Timefolio Asset Management announced on the 28th that the 'TIMEFOLIO Global AI Artificial Intelligence Active ETF' and the 'TIMEFOLIO Global Space Tech & Defense Active ETF' each achieved approximately double the returns compared to their respective benchmark indices.

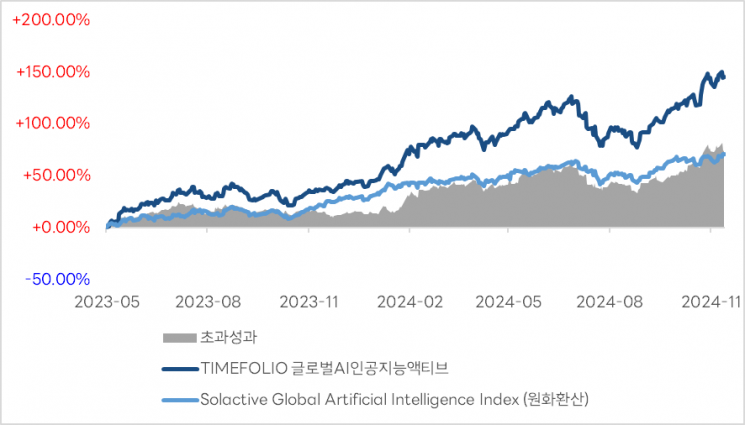

As of the 27th, based on the Korea Exchange, the TIMEFOLIO Global AI Artificial Intelligence Active ETF recorded a cumulative return of 145.0% since inception, achieving more than twice the performance of the benchmark index's 71.0% increase. The TIMEFOLIO Global Space Tech & Defense Active ETF recorded a return of 32.5% since inception, outperforming the benchmark index's 16.0% increase.

The TIMEFOLIO Global AI Artificial Intelligence Active ETF has ranked first in returns among domestically listed ETFs, excluding leveraged ETFs, since the beginning of the year.

Timefolio introduced the secret to the ETFs' performance as a flexible investment strategy that responds agilely to market and industry changes. In the early AI market, the TIMEFOLIO Global AI Artificial Intelligence Active ETF increased its weighting in hardware and infrastructure companies such as Nvidia (NVDA). As the performance of AI software companies improved, it actively included software-related stocks such as Palantir (PLTR), Snowflake (SNOW), and MercadoLibre (MELI). By balancing AI hardware, software, and power infrastructure in the portfolio, it continuously generates excess returns.

While the domestic market's AI-themed ETFs are segmented, Timefolio's Global AI Artificial Intelligence Active ETF offers a balanced portfolio encompassing software, hardware, and infrastructure within a single ETF. It is regarded as an optimal choice for pension investors who find trading difficult.

The TIMEFOLIO Global Space Tech & Defense Active ETF has recorded excellent performance by selectively investing in companies benefiting from the rapidly growing space industry driven by technological innovation and deregulation. The space industry is expanding into various themes such as launch vehicles, satellite networks, and the defense industry. Due to frequent events and frequent changes in leading stocks, the flexible strategy of an active ETF is particularly advantageous.

Timefolio's Global Space Tech & Defense Active ETF holds core stocks such as Rocket Lab (RKLB) and Intuitive Machines (LUNR) at the highest weighting among domestically listed ETFs. It strategically responds to major events such as successful launches to maximize operational performance. Notably, LUNR is the only stock included in domestic ETFs and is regarded as a leading investment case aligned with the deregulation of the space industry and the expansion of government support.

Jang Sang-jun, Deputy General Manager of Timefolio Asset Management, said, "AI and the space industry are currently the most notable megatrends in the market," adding, "They are evaluated as themes with the highest scalability and growth potential." He continued, "Because the pace of technological advancement is rapid and it is still in the early stages, it is difficult to predict which companies will be the winners. Therefore, an active ETF where the manager carefully selects sectors and stocks and makes timely replacements can be a favorable choice."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)