Bank of Korea November All-Industry Business Survey Index (CBSI)

Manufacturing Sector Sentiment Deteriorates Amid Export Slowdown Concerns

Concerns have spread that South Korea's exports will slow down due to former President Donald Trump's potential return to power, leading to a deterioration in corporate sentiment for the first time in two months. There are many uncertainties regarding the trade policies of a possible second Trump administration, and forecasts suggest that the economic outlook will worsen next month, particularly in the manufacturing sector.

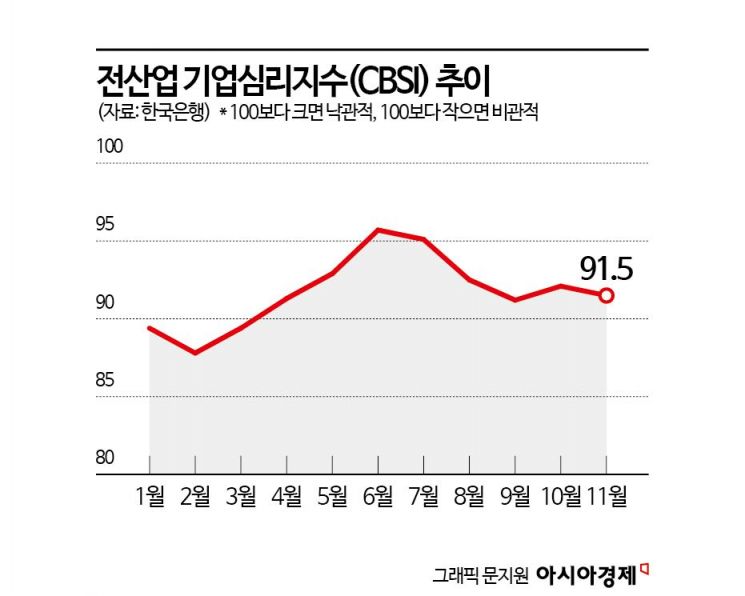

According to the 'November Business Survey Results and Economic Sentiment Index (ESI)' released by the Bank of Korea on the 27th, the Composite Business Survey Index (CBSI) for all industries this month stood at 91.5, down 0.6 points from the previous month.

The CBSI is a sentiment indicator calculated using key indices from the Business Survey Index (BSI). A CBSI above the long-term average (January 2003 to December 2023) of 100 indicates optimism, while a value below 100 indicates pessimism.

The overall CBSI had declined for three consecutive months from July (95.1), August (92.5), and September (91.2), then slightly improved in October (92.1) after four months, but fell again this month.

Corporate sentiment worsened mainly in the manufacturing sector. The manufacturing CBSI for November was 90.6, down 2.0 points from the previous month. Inventory levels and financial conditions were major factors contributing to the decline. By sector, electronics, audiovisual and communication equipment, automobiles, and chemical substances and products saw deteriorations.

The electronics, audiovisual, and communication equipment sector was affected by a decrease in exports centered on mobile phone component manufacturers. The automobile sector experienced production declines due to strikes at some auto parts manufacturers, while the chemical substances and products sector was impacted by reduced domestic and foreign demand and intensified competition with Chinese companies.

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea's Economic Statistics Bureau, explained the background of the manufacturing sector's worsening sentiment: "Although Trump's election and the rise in exchange rates did not significantly affect overall performance earlier this month, concerns about expanded protectionist trade policies such as tariffs were reflected in sentiment. In particular, companies related to automobiles, eco-friendly energy, and electronics, audiovisual and communication equipment anticipated negative impacts if tariff policies were realized."

Sentiment in the non-manufacturing sector improved slightly. The non-manufacturing CBSI for November was 92.1, up 0.4 points from the previous month. Profitability and sales were key factors driving the increase. By sector, transportation and warehousing worsened, but business facility management, business support and rental services, as well as electricity, gas, and steam sectors improved.

The transportation and warehousing sector was affected by a decrease in off-season passenger transport demand. Conversely, business facility management, business support, and rental services saw an increase in new year-end contracts, mainly among facility management and staffing companies, while electricity, gas, and steam sectors benefited from industrial electricity rate hikes and increased heating demand.

Many companies expect the economic outlook to worsen next month, especially in manufacturing. The December CBSI forecast shows manufacturing dropping 1.6 points from the previous month to 88.9, while non-manufacturing is expected to rise 1.1 points to 90.3. The manufacturing outlook deteriorated mainly in electronics, audiovisual and communication equipment, and chemical substances and products. In contrast, the non-manufacturing sector improved, centered on professional, scientific and technical services, and information and communications.

The Economic Sentiment Index (ESI) for November, which incorporates the Consumer Sentiment Index (CSI) into the BSI, recorded 92.7, up 0.2 points from the previous month. The seasonally adjusted cyclical component rose 0.1 points to 93.8 compared to the previous month.

Meanwhile, this survey was conducted from the 12th to the 19th of this month, targeting 3,524 corporate entities nationwide. There were 3,326 respondents, including 1,869 in manufacturing and 1,457 in non-manufacturing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.