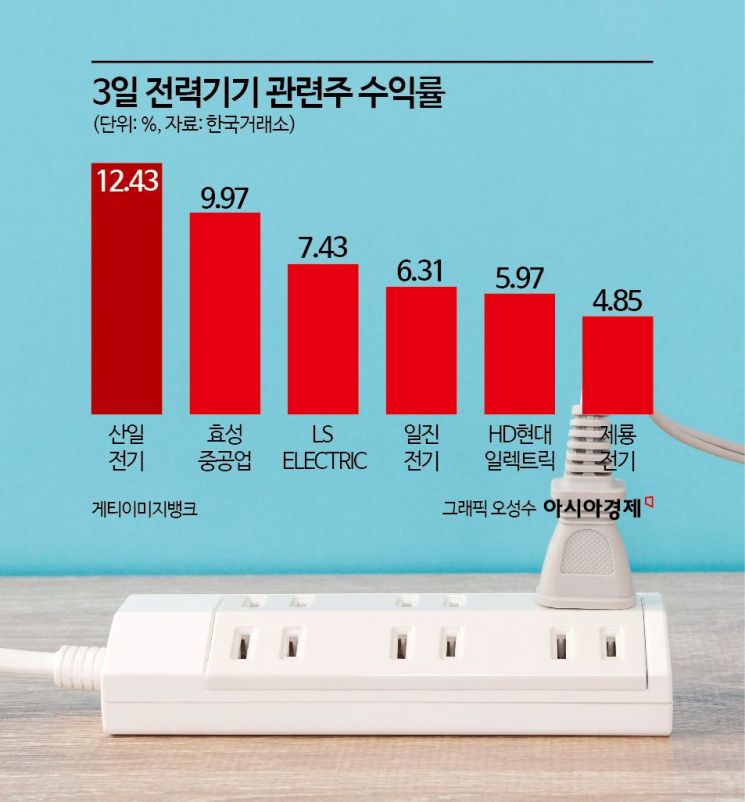

According to the Korea Exchange on the 4th, HD Hyundai Electric closed at 355,000 won, up 20,000 won (5.97%) from the previous day. In addition, domestic power equipment-related stocks such as Sanil Electric (12.43%), Hyosung Heavy Industries (9.97%), LS ELECTRIC (7.43%), Iljin Electric (6.31%), and Jeryong Electric (4.85%) showed simultaneous strength. Although these stocks have recently undergone corrections due to profit-taking pressure following a sharp rise in the first half of this year, they rebounded more than the KOSPI’s increase of 1.86% the previous day, raising expectations about whether they can reproduce the rally.

Domestic power equipment companies continue to show significant performance growth through exports of power facilities such as transmission and distribution transformers. Kim Taehyun, a researcher at IBK Investment & Securities, said, "Currently, the lead time for ultra-high voltage transformers exceeds two years, and it appears that the volume ordered in the second half of 2022 is being reflected in sales. The proportion of high-margin North American sales is expanding, and product prices are rising due to a shortage of ultra-high voltage transformers, resulting in a noticeable improvement in profitability relative to scale." He added, "In a supplier-favorable business environment, profit margins are expected to be higher than previous levels, and the trend of profitability expansion in the power equipment industry is expected to continue until 2026."

With the U.S. government’s expansion of power grid investments acting as a driving force for the export performance of domestic power equipment companies, the large-scale power grid investment trend is expected to continue even after the inauguration of President-elect Donald Trump in January next year. Researcher Kim said, "Concerns that U.S. power grid investment will shrink due to the Trump administration’s return to power are limited," adding, "Although investment in the renewable energy sector may shrink, overall power consumption is expected to increase due to expansions such as AI data centers." In fact, the U.S. Electric Power Research Institute (EPRI) forecasted that by 2030, power usage in U.S. data centers will double compared to the current level, accounting for more than 9% of total electricity consumption.

Securities firms analyzed that if domestic companies receive evaluations comparable to global firms in the 'power infrastructure supercycle' driven by AI demand, their stock prices could rise further. Kim Kwangsik, a researcher at Sangsangin Securities, said, "North American power equipment companies have shown a remarkable increase in gains due to expectations of reshoring after Trump’s election," noting, "Meanwhile, domestic companies maintain a valuation discount compared to global competitors." He added, "Considering current earnings forecasts, there is sufficient potential for earnings surprises from domestic companies. The valuation discount could be reduced in the future, leaving room for further stock price increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.