Created a Strategic 10% Currency Hedge Clause but Not Implemented Yet

As the won-dollar exchange rate continues its high-level surge, the expansion of the National Pension Service's (NPS) overseas investments is being identified as a factor fueling the rise in the exchange rate. This is because the NPS, a major player in the foreign exchange market, acts like a black hole by absorbing dollars in the spot foreign exchange market as it expands its overseas investments every year. If the NPS implements maximum currency hedging on its overseas investment assets, the additional dollars supplied to the foreign exchange market could exceed 60 trillion won. Given the significant impact of the NPS, a public institutional investor, on exchange rate volatility, there are calls to increase the currency hedging ratio on overseas investment assets to serve as a source of dollar supply.

According to related government departments on the 27th, the National Pension Fund Management Committee, the highest decision-making body of the NPS, will hold its 7th meeting next month to discuss a plan to temporarily raise the currency hedging ratio for overseas investments to a maximum of 10%, among other fund management plan amendments. A committee official said, "The plan to increase the hedging ratio, introduced in 2022, was extended once at the end of last year, and if the exchange rate does not stabilize, it may be extended once more by the end of this year."

Since 2018, the NPS has adhered to a principle of '100% currency exposure' for overseas assets. In 2022, at the request of the Ministry of Economy and Finance and others, a clause was added to the operational guidelines allowing the strategic currency hedging ratio to be temporarily increased from 0% to up to 10% depending on market conditions, but it has never been implemented. Han Seong-hee, head of the NPS Investment Strategy Team, said, "(Currently, currency risk management) is only used for tactical foreign exchange exposure management at 5%."

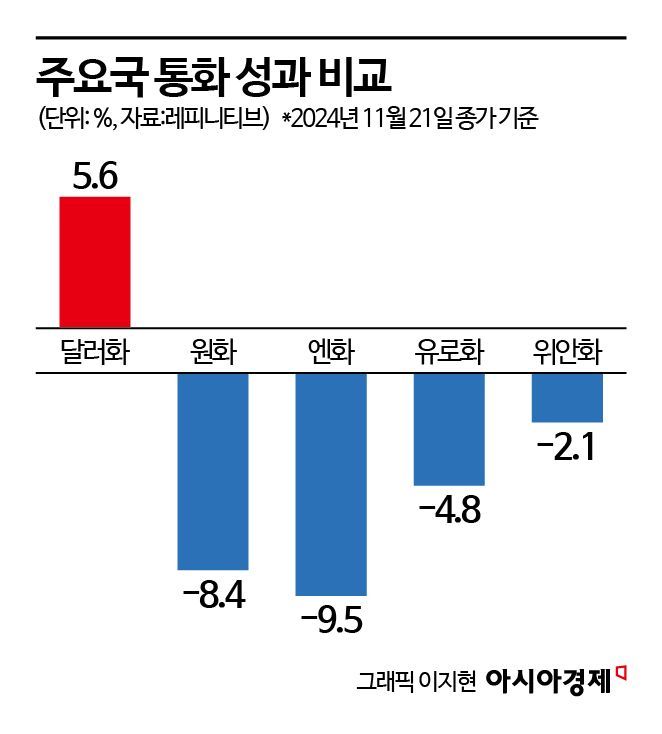

Amid a globally sustained strong dollar this year, the depreciation of the won has been steeper than that of other major currencies. The won-dollar exchange rate closed at 1,402.2 won yesterday, up 6.7% from 1,314.16 won at the end of last year (December 31). An increase in the won-dollar exchange rate means a decline in the won's value. The won's value has been declining since around the U.S. presidential election, with a larger depreciation compared to major currencies. According to Refinitiv, the won's depreciation rate this year is -8.4% (as of the close on the 21st), similar to the Japanese yen (-9.5%) and lower than the euro (-4.8%) and the yuan (-2.1%). The won's depreciation rate was nearly 3 percentage points higher than the dollar index's increase of 5.6% during the same period.

The deepening won weakness is viewed by government officials as influenced not only by the external factor of a strong dollar but also by the NPS's overwhelming scale of overseas investment expansion. When the NPS invests overseas, it buys spot dollars, increasing dollar demand and causing the won's value to fall.

This is why the government and foreign exchange authorities have continuously urged pension funds like the NPS to implement currency hedging following the sharp decline in the won's value. In July, Lee Chang-yong, Governor of the Bank of Korea, privately invited members of the NPS Fund Management Committee and officials from the Ministry of Health and Welfare, the supervising ministry, to the Bank of Korea headquarters to seek cooperation on expanding the currency hedging ratio. A senior foreign exchange authority official said, "The government and foreign exchange authorities have repeatedly requested the NPS to increase the currency hedging ratio on existing overseas assets," adding, "Without pension fund currency hedging, the current high exchange rate situation would not change significantly even after 10 years."

The reason authorities seek such cooperation from the NPS is that it has become a major player in the foreign exchange market. As of the end of July, the NPS's investments in overseas assets such as stocks, bonds, and alternative investments reached 630.6 trillion won. This exceeds South Korea's foreign exchange reserves of 415.69 billion dollars (about 582 trillion won as of the end of October). The NPS is increasing the proportion of overseas investments annually. It has announced plans to expand the share of overseas investments in its total financial assets from 47.9% at the end of 2022 to around 60% by the end of 2028.

If the NPS hedges 10% of its overseas assets, the additional dollars supplied to the foreign exchange market could exceed 63 trillion won. Considering that the average daily won-dollar trading volume last month was 11.69 billion dollars (about 16 trillion won), this is a substantial amount. Lee Jung-hoon, a researcher at Eugene Investment & Securities, explained, "When the NPS buys spot dollars for hedging and simultaneously sells forward contracts, the banks that buy these forwards will sell spot dollars in the market to balance their dollar buy-sell positions." He added, "When dollars are released into the foreign exchange market, it has the effect of stably defending the won's value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)