France-Greece Sovereign Bond Spread 0.004% Points

Effectively Converging to Zero... Worsening Massive Fiscal Deficit

Deadlock Between Government and Parliament Over Next Year's Budget

Credit Rating Agencies Downgraded France Last Month

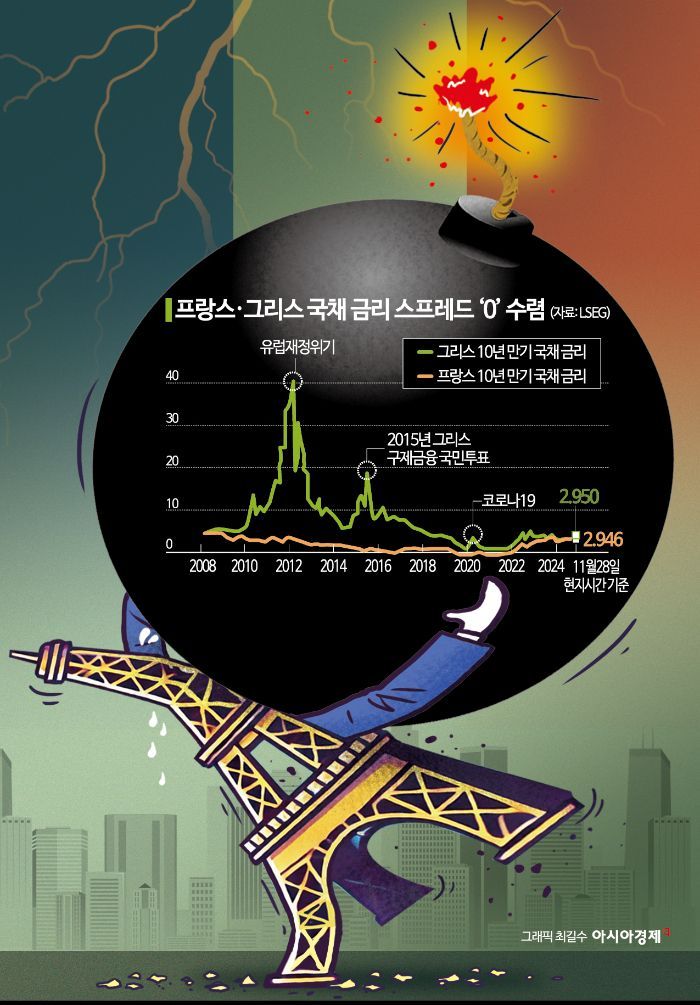

The 10-year government bond yield of France, which is facing a cabinet collapse crisis, has surged to the level of Greece. On the 28th (local time), the yield on France's 10-year government bonds, considered the safest in Europe, was 2.946%, while Greece's 10-year government bond yield, which was classified as 'non-investment grade' by major credit rating agencies until last year, was 2.950%.

The spread (yield difference) between the bonds of France, a leading European developed country, and Greece, which experienced a sovereign default after the 2008 financial crisis, has converged to virtually '0' at 0.004 percentage points. The previous day, the yield spread between French and German government bonds also reached 0.87 percentage points, marking the highest level since 2012.

France in Crisis... What’s Happening?

This means that the bond market views lending to France as risky as lending to Greece. France, which experienced political turmoil as neither the left nor right won a majority in this year's early general election, is facing a massive fiscal deficit. However, the current Michel Barnier government and the opposition have failed to find common ground on next year's budget, resulting in a deadlock.

The Barnier government has submitted a budget plan to reduce the fiscal deficit, expected to be 6.1% of GDP this year, to 5% next year by cutting government spending and raising taxes. EU member states are obligated to keep fiscal deficits within 3% of GDP.

However, the left-wing coalition in the lower house opposes the budget plan, arguing that reducing social welfare and public services will worsen inequality. The far-right National Rally also agrees, stating that tax burdens on individuals and companies should not be increased.

The deadlock continues. The Barnier government plans to process the budget without a vote in the lower house under constitutional authority if opposition persists next month, but the opposition has warned of passing a no-confidence motion against the government in response.

French Bond Market Likely to Remain Sluggish

Therefore, the slump in the French bond market is expected to continue. Michiel Tucker, ING’s Chief European Rates Strategist, expressed concern that “a no-confidence vote will reset the progress of the current budget and lead to new political difficulties.”

According to BNY Mellon data, the French government bond market experienced the largest capital outflow in two years over the past week. This indicates that investors see a high risk that the government and parliament will fail to take measures to prevent the worsening fiscal deficit. Last month, credit rating agencies Fitch and Moody’s downgraded France’s credit outlook from ‘stable’ to ‘negative.’

However, Antoine Armand, France’s Minister of Economy and Finance, said on BFM TV that day, “Barnier’s door is always open. We are clearly ready to make concessions to avoid the storm,” attempting to calm market concerns. Regarding the comparison of the bond market to Greece, he said, “France has a much larger economy and demographic strength than Greece,” and firmly stated, “France is not Greece.”

Economic Uncertainty... Stock Market Also Declining

As government bond yields rise, the French stock market is also on a downward trend. The French CAC index fell about 13% from its all-time high of 8259.19 in May to 7179.25 on this day. Bloomberg reported, “This year, the French stock market is expected to record the worst performance among European countries since 2010.”

The economic outlook for France is also not optimistic. Nicolas, Goldman Sachs’ senior equity fund manager, said, “There will be events in France that will cause much more significant stock price declines,” adding, “It is difficult to say that the bottom has been reached yet.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.