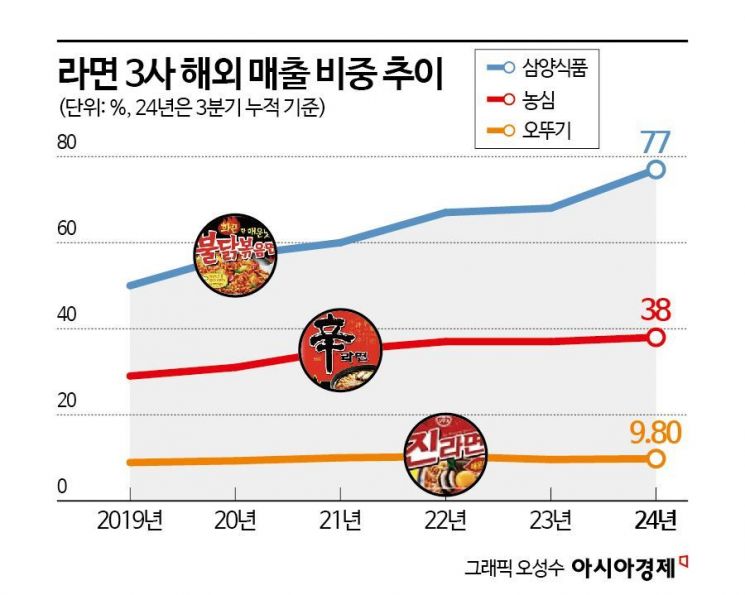

Ottogi's Overseas Sales Still Account for 9% Range

Contrasting with Samyang Foods at 77% and Nongshim at 38%

Nevertheless, Overseas Expansion Inevitable Due to Domestic Market Slump

This year, as K-Ramen exports surpassed $1 billion, marking its heyday, Ottogi's overseas sales ratio among the three major domestic ramen companies still remains in the single digits. Although it has been shifting focus from domestic sales to a global drive for several years, the results are still minimal. Experts point out that for Ottogi to become a beneficiary of the globalization of K-Food, it urgently needs to launch mega-hit products like Samyang Foods' 'Buldak Bokkeum Myun' and Nongshim's 'Shin Ramyun.'

According to an analysis by Asia Economy on the overseas sales ratios of the three domestic ramen companies (Nongshim, Ottogi, Samyang Foods) on the 4th, Ottogi's overseas sales ratio increased by only 0.9 percentage points over the past five years, from 8.9% in 2019 to 9.8% this year (cumulative through Q3). Although it reached double digits at 10% or more for two consecutive years in 2021 and 2022, it dropped back to 9.6% last year and has remained in the single digits since.

K-Ramen craze... Ottogi's overseas sales ratio still in the 9% range

This trend is distinctly different from the overseas sales ratio trends of competitors Nongshim and Samyang Foods. Samyang Foods, which caused a global sensation with Buldak Bokkeum Myun, saw its overseas sales ratio surge from 50% in 2019 to 77% this year. Although not as explosive as Samyang Foods, Nongshim also grew noticeably from 29% to 38% during the same period. As the scale of K-Ramen exports has expanded recently, both companies have succeeded in increasing their overseas market share.

K-Ramen export value was $210 million in 2014, ten years ago, but after the COVID-19 pandemic and the rising popularity of K-content such as Korean dramas and movies, it has increased sharply. After recording $367 million in 2019, it has maintained double-digit growth rates annually, surpassing $600 million in 2020 and $700 million in 2022, and successfully breaking through $900 million last year. Furthermore, as of October this year, it has already exceeded $1 billion, setting another record high.

No mega-hit like 'Buldak' and no solid distribution network like Nongshim

However, unlike its competitors, Ottogi has not benefited from the globalization of K-Ramen. Domestically, Jin Ramen has a thick customer base that threatens Nongshim's Shin Ramyun, but Ottogi's brand power overseas is weak. Since Ottogi has strong domestic sales in ramen as well as sauces, instant rice, and sesame oil, it seems that in the past, it judged that there was little need to expand overseas.

While Ottogi focused on the domestic market, Nongshim began pioneering overseas markets early on. Nongshim established Nongshim America 30 years ago in 1994 and operates a local production plant. It built a solid distribution network by immediately supplying locally produced products, including Shin Ramyun, to Walmart, Costco, and others. Although Samyang Foods was late in entering the market, it succeeded in receiving explosive love calls worldwide by promoting Buldak Bokkeum Myun through social media channels such as YouTube.

Full-scale global drive... Third year of uncertainty over U.S. production plant construction

With the rising status of domestic food companies due to the popularity of K-Food and being hampered by domestic market stagnation, Ottogi has belatedly launched a global drive. Last year, it upgraded its Global Business Division to the Global Business Headquarters and appointed former LG Vice President Kim Kyung-ho, father-in-law of Chairman Ham Young-jun's eldest daughter Ham Yeon-ji, as head of the division to oversee overseas business. It is especially focusing on the U.S., which accounts for the largest share of overseas sales. However, without a mega-hit product like Buldak Bokkeum Myun, it is not easy to quickly increase brand power.

The establishment of a U.S. production plant, which could be a new momentum for overseas expansion, is also sluggish. Ottogi aims to reduce logistics costs incurred during exports and cut costs by sourcing raw materials locally through the local plant. However, since purchasing land in California in 2022 for the plant, it has yet to break ground even after three years. An Ottogi official explained, "The approval process for factory establishment in the U.S. is complicated, so the time to get approval is somewhat prolonged."

Nevertheless, increasing overseas sales is an indispensable card for Ottogi, which has reached the limits of the domestic market. Ottogi aims to expand its ramen export countries from 65 to 70 worldwide this year. It has also begun actively implementing localization strategies by launching overseas-customized products such as Jin Ramen Chicken Flavor and Jin Ramen Veggie. Along with this, Ottogi changed its English spelling from OTTOGI to OTOKI last August. This bold change was made to eliminate pronunciation difficulties and help overseas consumers recognize Ottogi more easily.

An Ottogi official said, "Last year, we upgraded the Global Business Division to a headquarters, and Ottogi is focusing on expanding the global market," adding, "Along with localization policies, we will use the English spelling and symbol renewal as an opportunity to get closer to overseas consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)