Bank of Korea Cuts Base Rate Twice Consecutively Amid Growth Slowdown Concerns

Next Year's Growth Forecast at 1.9%, Below Potential Growth Rate

Preemptive Rate Cut Due to Trump Trade Uncertainty and Export Slowdown Concerns

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, on the 28th. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, on the 28th. Photo by Joint Press Corps

The Bank of Korea defied market expectations by cutting the base interest rate twice in a row. Despite the won-dollar exchange rate approaching 1,400 won, the rate was lowered faster than expected due to growing concerns over tariff burdens following the U.S. presidential election and a slowdown in exports, which increased the possibility of economic stagnation. The forecast for next year's economic growth rate was revised downward from the previous 2.1% to 1.9%, below the potential growth rate (2.0%).

Bank of Korea Shocks Market with Sudden Base Rate Cut

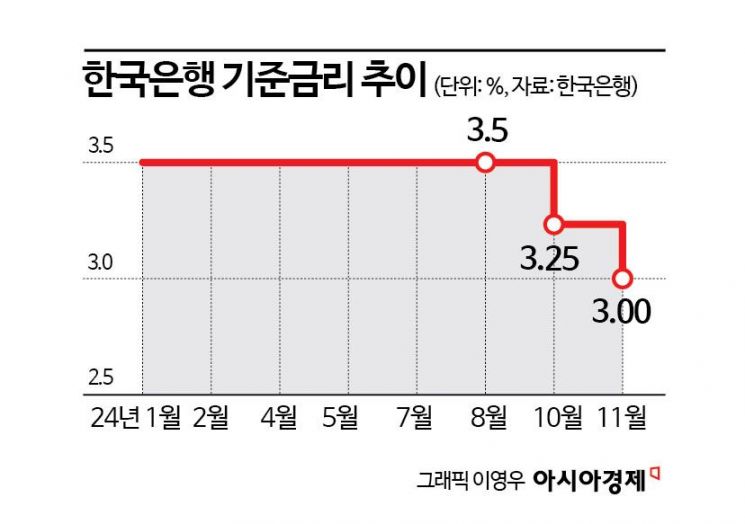

The Monetary Policy Board (MPB) of the Bank of Korea announced on the morning of the 28th at the Bank's headquarters in Jung-gu, Seoul, that it had set the base interest rate at 3.00% per annum. This was a 0.25 percentage point cut from the previous 3.25%. Among the six board members excluding Governor Lee Chang-yong, four voted for a rate cut, while two members, Jang Yong-seong and Yoo Sang-dae, dissented with a minority opinion to keep the rate unchanged. Regarding the three-month forward guidance on interest rates, three members favored holding steady, and three favored a cut.

The Bank of Korea's Monetary Policy Board had initiated a pivot by lowering the base rate by 0.25 percentage points from 3.50% to 3.25% on the 11th of last month, marking the first policy shift in three years and two months. The market had expected the Bank to hold rates steady this month to observe the effects of last month's cut, but the Bank chose to cut rates twice consecutively. This change in stance is interpreted as a response to rapidly changing market conditions since the last MPB meeting.

In particular, the victory of former U.S. President Donald Trump in the early November U.S. presidential election significantly increased future trade uncertainties. If the tariff policies of the second Trump administration are fully implemented next year, it could greatly reduce South Korea's exports and economic growth, prompting the Bank of Korea to take preemptive rate cuts.

Governor Lee said at a press conference held that morning, "There have been significant changes since the rate cut in October," adding, "The Republican Party's 'red sweep,' where it controls the presidency as well as both houses of Congress, was beyond expectations." He also noted, "Exports in the third quarter declined more than expected," and added, "We judged that this was due more to structural factors such as intensified export competition rather than temporary causes." According to Governor Lee, these factors were the decisive background for the recent rate cut.

In fact, South Korea's economic growth rate in the third quarter was 0.1%, far below the expected 0.5%. The slowdown in export growth of key items such as semiconductors, automobiles, and secondary batteries, which had supported the economy, was the cause. The problem, as Governor Lee pointed out, is that this trend is structural and likely to continue into next year.

