China Implements Visa-Free Entry... "Positive for National Airlines' China Route Recovery"

Korean Air-Asiana Merger Reshapes Industry... "Directly Leads to Re-Rating"

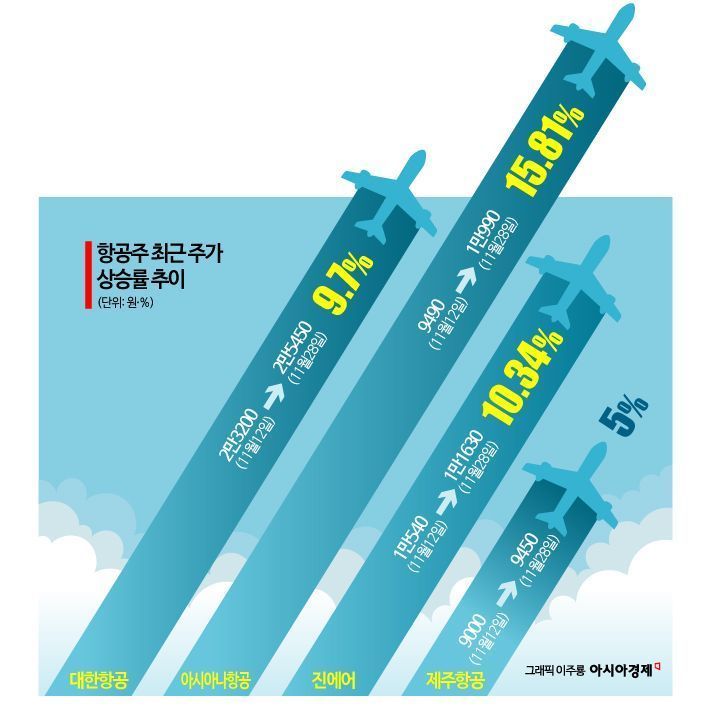

Airline stocks are rebounding. It appears that China's visa-free policy and expectations for restructuring in the airline industry are influencing this trend.

According to the financial investment industry on the 29th, the stock price of Korean Air, which was 23,200 KRW on the 12th of this month, recorded 25,450 KRW the day before. The increase rate during this period is 9.7%. During the same period, Asiana Airlines rose 15.81%, while Jin Air and Jeju Air also increased by 10.34% and 5%, respectively.

The Chinese government added "exchange visits" to the visa-free visit purposes, which were previously limited to business, tourism, and visiting relatives, as of the 22nd of this month. The visa-free stay period in China was extended to 30 days, up from the previous 15 days. Additionally, since the 8th of this month, visa-free entry measures have been implemented for holders of ordinary Korean passports.

These measures have raised expectations that flights to China may increase. According to Meritz Securities, the passenger recovery rate on China routes in September this year was only 78.4% compared to 2019, before COVID-19. Oh Jeong-ha, a researcher at Meritz Securities, explained, "The visa exemption expands convenience for visiting China, so an increase in demand for visits to China is expected," adding, "Since demand for visits to China was lower than demand for visits to Korea, the visa exemption is positive for the recovery of national carriers' China routes."

Expectations for industry restructuring following the merger of Korean Air and Asiana Airlines are also being reflected. The European Commission (EC) has given final approval for the Korean Air-Asiana Airlines merger. The merger process, which has lasted four years, is effectively entering its final stage. After completing the corporate merger review, Korean Air will acquire new shares and incorporate Asiana Airlines as a subsidiary. It plans to operate independently for two years. During this period, workforce reallocation, employment succession, and normalization of Asiana Airlines' financial structure will be carried out before launching the integrated Korean Air.

In particular, securities firms view this merger positively in terms of synergy. Choi Goeun, a researcher at Korea Investment & Securities, explained, "It is unrealistic to think there will be no synergy when the first and second largest operators merge to secure a 50% market share," adding, "They will secure oligopolistic dominance in long-haul routes, business, and premium passenger markets, where low-cost carriers (LCCs) find it difficult to enter."

After the merger of Korean Air and Asiana Airlines, restructuring of LCCs is also anticipated. Air Busan and Air Seoul are expected to integrate around Jin Air, a Korean Air subsidiary. Additionally, since many LCCs have private equity funds as major shareholders, there are forecasts that alliances and mergers and acquisitions (M&A) may occur within the LCC industry. Researcher Choi Goeun recommended, "I also suggest expanding investment in LCCs," stating, "The M&A momentum in 2025 has shifted to the LCC industry."

Park Soo-young, a researcher at Hanwha Investment & Securities, emphasized, "There is a high possibility that industrial restructuring events, which have been delayed for decades, will continue to occur over the short term of one to two years," adding, "Restructuring can directly lead to valuation rerating."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.