"Seoul Housing Prices Stable or Slightly Weak Despite Base Rate Cut"

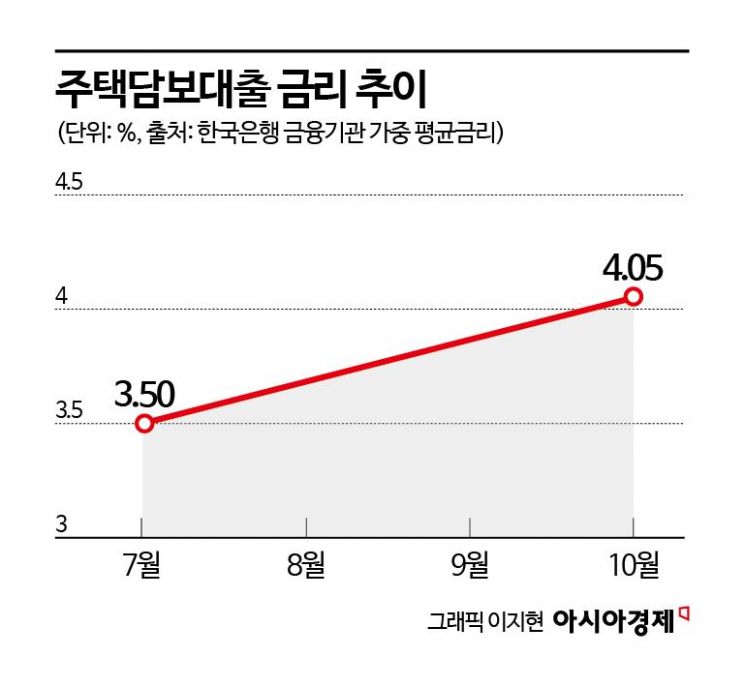

Mortgage Loan Rates Rose to 4.05% Last October

"Real Estate Market Slump Due to Domestic Demand Contraction"

Although the Bank of Korea implemented a baby step (a 0.25 percentage point cut in the base interest rate) last month, lowering the rate twice in a row (3.50%→3.25%→3.00%), forecasts suggest there will be little change in the housing market.

Unlike the base interest rate, market interest rates show no signs of falling, and the capacity to borrow funds is limited due to the introduction of the second phase of the stress Debt Service Ratio (DSR) and reductions in the Didimdol loan limits. Typically, a cut in the base interest rate acts as a catalyst to stimulate buying sentiment in the real estate market, but experts evaluate that this time it will not fulfill that role.

"Base interest rate falls but loan interest rates rise"

Ham Young-jin, head of the Real Estate Research Lab at Woori Bank, said on the 1st, "Seoul housing prices will remain flat or weak until the end of the year," adding, "Due to conservative attitudes in the financial sector caused by total loan volume regulations, demanders will continue to take a wait-and-see stance."

Ko Jong-wan, director of the Korea Asset Management Research Institute, also explained, "Homebuyers rely on loans for about 40% of their purchase funds, and among them, young people depend on loans for about 55%," adding, "In a situation with high loan dependence, it is difficult to expect housing price increases unless interest rates fall." He further noted, "Since it is already the seasonal off-season in winter, it is difficult for housing transactions to increase."

According to the Bank of Korea's 'Weighted Average Interest Rate of Financial Institutions,' the mortgage loan interest rate at deposit banks steadily rose after recording 3.50% in July. In October, it reached 4.05%. Although the Bank of Korea cut the base interest rate for the first time in 3 years and 2 months that same month, mortgage loan interest rates reversed course as banks raised their spread rates.

Until July, mortgage loan interest rates had fallen to the base interest rate level of 3.50%, reflecting expectations of a rate cut. However, banks' spread rates were effectively 0%, raising concerns about negative margins. Government pressure increased due to the rise in household loans. As a result, banks began raising spread rates from August.

The COFIX (Cost of Funds Index) rate, which serves as the benchmark for variable-rate mortgage loans, also exceeds the base interest rate. The COFIX rate based on new contracts was 3.37% in October, higher than the base interest rate. Although it decreased from 3.40% in September, it rose compared to August.

"Even with base rate cuts, buying apartments in Seoul remains difficult"

Experts believe that domestic demand stimulation will be difficult despite the rate cuts. They especially expect it will be hard to change the trend in the real estate market, which has entered a correction phase.

Park Won-gap, senior real estate specialist at KB Kookmin Bank, diagnosed, "This base rate cut decision was made due to sluggish domestic demand, but it is highly likely that this sluggishness will continue despite the rate cut."

