Hankyung Association Analyzes Trade Specialization Index

Jan-Aug: Korea 25.6 · China 27.8

R&D Investment Also One-Quarter of China

An analysis revealed that South Korea has been losing its export competitiveness to China in advanced industries such as electrical and mechanical sectors for three consecutive years. It also showed that South Korea's advanced companies' research and development (R&D) expenditure is only about one-quarter of China's. With Chinese products like electric vehicles and batteries flooding the global market, domestic advanced products are gradually losing their foothold. The business community is responding urgently, calling for policy support such as extending the tax credit period for national strategic technologies under the Special Tax Treatment Control Act, which is set to expire at the end of the year.

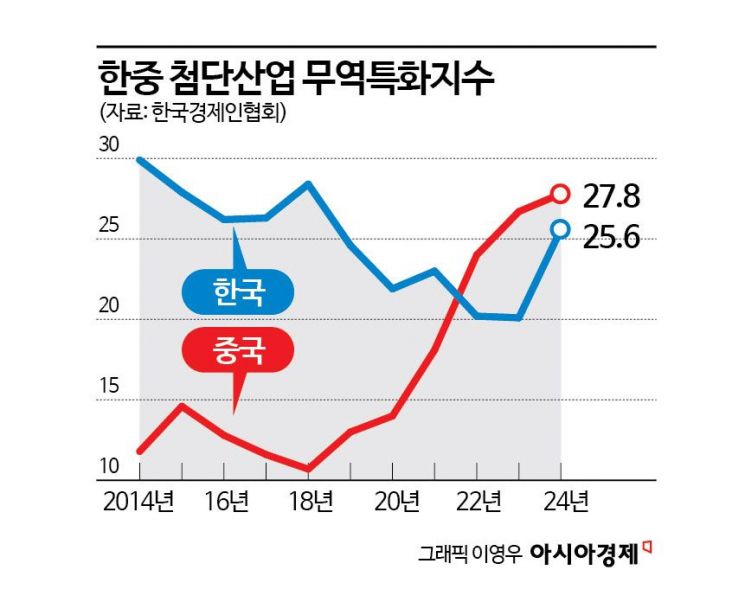

According to the analysis of advanced industry export-import data and advanced company financial data between South Korea and China released by the Korea Economic Association on the 28th, the Trade Specialization Index (TSI) for advanced industries from January to August this year was 25.6 for South Korea and 27.8 for China. The Trade Specialization Index indicates the comparative advantage of specific products; a positive value (+) means a net exporting country, while a negative value (-) means a net importing country. The higher the value, the stronger the competitiveness. Since 2022, South Korea's index has been lower than China's for three consecutive years.

The gap widened significantly in the electrical and mechanical fields. The electrical gap expanded from 17.1 points in 2014 (South Korea 24.7, China 41.8) to 63.2 points this year (South Korea 5.3, China 68.5). In machinery, the gap increased from 17.1 points (South Korea 11.3, China 28.4) to 39.7 points (South Korea 12.3, China 52.0) over the same period.

Mobility was an area where South Korea held an advantage, but the gap has narrowed over the past three years. The difference between the two countries shrank from 75.6 points to 6.3 points. This indicates that the technological level of Chinese-made mobility products such as automobiles has improved significantly. The gap in chemicals also decreased from 43.9 points to 23.5 points. Chinese mobility turned positive (net export) in the Trade Specialization Index from 2018, and chemicals from 2022, marking the beginning of serious competition with South Korea.

A bigger problem is that the gap between the two countries is widening in R&D investment, which is essential for securing industrial competitiveness. An analysis of 32,888 companies (headquarters) in both countries using Standard & Poor's (S&P) Global data by the Korea Economic Association showed that last year, South Korean advanced companies spent $51.04 billion (approximately 71 trillion KRW) on R&D. In contrast, China spent $205.08 billion (approximately 286 trillion KRW). The ratio of R&D expenditure to sales was 3.5% for South Korea and 4.1% for China. Regarding the growth rate of R&D expenditure, South Korea recorded an average annual increase of 5.7% compared to 2013, while China recorded an average annual increase of 18.2% during the same period.

The business community believes that to secure South Korea's advanced industry competitiveness, the scale of investment must be significantly increased. To encourage corporate investment, they emphasized the need to improve the R&D research environment through policy support. First, they called for a prompt extension of the tax credit benefits period for R&D and commercialization facility investments in national strategic technologies under the Special Tax Treatment Control Act, which is set to expire at the end of this year. They also suggested proactively considering including artificial intelligence (AI), defense, and nuclear power in national strategic technologies. Furthermore, they proposed changing the designation method of national strategic technologies from the current positive system (everything is prohibited except allowed items) to a negative system (everything is allowed except prohibited items).

They also argued that a direct refund system for tax credits is necessary to encourage long-term investment. The direct refund system reimburses the difference or the entire credit amount in cash when companies cannot fully utilize tax credits due to deficits and inability to pay taxes in the current year. The United States is implementing this system through the Inflation Reduction Act (IRA). If introducing a direct refund system is difficult, they requested extending the carryforward period beyond the current 10 years. Currently, companies can carry forward tax credits if they generate profits within 10 years, but they want this period extended. Additionally, there are opinions that tangible assets such as land and buildings, as well as R&D facilities and equipment, should be included in the facility investment credit target.

Jang Seok-kwon, Chair of the Industrial Future Strategy Committee at the Korean Academy of Engineering, said, "No country, including South Korea, can compete with China in terms of industrial scale, labor cost competitiveness, and speed of technology acquisition. Therefore, we must win in the competition of new product development rather than competing on 'making things cheaper.'" He added, "South Korean advanced companies need to shift their R&D direction and structure from 'process technology development' to 'new product development.'" He further stated, "We must increase cases of leading the production of irreplaceable products that can only be purchased from South Korea, such as high-bandwidth memory (HBM) semiconductors."

Lee Sang-ho, Head of the Economic and Industrial Division at the Korea Economic Association, said, "To prevent domestic advanced industry competitiveness from falling behind China, various policy supports such as tax credits, investment subsidies, and infrastructure development for electricity and water supply must be backed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)