Experts believe that if the tariff policies of the second Trump administration are fully implemented next year, they will significantly reduce South Korea's exports and economic growth. The Korea Institute for Industrial Economics and Trade, a government research institute, estimated that if the universal tariffs (10-20%) promised by President Trump are actually imposed, South Korea's exports to the U.S. could decrease by up to 14% (about $9.3 billion), lowering the country's economic growth rate by 0.2 percentage points. The Hyundai Research Institute analyzed that if the U.S. wages a tariff war not only with China but with all countries worldwide, South Korea's economic growth rate could fall by as much as 1.1 percentage points in the worst case.

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 28th. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 28th. Photo by Joint Press Corps

Next Year's Growth Forecast Lowered to 1.9%, Raising Concerns of Low Growth

The Bank of Korea's downward revision of next year's economic growth forecast was also cited as a reason for the rate cut. In its revised economic outlook released that day, the Bank lowered the forecast for next year's economic growth from 2.1% to 1.9%. The 1.9% figure is below the Bank's estimate of South Korea's potential growth rate of 2.0%, suggesting the possibility that the Korean economy is entering a low-growth phase. This year’s growth forecast was also revised down from 2.4% to 2.2%, and the forecast for next year's consumer price inflation was lowered from 2.1% to 1.9%.

Private research institutions have increasingly expressed negative views that next year's economic growth will fall short of the Bank's 1.9% forecast. Goldman Sachs projected South Korea's economic growth at 1.8% next year. Senior economist Kwon Gu-hoon of Goldman Sachs said, "The tariff policies of the second Trump administration will be a downside risk for the Korean economy," adding, "Export weakness has already begun in the second half of this year, and investment is likely to decline accordingly."

Morgan Stanley also forecast South Korea's growth rate at 1.7% for next year, citing weak domestic demand and Trump's tariff policies as negative factors. Other major investment banks (IBs) such as Nomura Securities, JP Morgan, Barclays, and Citi have also lowered their growth forecasts for South Korea next year to the high 1% range.

Professor Son Jong-chil of the Department of Economics at Hankuk University of Foreign Studies said, "Corporate investment is shrinking, and the pace of base rate cuts is slower than initially expected, so next year looks challenging for our economy," adding, "Without government intervention such as issuing government bonds, it will be difficult for next year's economic growth rate to exceed 2.0%."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 28th. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul on the 28th. Photo by Joint Press Corps

Rapid Rate Cuts Raise Concerns of Foreign Exchange Market Instability

There are also concerns about side effects from the faster-than-expected rate cuts. The biggest issue is the exchange rate. Since former President Trump's election victory earlier this month, the won-dollar exchange rate has surged sharply, surpassing 1,410 won intraday on the 13th, reaching the highest level in two years. Since then, it has remained around the low 1,390 won range without significant decline.

Analysts say that concerns that Trump's tariff policies could reignite inflation and slow the pace of rate cuts have strengthened the dollar and been reflected in South Korea's foreign exchange market. In this situation, further base rate cuts could push the dollar's value higher, causing the exchange rate to surge again. If the exchange rate rises too much, it could stimulate import prices and negatively affect the Korean economy.

Professor Kim Jin-il of Korea University’s Department of Economics evaluated, "The Bank of Korea's two goals of price stability and financial stability are in conflict, and at this point, the biggest risk is the exchange rate."

However, Governor Lee emphasized that exchange rate volatility is manageable. He said, "We have sufficient foreign exchange reserves to manage exchange rate volatility," and added, "We are discussing expanding and extending the foreign exchange swap amount and period with the National Pension Service, which will also help manage exchange rate volatility."

There are also concerns about a mismatch with the U.S., which has turned cautious on rate cuts. The minutes of the Federal Open Market Committee (FOMC) released on the 26th showed that members agreed on the need to be cautious about future rate cuts. They cited the sustained strength of the U.S. economy and uncertainty about the 'neutral rate' level as reasons to moderate the pace of rate cuts.

Governor Lee also said that day, "We need to keep in mind that the U.S. base rate may not fall quickly," adding, "Overall, the U.S. economy is perceived to have a high growth rate on its own, which may slow the pace of inflation decline more than expected."

Meanwhile, regarding speculation about him becoming the next Prime Minister candidate, Governor Lee stated, "I will faithfully carry out my duties as the Governor of the Bank of Korea."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.