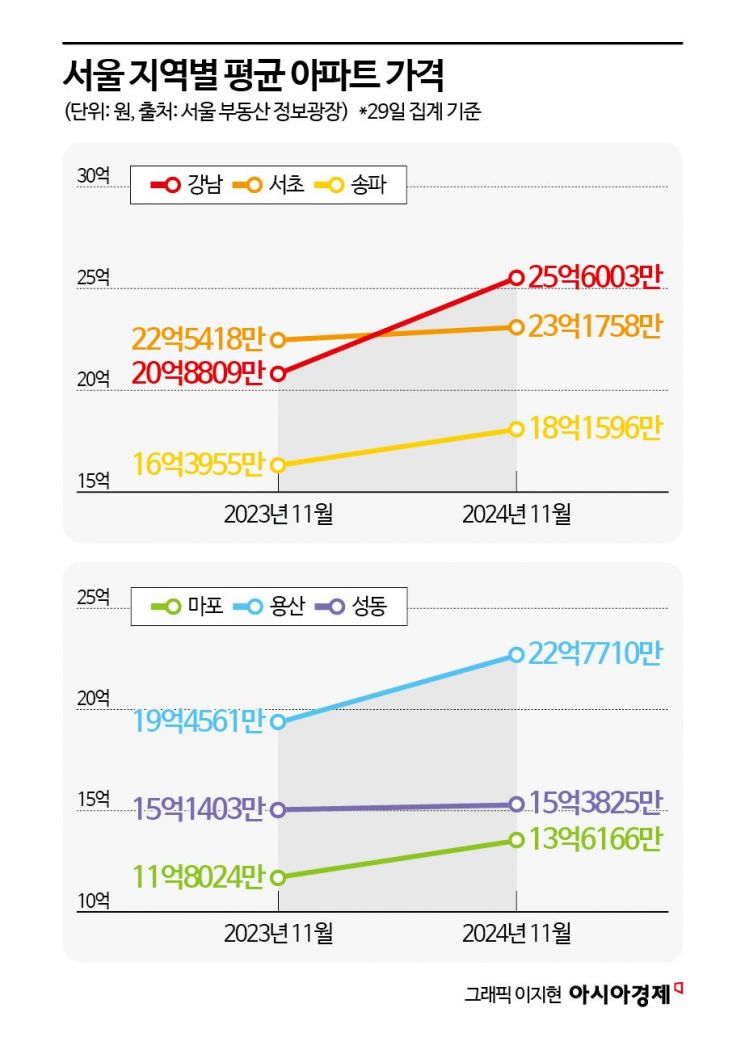

Kim Hyo-sun, senior real estate specialist at NH Nonghyup Bank, also noted, "The current base interest rate level in Korea is the same as in September 2012, when the average new mortgage loan interest rate at the five major banks was 4.29%, a 1.29 percentage point difference from the base rate. As of October this year, the difference is about 0.95 percentage points." He added, "The possibility of the real estate market reviving solely due to the base rate cut is low. The extent and speed of actual loan interest rate reductions are important, but it will be difficult for loan interest rates to decrease."

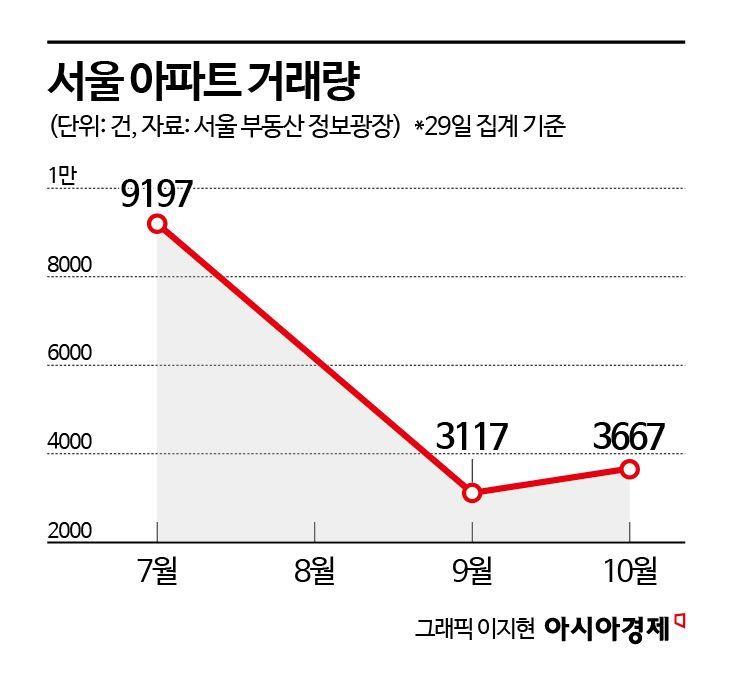

According to the Seoul Real Estate Information Plaza, as of the 29th of last month, the number of apartment transactions in Seoul has been declining since peaking at 9,197 in July this year. Although the number of transactions in October (3,667) increased compared to September (3,117), experts analyze that the September figure was effectively reduced by about a week due to the Chuseok holiday, indicating a downward trend in transaction volume.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)