25% Tariff Imposed on Mexico and Canada

Slowing Down Local Factory Construction

Coordinating Equipment Project Imports

Potential Delay in Operation Start Time

The tariff imposition policy of 25% on goods from Mexico and Canada, announced by President-elect Donald Trump of the United States, is expected to cause disruptions in the construction of local factories by our companies. These countries had been notable for their duty-free access to the U.S. market, but if the tariff bomb becomes a reality, establishing production facilities could instead become a disadvantage. Some companies are closely monitoring the situation by adjusting the pace of factory construction and the schedule for importing equipment projects. As a result, there is increasing likelihood that the originally anticipated factory operation timelines will be delayed.

According to KOTRA on the 27th, there are 224 Korean companies that have established corporations or are operating businesses in Mexico and Canada. Representative examples include Samsung Electronics' home appliance factory in Quer?taro, Mexico, and LG Electronics' TV factory in Tijuana, Mexico.

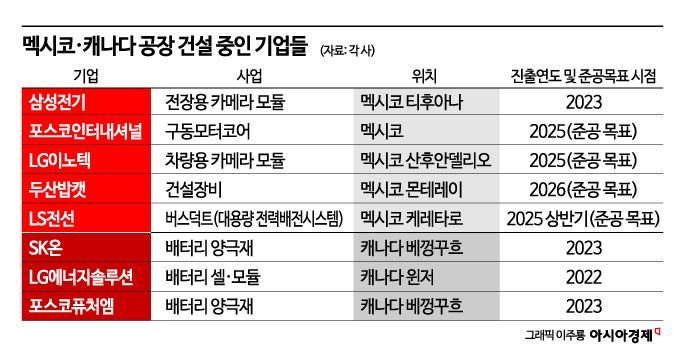

In particular, companies currently constructing factories have been put under urgent pressure due to Trump's tariff policy. According to industry sources and KOTRA, in Mexico, Samsung Electro-Mechanics, LG Innotek (automotive parts business), Doosan Bobcat (construction equipment), POSCO International (drive motor core), and LS Cable & System (high-capacity power distribution systems) are building factories. In Canada, SK On is preparing to build a battery cathode material factory together with EcoPro BM and Ford.

Samsung Electro-Mechanics is already known to have slowed down the pace of factory construction. They have only established a production corporation and have not yet started construction. It is anticipated that the management strategy to use Tijuana, Mexico as a hub for automotive camera modules and expedite deliveries to major North American customers will inevitably face setbacks.

LS Cable & System also plans to slow down the construction speed of its bus duct (high-capacity power distribution system) factory in Quer?taro, Mexico, which was originally targeted for completion in the first half of next year. Since construction began in August, it is unlikely that the business model itself will be revised, but delays in construction speed are expected to be unavoidable. A senior company official said, "Due to the possibility of the tariff policy being implemented by President-elect Trump, we are inevitably in a situation where we have to adjust the project speed (in Mexico)" and added, "We are monitoring the situation closely."

Some companies are weighing options between maintaining local production in Mexico and Canada and increasing production in nearby regions such as the United States. The main customers of companies that have selected sites in Mexico and Canada are U.S. companies. Their strategy was to reduce production costs by utilizing USMCA (United States-Mexico-Canada Agreement), but the situation changes if tariffs increase. Representative companies include Doosan Bobcat, which is building a new small loader production factory, and POSCO International, which is constructing a second drive motor core factory.

Battery companies such as SK On and LG Energy Solution are in the same situation. They had established joint ventures (JVs) with local companies and planned to operate factories in the U.S. and Canada to maximize sales to North American customers, but if high tariffs become a reality, disruptions are inevitable. SK On invested in a battery cathode material factory with EcoPro BM and Ford, while LG Energy Solution established a joint venture with Stellantis and invested in Canada. Since these companies have production bases in Indiana and Michigan in the U.S., they are also considering increasing production within the United States.

Despite the Trump risk, some companies are maintaining the pace of local operations. LG Innotek is reportedly judging that the positive factors, such as the expansion of the autonomous vehicle market in the U.S., outweigh the risks.

If the establishment of production facilities in Canada and Mexico is delayed, it could also hinder efforts to penetrate the U.S. market. If the tariff impact becomes a reality, the burden on client companies will increase, and companies operating in these countries are expected to seek alternative markets.

Lee Si-wook, President of the Korea Institute for International Economic Policy, said, "For investments already made in Mexico and Canada, companies need to maintain profitability to some extent by developing markets in Latin America other than the North American market," and added, "Especially for companies in the electric vehicle and battery sectors, the government should convey to the second Trump administration the logic that increasing local production will reduce Korea's trade surplus with the U.S."

Jung Cheol, Chief Research Officer of the Korea Economic Research Institute and Research Director of the Federation of Korean Industries, advised, "Even if the Trump administration's justification for imposing a 25% tariff on Mexico and Canada is the same, such as 'illegal immigration and drug control,' Mexico, which has issues with China’s circumvention exports and trade balance, will face much greater pressure than Canada," and added, "Companies operating in Mexico, where the second Trump administration is more likely to impose a 25% tariff, need to prepare 'contingency plans' for various scenarios."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)