Introduction of Forecast Differential Insurance Premium Rate Calculation Standards Possible

Strengthening of Capital Adequacy Standards for General Investment Companies to Bank Level

Bank Burden Expected to Decrease by 6-7%

Financial Investment Industry Claims "5% Increase in Securities Firms' Burden"

The financial investment industry is strongly opposing the Korea Deposit Insurance Corporation's (KDIC) plan to improve the differentiated insurance premium rate system. They argue that, as a result, the insurance premium burden on banks will decrease while the burden on the securities industry will increase.

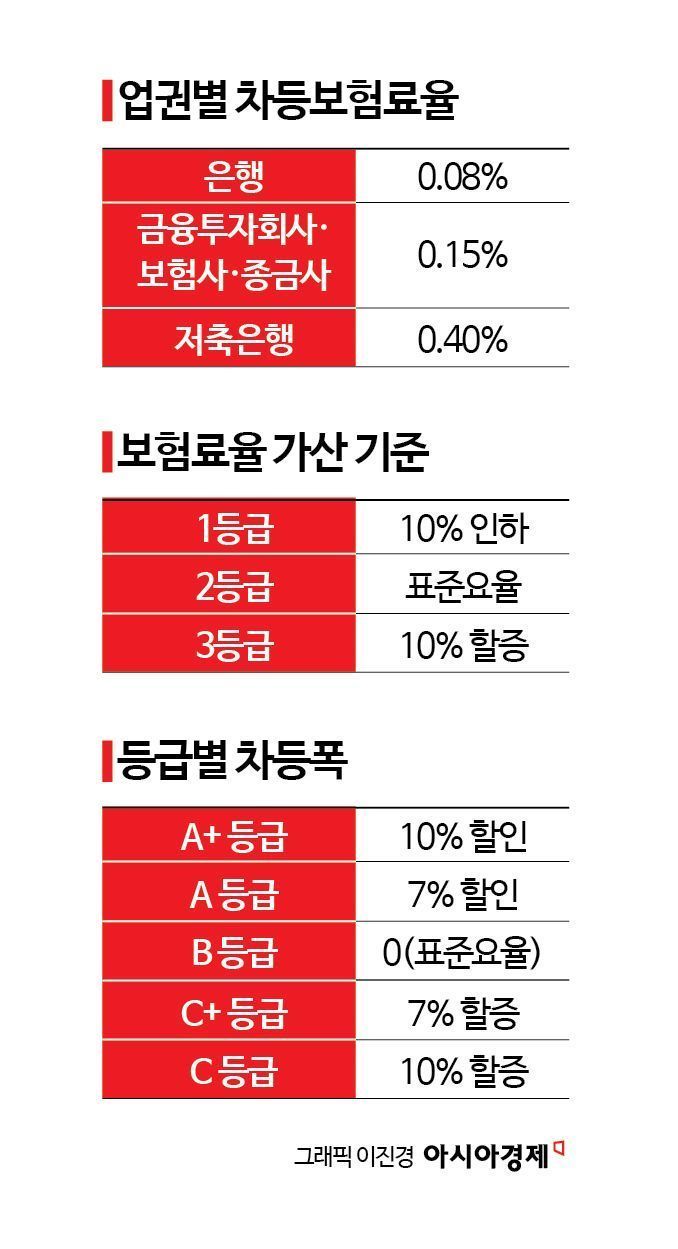

According to comprehensive reporting by Asia Economy, the main point of the 'Differentiated Insurance Premium Rate System Improvement Plan' is to strengthen the criteria for calculating differentiated insurance premium rates for securities firms compared to the current standards. In particular, the new standards will be applied only to comprehensive financial investment business entities (Jongtu-sa).

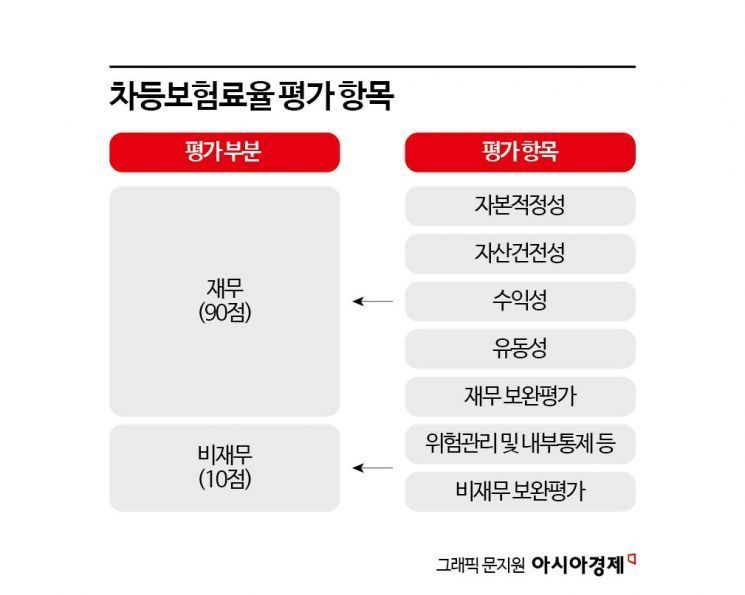

A financial investment industry official said, "Currently, Jongtu-sa and securities firms have used the Financial Supervisory Service's (FSS) timely corrective indicators for soundness and liquidity, such as the (new) Net Capital Ratio (NCR) and liquidity ratio, to assess risk levels for differentiated insurance premium rate calculation," adding, "The core of this system improvement plan is to apply Basel-level soundness indicators and stress liquidity ratios, similar to those used for banks, to Jongtu-sa."

Currently, KDIC uses the NCR evaluation standard for soundness and the FSS's indicators for liquidity when assessing the capital adequacy of securities firms. This implies that instead of using financial authorities' standards, the securities industry will have to create its own criteria for calculating differentiated insurance premium rates.

A new liquidity indicator under consideration is a stress liquidity ratio similar to the bank's Liquidity Coverage Ratio (LCR). The stress liquidity ratio evaluates how much high-quality liquid assets a bank holds under the assumption that financial stress lasts for one month.

In a stress scenario, it is advantageous to hold a large amount of cash, reserves, government bonds and bonds equivalent to government bonds, corporate bonds of non-financial companies, and mortgage-backed securities that can be quickly liquidated. After the Basel Committee on Banking Supervision (BCBS) gradually raised the minimum LCR level to strengthen the stability of the banking system following the global financial crisis, the Financial Services Commission (FSC) also introduced LCR regulations.

The financial investment industry claims that KDIC's system improvement will increase the burden on all sectors except banks (securities, insurance, savings banks). Currently, the annual deposit insurance premium amounts to about 2.5 trillion KRW. Of this, banks bear about half, while securities, insurance, and savings banks pay roughly equal shares of the remainder.

In particular, the securities industry argues that it is practically impossible to meet KDIC's new standards since banks have been granted grace periods to comply with Basel's LCR standards. Basel regulations apply on a consolidated basis to bank holding companies, but the FSC applies LCR regulations only to banks. Although the FSC lowered the LCR regulatory standard from 100% to 85% in response to the COVID-19 pandemic, it has been gradually raising it since 2023.

A securities industry official emphasized, "If KDIC independently introduces capital adequacy indicators, banks are estimated to reduce their insurance premiums by about 6-7%, while securities firms' premiums would increase by more than 5%," adding, "Applying bank-level standards immediately would be a heavy burden."

Meanwhile, the Korea Institute of Finance will hold a public hearing on the 'Improvement of the Differentiated Insurance Premium Rate System' at KDIC headquarters on the 28th to announce the results of a commissioned study. KDIC announced in its January work report that it plans to promote the 'Improvement of the Differentiated Insurance Premium Rate System' this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.